Janet L. Yellen, Chair of the Board of Governors of the Federal Reserve System. Washington, D.C., on February 3, 2014.

Investing is as much art as it is science. That probably isn’t music to the pure quantitative investor’s ear, but was it not a quantitative approach at Long-Term Capital Management that almost took down Wall Street in the late 1990s, and was it not also a quantitative formula that allowed brokerage firms to take on too much risk during the housing bubble?

Quantitative investment analysis can be a useful tool for investors, but it should not be the only tool used to craft portfolios. One of the mistakes often repeated by quantitative investors is not adequately accounting for their own influence in markets. This happens on scales both large and small.

Similar mistakes are made by folk in the economics profession who are too data dependent. The frenzy at the Federal Reserve over too-low inflation and inflation expectations would seem to qualify today.

Last week Bloomberg reported that Charlie Evans, the President of the Chicago Federal Reserve said he was concerned that low inflation expectations were preventing prices from rising. Mr. Evan’s comments were in response to the Michigan survey of U.S. consumers that showed inflation expectations fell to 2.4% in October, close to the lowest level on record.

Many monetary policy experts believe inflation expectations act as an anchor for actual inflation. That is, if consumers expect high inflation, actual inflation will tend to drift higher, and if inflation expectations are too low, actual inflation will drift lower. There is some historical evidence to back this up.

Okay so then why are inflation expectations falling?

The Fed didn’t have an inflation target until 2012, when the Bernanke Fed adopted a 2% goal.

Before that, consumers were left to guess what inflation would be over the long-run and the guesses were often much higher than the Fed’s current 2% goal. Soon after the Fed set its target, consumer inflation expectations started to drift lower.

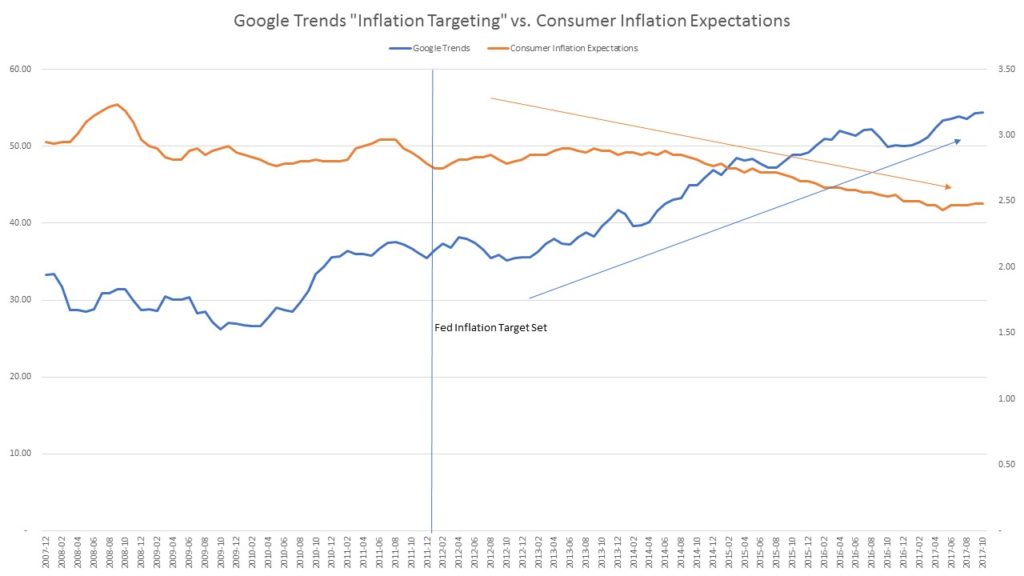

There isn’t any truly reliable data to find out just why their inflation expectations are changing, but Google Trends offers some insight. The chart below shows the volume of searches in the U.S. for inflation target compared to the University of Michigan Inflation Expectations survey. The increased interest in inflation targeting explains about 60% of the variation in inflation expectations.

Maybe when the folk tasked with controlling inflation start talking incessantly about a 2% inflation target, the public starts to listen. We of course can’t be certain the Fed’s target is the only reason why consumer inflation expectations are drifting lower. However, with the economy humming along nicely and financial markets already in frothy territory, is further delaying the normalization of monetary policy in the name of driving inflation expectations higher really a good long-term strategy?