How much more demand can low interest rates pull forward? It appears that while mortgage demand may be low (after a flurry earlier in the recovery), auto loans are going strong. But what’s interesting about these loans is that they get longer and longer. People are pulling more and more of their future incomes into the present to buy vehicles they can’t otherwise afford.

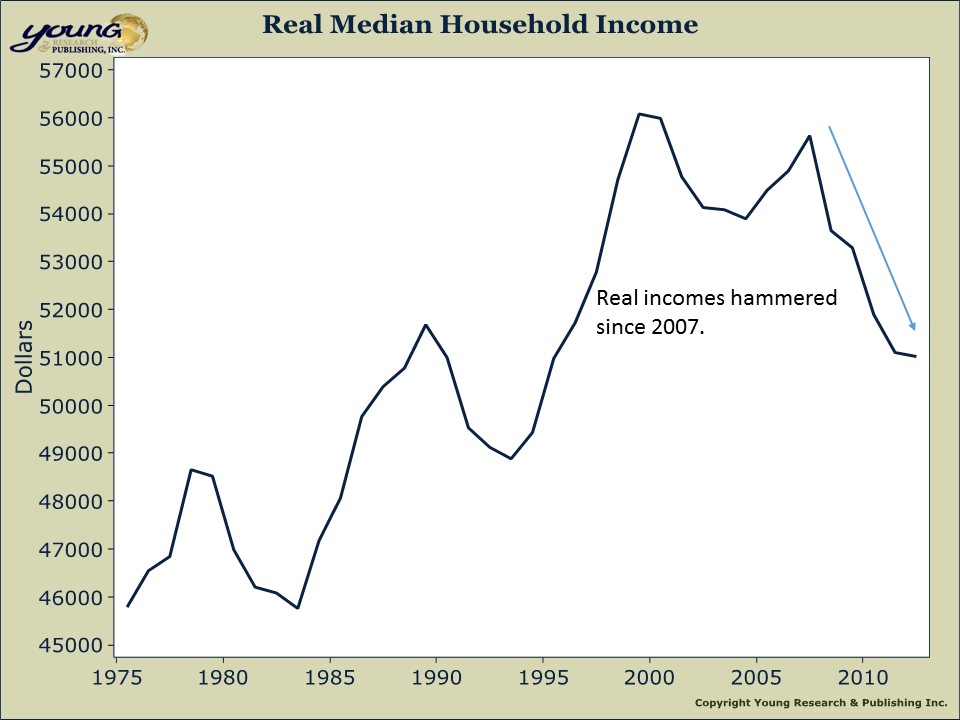

It’s not surprising Americans are hard pressed to afford the necessities. On the chart below you’ll see that in inflation adjusted terms, incomes peaked in 2009 and have dropped rapidly since 2007. The recent report on consumer spending in April turned up a surprise drop of 0.1% compared to the month before. If low interest rates are simply pulling future demand into the present, and incomes are stagnating, it’s hard to see where future productivity gains will be generated in an economy that relies heavily on consumer spending to drive GDP growth.