With the odds of a rate hike at the Fed’s December meeting now approaching 75%, we are picking up chatter about the Fed making a policy error if they go through with a hike. This line of argument contends that the U.S. economy is too weak for a rate hike or series of rate hikes. Higher interest rates will just send the economy right back into recession and the Fed won’t have any tools to combat the downturn.

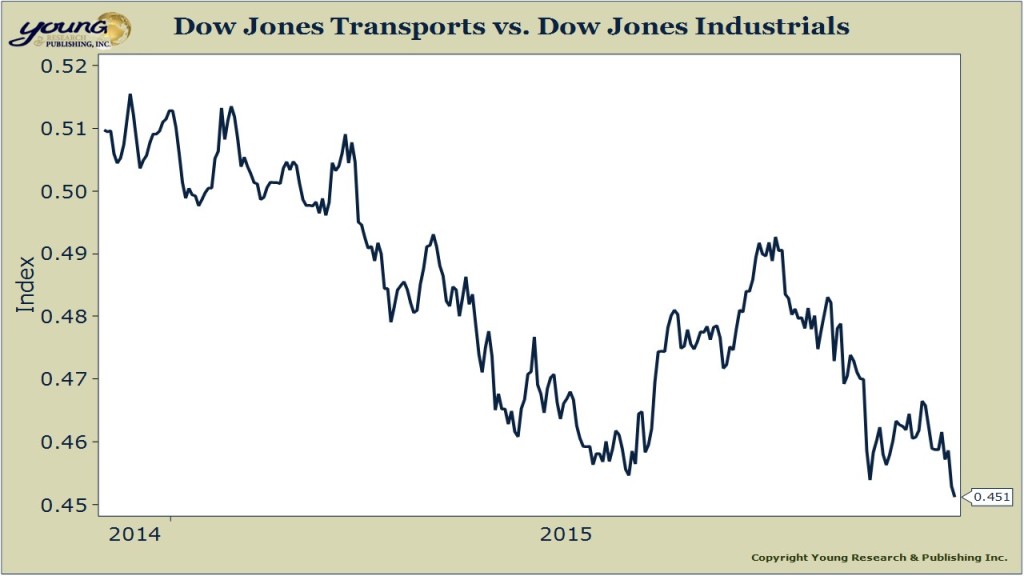

While the U.S. economy may not be as strong as the Fed assumes (see our dismal chart on the Dow Transports vs. Industrials below), hiking rates in December wouldn’t be the policy error. The policy error was already made. It was made years ago when the Fed decided to not only hold interest rates at emergency levels long after the crisis had passed, but to buy trillions of dollars more of government bonds when it should have been thinking about normalizing policy.

The current economic expansion is now over six years old and we haven’t seen a single solitary interest rate hike. Is it possible that the economy could fall into a recession during the Fed tightening cycle? Without a doubt, but a recession would have little to do with a few 0.25% interest rate hikes. We are now in the winter stage of the business cycle. Almost every cyclical sector of the economy has already hit peak growth for the cycle and some are now showing signs of contraction. They call it a business cycle for a reason and by historical standards this cycle is already a grey-beard.

If you want to worry about a future Fed policy error, don’t focus on a December rate hike. Instead take a careful look at the Fed’s newfound contention that the neutral rate for monetary policy is now zero. In effect the Fed is saying that this time is different (them’s dangerous words) and that money, despite centuries of evidence to the contrary, now has no opportunity cost.

We’ll have lots more to say on this and the investment implications of a Fed that believes the neutral rate is now zero, but that is a topic for another day.