For those of you who know our philosophy on investing, you know that we are regular critics of the short-termists on Wall Street, focusing their decisions on quarterly earnings data without taking into view the bigger picture. But perhaps the worst short-termist of all is the Federal Reserve.

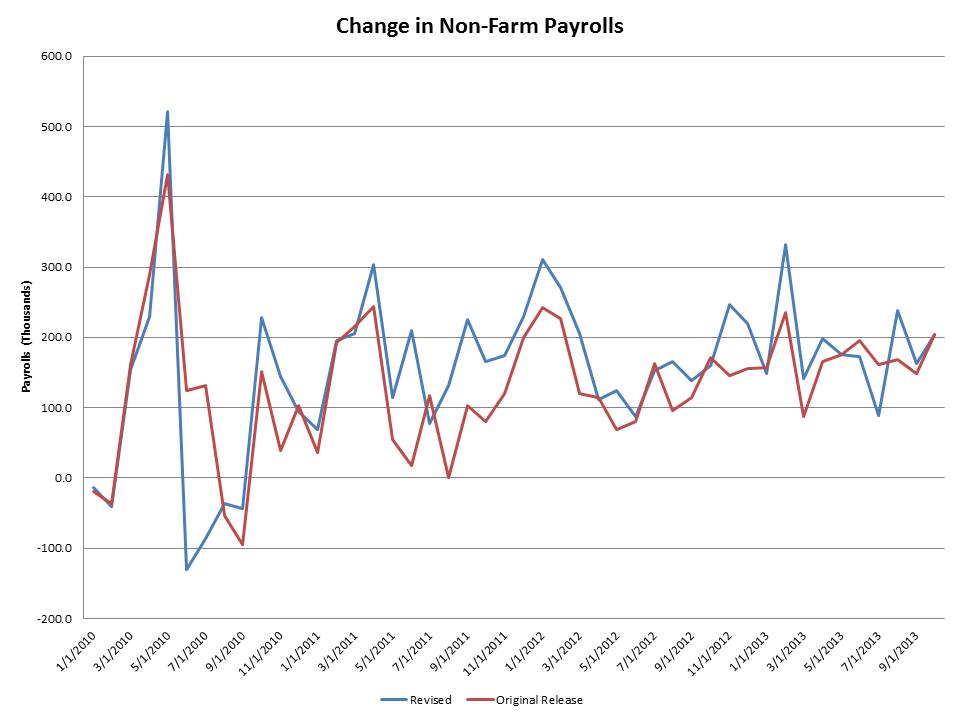

Take a look at the chart below of non-farm payrolls, released today, to get a clearer picture of what we’re getting at. The Fed has continued its quantitative easing based on what initially looked like slowing employment growth. But after revisions, payroll growth has been much stronger than initially reported. The Fed is making policy decisions that have wide-ranging and long-lasting impacts on every single American using data that after revisions looks nothing like the original estimate. Doesn’t give one much confidence in the Fed’s current “data dependent” policy, does it?