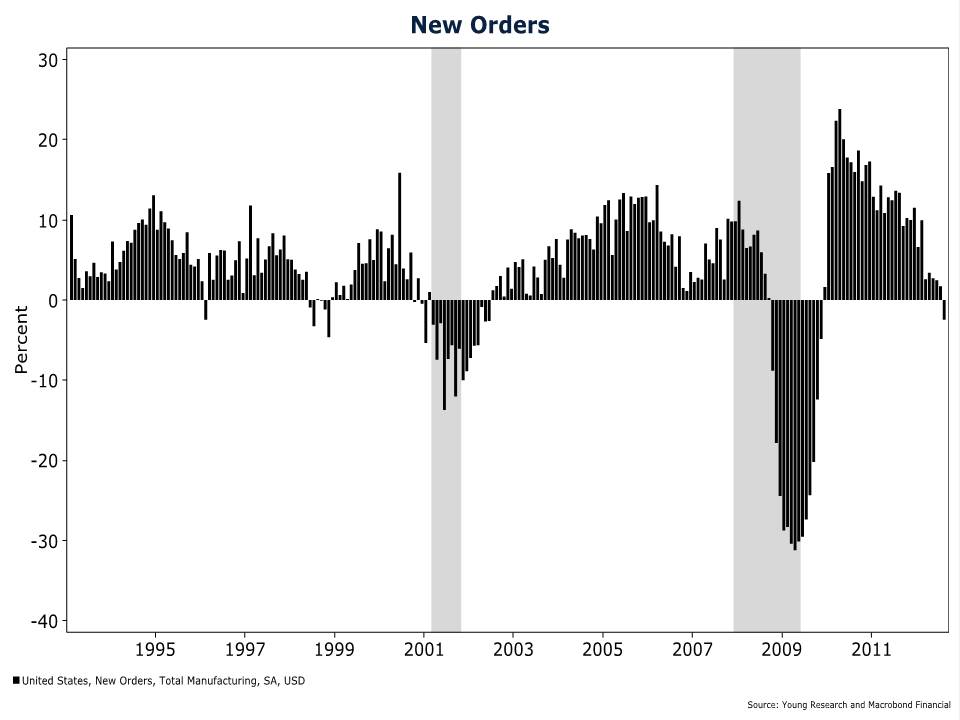

The trend of slowing annual growth in new orders was completed this month with a sharp decline in for the first time since November of 2009. You can see on the chart the declining growth rates before each recession (shaded in gray). The current trend looks even worse than the two recessions earlier this decade. The effects of liberally employed monetary and fiscal stimulus seem to be fading fast as the market once again attempts to complete the recession it began in 2008. Look for a possible burst of activity at the end of the year when companies will pull forward future purchases to take advantage of temporary favorable tax treatment (a.k.a. fiscal stimulus), but don’t expect it to last into the new year.

Latest posts by Young Research (see all)

- Tesla’s Charging Station Adaptation - March 6, 2024

- Can $7 Trillion End AI Chip Scarcity? - March 1, 2024

- Apple Ends Its EV Effort - February 28, 2024