The Bureau of Labor Statistics released the September employment report today. The headline numbers are an increase in non-farm payrolls of 114,000 and an unemployment rate of 7.8%. The payroll number was in-line with estimates for subdued jobs growth, but the 7.8% unemployment rate was a shocker to economists. According to Bloomberg, the average economist was looking for the unemployment rate to tick up a tenth of a point in September.

Employment growth of only 114,000 is barely enough to keep up with growth in the labor force. In fact, the labor force increased by 418,000 last month, more than three times the number of jobs that were created. So how did the unemployment rate fall if job growth didn’t keep pace with new entrants into the labor force? Is the labor department fudging the numbers to influence the election? Jack Welch, the retired CEO of General Electric, thinks so. Here is what he tweeted about jobs report earlier this morning.

“Unbelievable jobs numbers..these Chicago guys will do anything..can’t debate so change numbers,”

What is our take? We aren’t going to accuse the labor department of cooking the books, but there is no question that the unemployment rate is an outlier. More on this in a minute.

First some background is necessary to understand how the unemployment rate dropped 0.3% despite a jobs growth number that fell short of new entrants into the labor force.

The monthly Employment Situation report is actually the combination of two surveys done by the labor department. There is a survey of about 60,000 households (think of this like a poll) that is used as the basis of the unemployment rate, and then there is a survey of 141,000 businesses and government agencies that is used to report the non-farm payroll numbers. Changes in the household survey are much more volatile than changes in the business survey. For this reason, most economists believe the business survey provides a more accurate estimate of the actual number of jobs created or lost each month. The problem is that when you are interested in estimating the unemployment rate, a survey of businesses is not useful. To reach the unemployed, you must survey households.

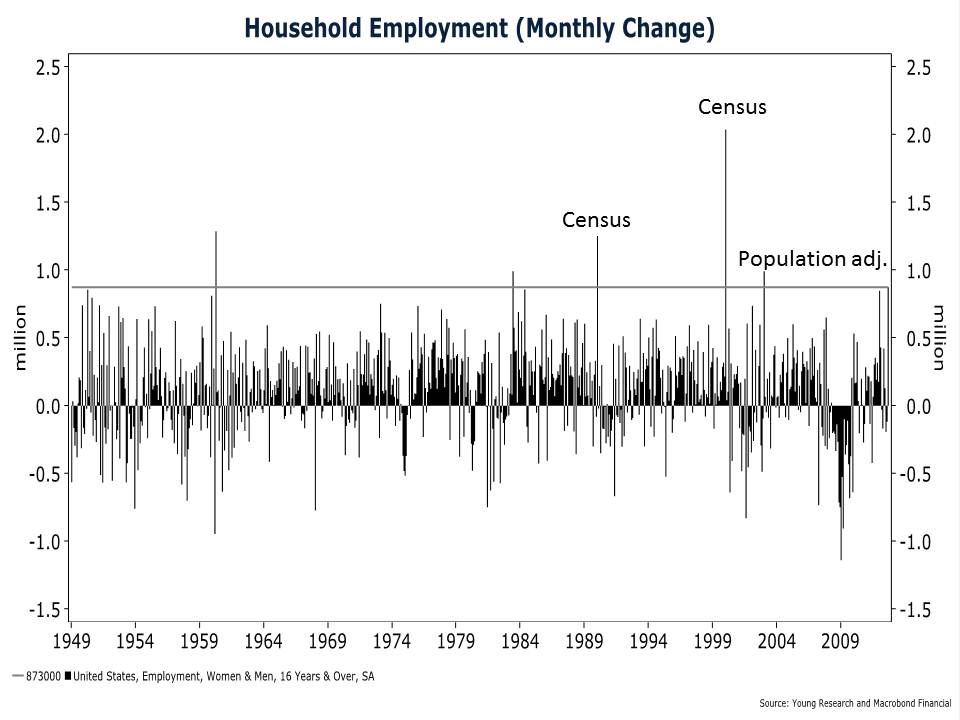

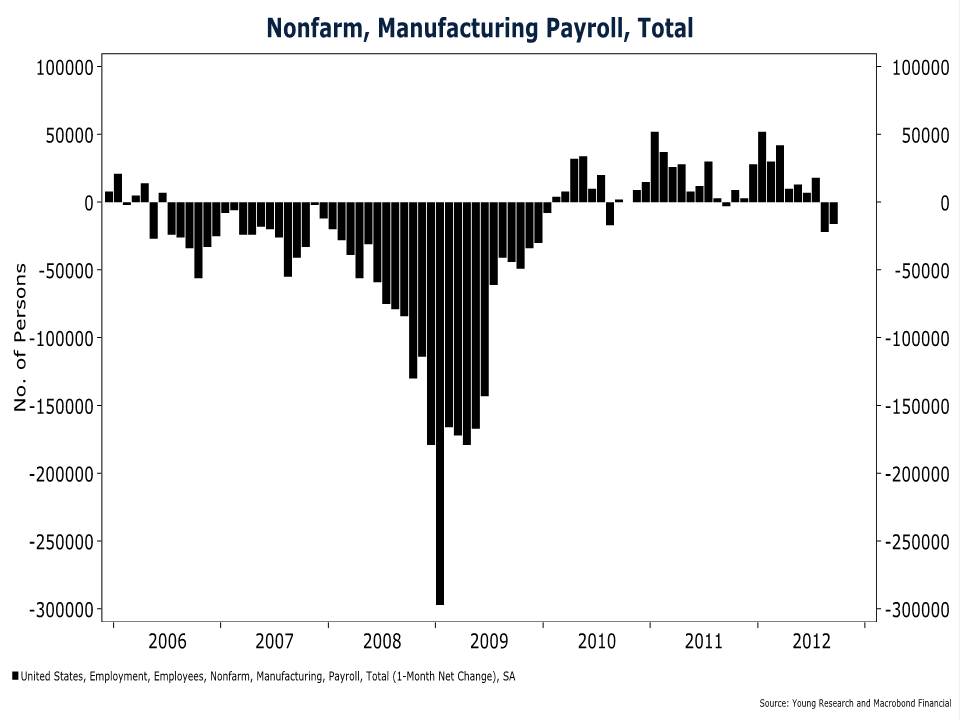

So according to the more volatile survey of households, there were not 114,000 jobs created in September, but a shocking 873,000. That is the largest non-census, non-population adjusted monthly increase in household employment since 1983 and the third largest on record—an outlier indeed (see chart). The 873,000 increase looks especially dubious in the context of 1.3% GDP growth, slowing global economic momentum, and the first back-to-back drop in manufacturing employment (chart) since the recovery began.

Well, it turns out that the strong jobs growth in the household survey that is responsible for the drop in the unemployment rate isn’t nearly as positive as it appears on the surface. What you find when you dig a little deeper into the household survey is that two-thirds of the reported increase in employment, or 582,000 of the jobs created were part-time jobs that folk are taking because they can’t find full time work. These are burger flipper jobs and maybe some part-time jobs related to the Presidential campaigns. Whatever the case, the big drop in the headline unemployment rate doesn’t jive with the true state of the labor market.

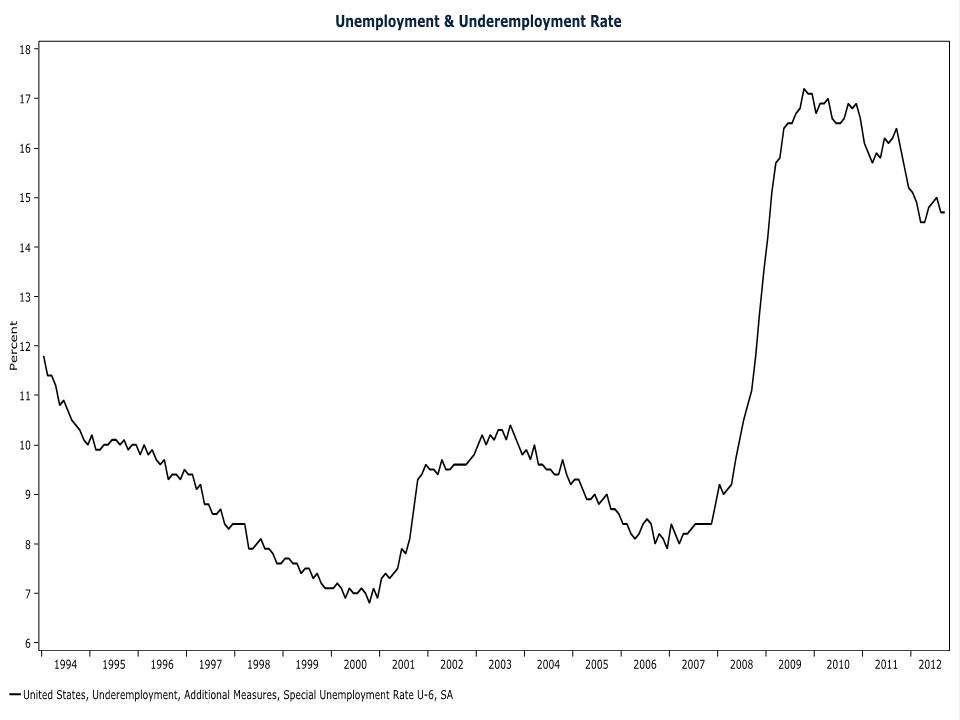

If you want the unvarnished truth on the labor market focus on the U-6 unemployment rate. This includes discouraged workers and people working part time for economic reasons. By this measure there was no improvement in the unemployment rate last month. About 14.7% of the population remains unemployed or underemployed.