By Everett Historical @ Shutterstock.com

“When we were first starting out our mortgage rate was ten percent, not a two percent adjustable.”

–says any parent who bought a home in the 1970s

Remember when you understood how the banking system worked? They lent you money, you bought a home, paid them back for what felt like the rest of your life and dreamed of a mortgage burning party.

The bank was happy, you had a roof over your head and they spread more money around town. In other words, the fractional banking system worked.

Today? Sure, houses are being bought and sold. But who’s really making out at two percent? Your local bank? I doubt it.

What’s that you say? “Wall Street?” The guys that move with ‘grace’ and ease from Vegas, to Washington, D.C. in their Gulfstream?

Oh them.

Well, they’re always fine. Pick your table: Auto Loans, Trust Deeds, Subprime, Credit Default Swaps.

Borrow for nothing, throw dice at private equity, private placements or proprietary trading algorithms. And if it doesn’t work, there’s always the chance for a bailout.

Why Interest Rates Matter

One way to think about Interest rates is they act like gravity for asset prices—too low and asset prices become untethered from reality and float at unrealistic prices. They also grease the skids for your nephew to brag about flying private.

What could go wrong?

Today it’s not uncommon to hear the phrase: “Why not pay $950,000 for a one-bedroom in San Francisco? Prices are only going up and I might miss this chance?”

What could go wrong?

Meanwhile, retired and soon to be retired investors have lived the double whammy of being on the wrong side of interest rates twice: paying a high mortgage rate in the 70s and receiving low savings rates today.

What could go wrong?

Well, a lot. As many have opted for stocks—mostly through ill-advised ETFs and mutual funds—that ape the market.

Again, what could go wrong?

My Advice to You

Pay attention. Because when you see your local bank advertising CD rates that make you pause and think, “hmm that’s not too bad,” we’re closer to the point where you take your last sip of coffee and head down to the bank or open your computer and type “Highest CD Rates.”

Gravity shifts. And as it does we’ll see some pockets of opportunity, especially in fixed-income. Why? Because of the golden rule: He who has the gold, makes the rules.

“Why,” you wonder to yourself, “should I stick with stocks when I can sleep better at night with a three or four or perhaps five percent guaranteed?”

Back to the Future, I mean Fed

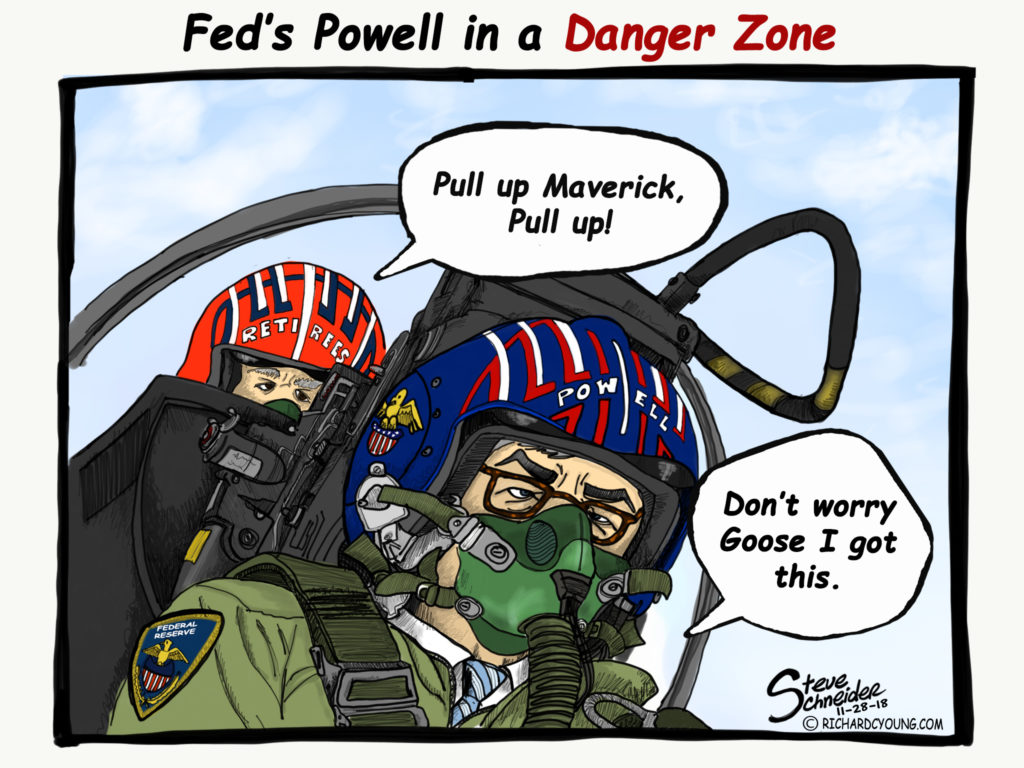

So where are interest rates headed? Will Chairman Powell be a Top Gun and raise rates high enough while avoiding recession? Or will he keep them too low and allow asset prices to float away and then crash?

Stop. Let’s take a breath for a minute. What kind of world do we invest in where so much money is staked on such a preposterous scenario? It’s a damned if you do, damned if you don’t deal.

I can tell you for a fact that when the end happens, as any pro-athlete will tell you—it happens fast.

Yes, interest rates need to be higher. But it will take years to get out of this danger zone of low flying rates. There will be many, pros and novices, who will get thrown about in the jet wash. Because, when rates are this low, any mistake could be catastrophic, like an F-14 Tomcat jet washed in a low altitude dogfight—as we’ve seen with the 14,000 jobs lost at General Motors.

Yes, interest rates need to be higher. But it will take years to get out of this danger zone of low flying rates. There will be many, pros and novices, who will get thrown about in the jet wash. Because, when rates are this low, any mistake could be catastrophic, like an F-14 Tomcat jet washed in a low altitude dogfight—as we’ve seen with the 14,000 jobs lost at General Motors.

You know how interest rates work. You know it’s hard to pay off a mortgage. And you’ve lived long enough to know there will be more disasters to come, especially with a banking system that is not as simple as it once was.

P.S. Top Gun 2 is expected to be released in the Summer of 2020. Kelly McGillis—Top Gun flight instructor Charlie—after the original Top Gun, opened a restaurant in Key West in the old Pan Am building. And as Dick Young has told me, she was there from the beginning working hard while pregnant overseeing its opening. Always a popular spot, it has since been sold, and, although the Top Gun memorabilia (her leather jacket) may be gone, it’s still a neat spot to have a beer.

You have two winters, until the release of Top Gun 2, to Escape to Margaritaville—from the wind, snow, sleet and rain—and soak up some sun and fun in Key West. Visit the Ernest Hemingway Home & Museum on Whitehead Street and later review the tour over a beer at Kelly’s old stomping grounds as you talk about Hemingway’s pool—at the time, the most expensive pool in America. And you have plenty of options from there. Take the excellent tour of the Truman Little White House which is an easy walk or continue on to Hemingway’s favorite watering hole Sloppy Joe’s on Duval. And don’t forget to take a look at the live music calendar at The Green Parrot and catch the 5:30 sound check before dinner. Have fun planning your trip—best done during a Nor’Easter or a blizzard—and hit the ground running (strolling) by visiting Key West’s foremost travel directory, The Key West Insider Guide, and Key West at Richardcyoung.com.

P.P.S. The drive by media has a lot of heart—giving President Trump a hard time about GM (Government Motors) cutting jobs—running headlines that he’s “Angry” and is “Threatening” the company.

Talk about inheriting a government disaster. It was the Obama administration’s misguided bailout of the autos in 2008 that lead to this mess to begin with. And it was put on Trump’s plate.

An industry reckoning was simply delayed as Obama doled out $11.3 billion to resuscitate—essentially an underfunded pension plan that happens to make cars and trucks—a dying business.

And it was under Obama’s watch that the Bernanke/Yellen Fed created money out of thin air while at the same time nailing interest rates to the floor boards so Wall Street could borrow for nothing, play the markets for free, and basically everyone in America with a driver’s license could get an auto loan for a shiny new truck.

Now, as interest rates rightly increase—and certainly by not nearly as much as they need to—under today’s Fed “Top Gun” Jerome Powell, it turns out the car business is a mess. A sputtering broken down piece of junk (let’s not forget the bond holders that were never bailed out and lost everything).

The business was a loss leader to begin with, and it was the Obama administration that failed to look under the hood and instead put this wreck of a company back on the road for Trump to fix. Yet another example of government malfeasance.

P.P.P.S. You may recall this piece I wrote to you, Maximize Your Retirement by Leaving Income Taxes Behind. A reader friend of mine wrote and asked why our favored state of New Hampshire didn’t make the cut. After all, he noted, what’s not to like about no sales or ordinary income taxes? Agreed. But unfortunately, NH does levy a five percent tax on dividends and interest—a form of income especially in retirement.

There’s always room for improvement. New Hampshire legislators introduced SB 404 on March 15, 2018, which would have phased out the five percent tax over a five-year period and ultimately repeal it on Jan 1, 2024. It didn’t receive the necessary votes, but it’s likely to come up again. I’ll keep you posted.

Having spent Thanksgiving at our cabin in Bartlett, NH and additional time in North Conway, I can tell you without a doubt that New Hampshire remains one of my favorite ski areas in America—and a state I’m never in a rush to leave. And believe me, neither is my friend.

Anyway, our email interaction ended this way. I think you too will agree with his P.S. Enjoy:

E.J.-Forgot to mention that I too WAS a drummer. First inspired by the Dover Highlanders pipes & drums band in our 4th of July parades back in the early 1960’s. Then firmly cemented by the Beatles and rock scene of the day. Bought my first drum set from Ted Herbert’s Music Mart in Manchester NH in 1966. It was a Ludwig Super Classic set in silver sparkle and ordered with Zildjian cymbals. Much to my disappointment it came in with Paiste cymbals (which I had never heard of!!) but I was a young kid and ‘that was the way it was’. I paid $650 for the kit and it featured the infamous Ludwig Speed King pedal which I loved.

Nowadays I’ve picked up strumming the guitar with my “YouTube” backup band and still have lots of fun!!

Merry Christmas

P.S. Damn I wish your father in law was still at the helm of Intelligence Report!!!! 🙁

Originally posted on Your Survival Guy.