In this morning’s Wall Street Journal, Steven Russolillo and Kaitlyn Kiernan offer two perspectives on the low levels of volatility being telegraphed by the VIX Index.

Some investors interpret the benign numbers as evidence that worries about gridlock in Washington and the slowing global economy are overblown.

But others worry that the low readings are a sign of complacency, and that the potential for further declines in response to unexpected bad news isn’t reflected in stock prices, even after the Dow Jones Industrial Average’s decline of 4.4% since Oct. 5.

You can put us in the category that believes markets have become complacent, and aren’t fully factoring in the dangers of a failure to fix the “fiscal cliff,” the European-incompetence-crisis, and a developing world that can’t seem to get its act together in the absence of strong growth in the OECD.

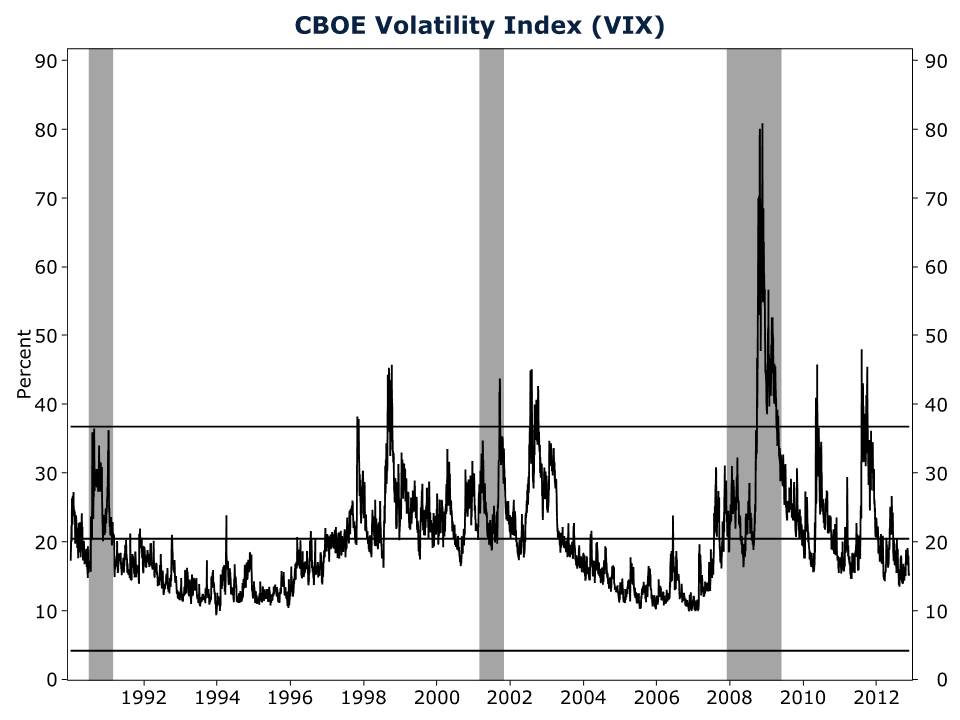

Take a look at a long-term view of the VIX Index in the chart below, and you’ll see right away that it often observes periods of tranquility, even while the underlying economics are building-in a recession (shaded in grey). The VIX Index indicated that fundamentals were hunky-dory while the housing market was being armed like a time-bomb in early 2007.

The long-term mean for the VIX is around 20 percent. Below that, analysts, economists and investors must consider that there are dangers the market is not properly pricing in.