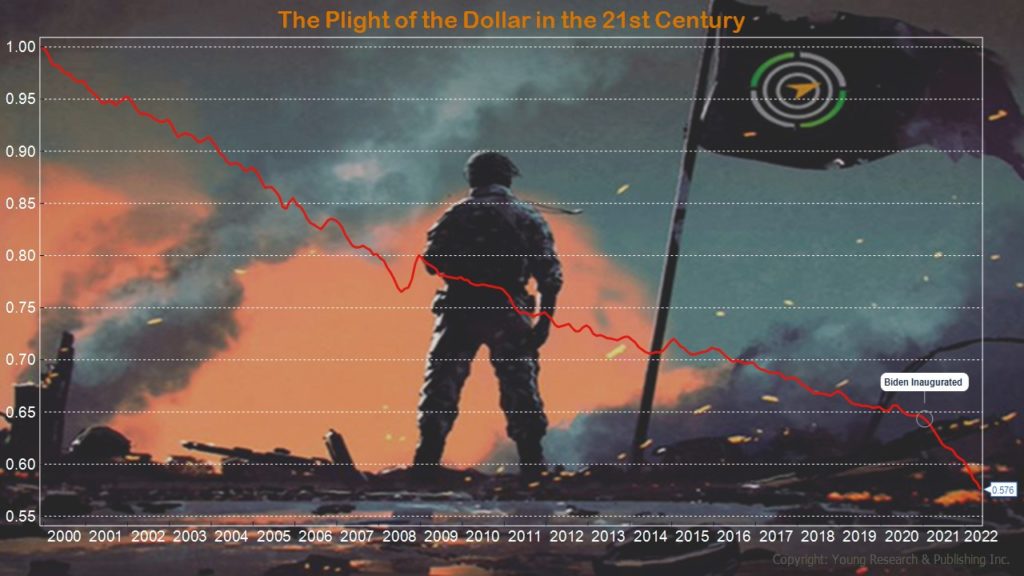

After decades of low-interest rates, inflation has finally caught up to the Fed. America never should have been in this position. Everyone knew that pulling demand from the future with low rates would eventually catch up to the Fed, but no one seemed to worry about that. The value of the dollar has been regularly falling since America came off the gold standard, and in the 21st Century, it’s been continuing that trend. But during the Biden era, the rate of dollar value destruction has accelerated. Now the Fed has a chance to make it right, or at least clean up some of the mess they caused.

Yesterday’s 0.75% increase by the Fed was exactly what the doctor ordered. Let’s hope the Fed has the conviction to keep it going in future meetings. There’s still a ways to go, but yields are getting more attractive.

In The Wall Street Journal, monetary economist Judy Shelton suggests that the only way the Fed can deal with all the inflation it caused is a “punishing sequence of rising interest rates.” She writes:

People may be starting to question the wisdom of wholly discretionary monetary policy as they are asked to accept a punishing sequence of rising interest rates. But a punishing sequence of rising interest rates seems to be the Fed’s only feasible option for addressing the latent inflation it enabled, which was triggered by fiscal stimulus.

Mr. Powell should note that the original inflation-targeting operating model for central banks—first put in place in New Zealand in 1990—included a provision for dismissing the top official for inadequate performance.

Accountability shouldn’t require omniscience, but neither should it excuse errors of judgment that end up harming Americans across the income spectrum. It was jarring to hear Ms. Yellen tell the Senate Finance Committee last week: “I do expect inflation to remain high although I very much hope that it will be coming down now.” You would think the former Fed chief would rely more on quantitative reasoning than wishful thinking.

The latest CPI number made it clear that inflation isn’t yet coming down—prompting the Fed to take a more aggressive stance. Contractionary monetary policy theoretically requires a nominal interest rate higher than the inflation rate. It isn’t clear the Fed is willing to go that far. In the extreme, high interest rates could cause bankruptcies and defaults. Meanwhile, a rising dollar could render dollar-denominated debt untenable for foreign borrowers with weak currencies.

All of this should cause us to rethink how the Fed intervenes in the economy. Neither artificially high interest rates nor artificially low interest rates are most conducive to productive economic growth. What a market economy needs is meaningful price signals—real interest rates.

Let’s abandon talk of hawks and doves on the Fed’s monetary policy-making committee and listen to the woodpeckers prepared to hammer away on the principle that money should provide a dependable store of value.

You should be able to rely on the value of your money. It should not be subject to the whims of central bankers. The last twenty-five years have proven the problems with that system.

Action Line: Many investors rely on the Fed always reinflating the market with easy money. The “Fed Put” as it’s known. But instead of relying on the Fed’s ability to move markets to generate returns, you should instead rely on a portfolio of individual dividend-paying stocks and interest-paying bonds. If you want to build such a portfolio but need help, let’s talk.

Originally posted on Your Survival Guy.