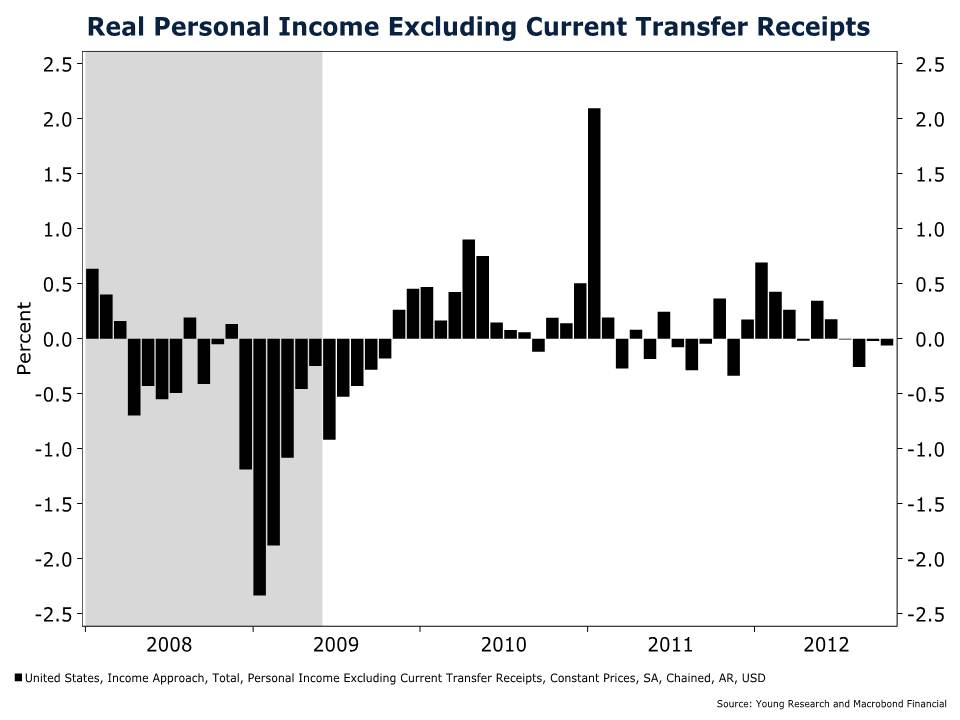

On Friday the BEA released the October numbers for American’s income growth. After adjusting for inflation, Americans chalked up their fourth month in a row of diminishing incomes. That is the most consecutive negative months since 2009. Real incomes fell by 0.06% in the month. The effect of the income drop acts like a $369 tax on the median wage earning American by the end of the year.

Americans are being pressed between a vice, with a weak dollar policy promoting Federal Reserve on one side, and a fiscal policy on the other side that is stifling economic growth with uncertainty and the prospect of increased tax rates.

As Americans face the reality of less real income to spend, they are forced to draw down their savings. After sharply increasing their savings during the height of the Great Recession, Americans are once again spending down their nest egg. As you can see in the chart of the Personal Savings Rate below, Americans are being forced to dip into their savings to maintain their standard of living. Now that Christmas shopping season has come along, watch out below! Either Americans will be dipping even further into their savings, or retailers will be hurting in real revenue terms. That will have a perilous effect on real GDP growth rates.