It’s time to get your lazy money off the couch and back to work.

You know the lazy money I’m talking about. The rainy day fund that’s turned into a big-screen TV, the matured CDs that took a cruise to the islands, and the emergency cash that’s betting on Apple.

Let’s not forget where your safe money should safely be employed: At Vanguard GNMA.

Did you know that over the last three-years, a time when investors worried about interest rates going up, up, up, GNMA had an average annual return of 2.6%?

Today, just like three-years ago, that lazy money is sitting there, worried about the same thing. Inertia is a terrible foe.

The nice thing about Vanguard GNMA is the credit risk is taken care of for you by the government through its explicit full faith and credit pledge.

Interest rate risk comes from either mortgage refinancing—a ship that left port long-ago—or mortgages being held longer—where I believe we are today. You’re just going to have to ride out the ups and downs.

But there’s another risk out there and this is the kicker because it’s harder to predict. It doesn’t have much precedence in modern day investing. And it could be a killer.

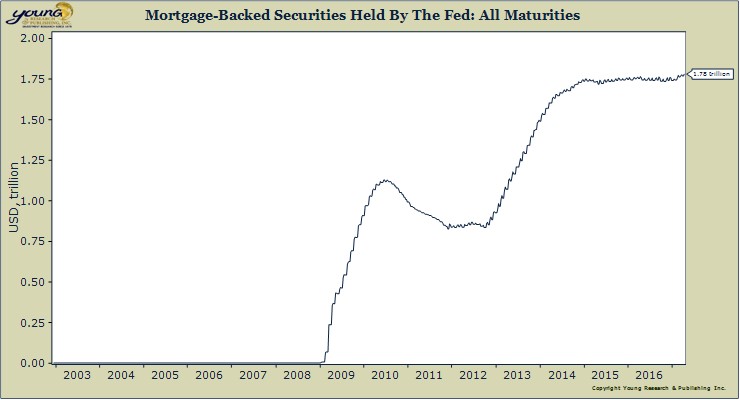

The Federal Reserve has played a huge role in the mortgage backed securities market, soaking up bonds like a shipwrecked sailor would a glass of ice-cold water.

The Fed has said it will wind down its bond holdings later this year. But will it do so to the point where it spikes mortgage rates and tanks the real estate market? We’re talking about a pretty big contributor to the economy: Real estate. It is a big part of the American Dream.

And the Fed has made itself into a big real estate player. It holds $1.8 trillion of the $7.5 trillion mortgage backed securities market. One could say the Fed is the most influential realtor this country has ever seen.

The Fed may say it’s getting out of the bond/real estate business but it’s hard to believe Yellen & Co. would hesitate for a second to ramp up the bond buying operation again in times of trouble. This is the same Fed that felt it needed to keep rates so low for far too long. Procrastination comes to mind.

Don’t be a procrastinator. Get your lazy money off the couch. Vanguard GNMA is hiring.

[gview file=”https://www.youngresearch.com/wp-content/uploads/2017/04/federal-reserve-statistical-release-4.20.17.pdf” width=”100%”]