Recent market volatility has been jarring for some investors. The volatility has whacked bond ETFs particularly hard. Last week bond ETFs sold off sharply and their prices diverged from their net asset values (NAVs). If one considers the characteristics of ETF investing, deviations from NAV should not happen.

Especially hard hit last week were emerging market bonds, as evidenced by the iShares JPMorgan USD Emerging Markets Bond Fund (EMB). On Friday the discount of EMB shares to NAV was 1.93% (Chart 1). While that may not sound like much, in today’s low interest rate environment, that is over six months’ worth of interest.

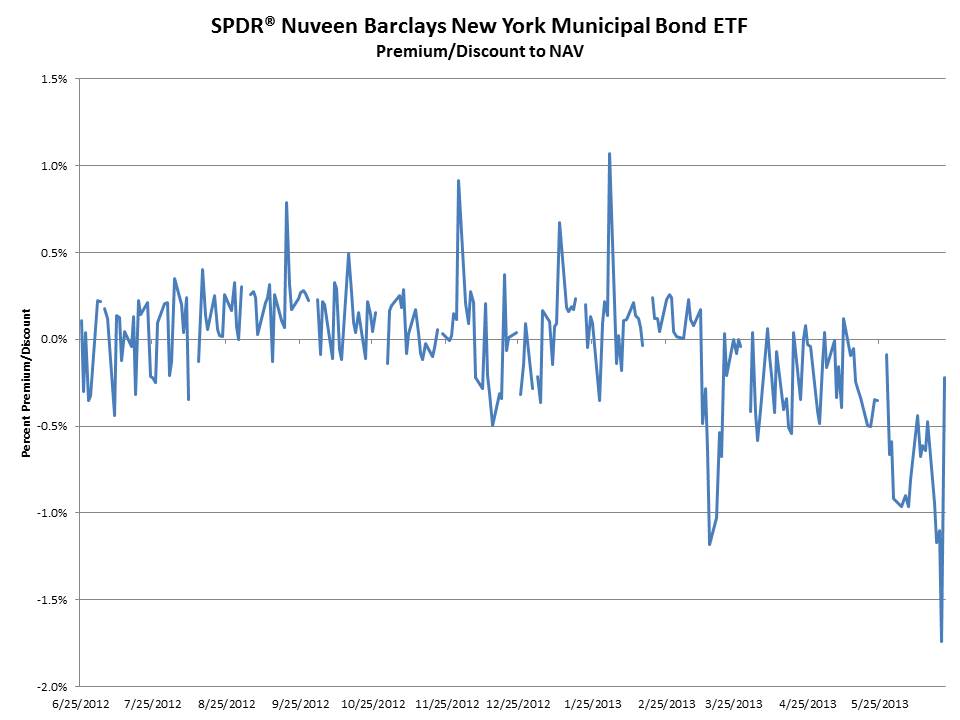

In fact, the volatility was so bad among bond funds that four of State Street’s SPDR funds stopped offering cash redemptions to dealers wanting to trade in shares. Instead, State Street offered redemptions in kind, in other words, giving dealers the basket of actual bonds represented by their shares in the funds. Thursday’s volatility was so bad shares of SPDR® Nuveen Barclays New York Municipal Bond ETF (INY) traded at a NAV discount of 1.74%.

Dealers were forced to take on the risk of the bonds, to the benefit of State Street. The Wall Street Journal explains:

State Street Global Advisors, the asset management arm of State Street Corp., told Wall Street trading desks Thursday that it would only accept so-called “in kind” redemptions for its suite of muni-bond ETFs, according to Tim Coyne, State Street’s global head of SPDR ETF capital markets. A spokeswoman said State Street resumed allowing dealers to its muni ETF shares for cash on Friday.

The move doesn’t directly affect end investors who are selling the ETF shares in the open market; they still get the cash in exchange for their shares as they normally would.

In bouts of strong selling, certain broker-dealers deliver blocks of ETF shares to their issuer, who then retires unwanted shares from the market. In return, dealers generally take ownership of the underlying bonds from State Street, Coyne said. For a fee, dealers can instead take cash from State Street, which then sells the bonds back into the market.

On Thursday, selling bonds became so difficult and expensive that State Street disallowed the option for dealers to take cash. For State Street, the risk was that unloading bonds could eat into investor returns, or cause the ETF’s price to veer from its underlying index, Coyne said.

Allowing only in-kind redemptions let ETF traders sell shares easily despite an underlying market caught in gridlock.

For dealers, in-kind only redemptions could potentially pinch those forced to take illiquid bonds onto their books.

What can you do to protect yourself from this type of volatility? First, avoid bond ETFs. Stick with open-end bond funds and individual bonds. Second, if you already own a bond ETF, don’t sell into a panic or buy into a melt-up. When ETF prices diverge from their NAVs, wait it out. Prices will eventually normalize.