The average investor has a hard time dealing with low interest rates. Don’t we all? But to put your life savings at risk is foolish and yet it’s done all the time. Sometimes the best advice is to do nothing at all and pick up yield gradually when rates begin to normalize. Unfortunately, there are wolves out there looking for sheep to prey on.

Here are the stories of some unlucky investors who trusted their advisors and were tricked into buying nearly worthless Regulation D securities. Jason Zweig reports in The Wall Street Journal:

Jeff Temeyer, 64 years old, is a semiretired farmer in Independence, Iowa. In 2016 he invested in private debt and equity in a Texas cancer-treatment facility offered by a local broker, Dana Vietor. Mr. Temeyer, who says he was told he would earn at least 8% annually, invested more than $900,000 in all—only to learn that the securities were near-worthless.

In 2020, Mr. Vietor was barred for life by the Financial Industry Regulatory Authority, which oversees how brokers do business. In November 2022, Finra arbitrators ordered Mr. Vietor to pay Mr. Temeyer and 10 other investors a total of $5.7 million in damages and other compensation. Mr. Vietor’s lawyer didn’t return requests for comment.

Jill Jester, 79, of Muncie, Ind., inherited a basket of private offerings in her husband’s individual retirement account after he died in 2020.

They, too, have turned out to be worthless, says her attorney, Bruce Oakes of Oakes & Fosher LLC in St. Louis. In October 2022, a Finra arbitration panel awarded Ms. Jester more than $420,000 in damages and other compensation from her former broker’s firm.

It’s disconcertingly common for the smaller of these private deals to be riddled with conflicts of interest.

Executives at the brokerages or financial-advisory firms selling these offerings may also serve as officials of the companies they are raising money for.

Mr. Vietor, for example, also was an owner and manager of the cancer facility he got his clients to invest in—even though he lacked extensive experience as a healthcare manager and often didn’t fully disclose his interest to clients, according to investors and their lawyers.

Because Regulation D companies aren’t obligated to issue current financial statements, investors can remain in the dark even as they sink deeper and deeper into the hole.

Mr. Temeyer’s attorney, Gail Boliver of Marshalltown, Iowa, says Mr. Vietor kept selling securities even after the cancer facility foundered: “It was like selling tickets on the Titanic after it hit the iceberg.”

I also spoke this week with an investor whose broker invested approximately 70% of her 401(k) in debt securities issued under Regulation D.

Only after it was too late did she realize that was like getting almost three-quarters of her retirement assets encased in quick-drying concrete. She can’t get her money out, and the value of what’s left is uncertain.

“I would like to sell,” she says, “but there’s no market.”

In fact, it’s often illegal to sell these private offerings to anyone else, unless the broker or financial adviser who sold them to you takes them off your hands.

Investors can avoid such headaches by trusting—but verifying. Buy nothing whose fees aren’t explicitly disclosed upfront in writing. Buy nothing without a prospectus or offering memorandum that discloses financial data, risks and conflicts of interest. Be wary of anybody who suggests putting private placements in your IRA or 401(k).

Alternative investments—anything but publicly traded stocks, bonds and real estate—have been all the rage in recent years. And you might well want an alternative to losing money. Just make sure you don’t end up with an alternative to making it instead.

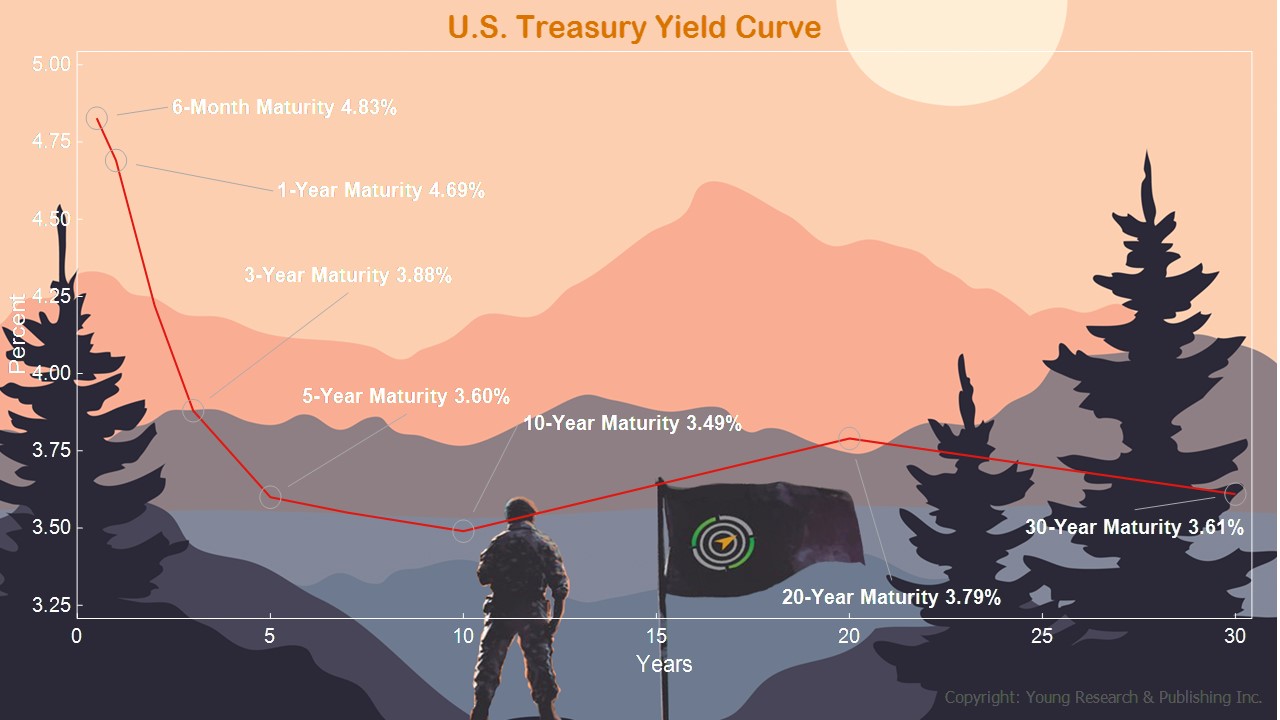

Action Line: Follow my yield curve and understand the landscape for what it is. Don’t underestimate the power of a balanced portfolio of stocks and bonds. If you need help building a portfolio like that, let’s talk.

Originally posted on Your Survival Guy.