Investors waiting to pounce? Not buying it. They finally have rates they can sink their teeth into. They’re in no rush to take on more risk. At least, that’s not what they’re telling me. In The Wall Street Journal, Jack Pritcher suggests investors are looking for more risk. He writes:

Stocks and bonds have surged in November. With record investor balances in money-market funds, some analysts are optimistic that they have more room to run.

Everything from technology stocks to junk-rated company debt has been rising after an encouraging inflation report reinforced bets that the Federal Reserve can achieve a soft landing by cooling the economy without pushing it into a deep recession.

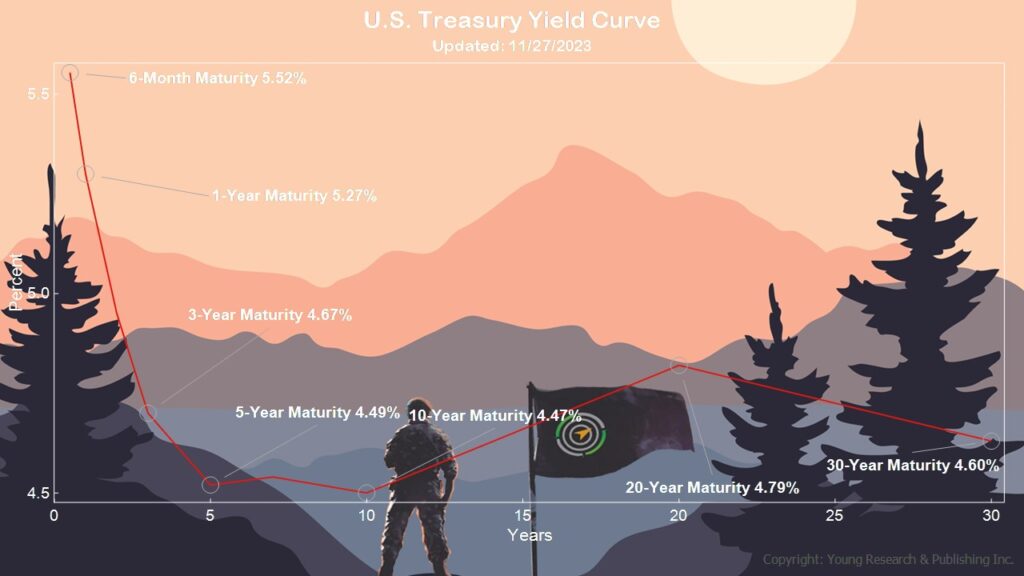

The S&P 500 is up 8.7% this month, while the Nasdaq Composite has climbed 11%. The yield on the benchmark 10-year Treasury note, which falls as bond prices rise, is down by nearly half a percentage point to 4.483%—a substantial move in a market where daily moves are measured in hundredths of a point.

Investors are plowing cash into stocks and bond funds. Invesco’s QQQ exchange-traded fund, which tracks the tech-heavy Nasdaq-100 Index, reported its largest weekly inflow in history the week of Nov. 13. Funds that track high-yield bond indexes—the higher risk portion of the corporate bond market—reported their two highest weekly inflows on record in the middle of November.

Meanwhile, institutions and investors together have a record $5.7 trillion parked in cash-like money-market funds, many of which are yielding above 5%, according to the Investment Company Institute.

Some on Wall Street see the cash as a bullish signal and a potential tailwind for stocks and bonds if the inflation outlook continues to improve. Others say some of that money has simply shifted to higher-yielding money markets from traditional bank accounts. They question the idea that the money is waiting on the sidelines and ready to enter the market.

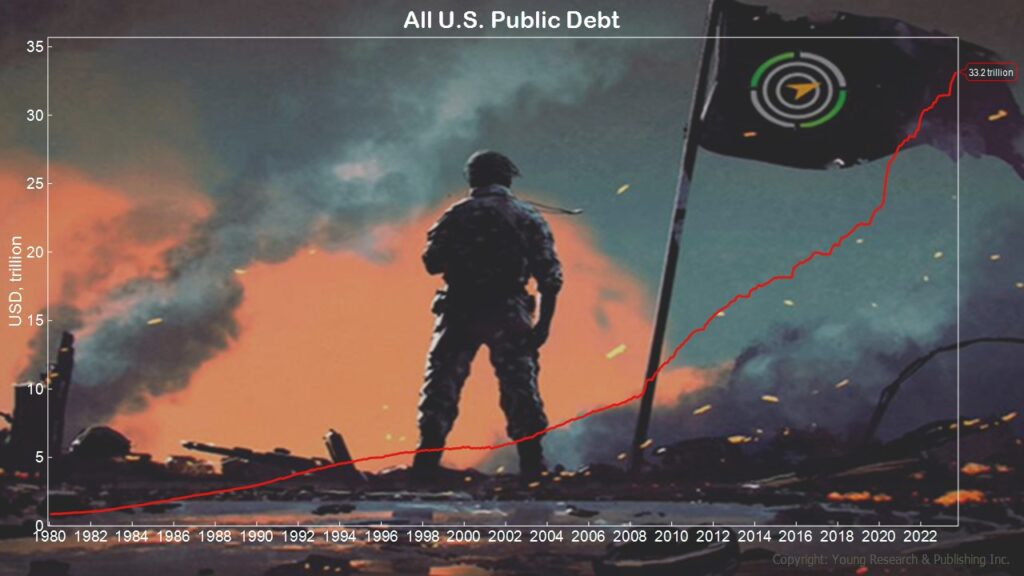

The investors I work with are the highly successful, fairly wealthy variety who are wary of the debt being accumulated by the United States but are also happy to finally have some yields they can sink their teeth into.

Action Line: When you are weighing risk in your portfolio, consider the actions of a “Prudent Man.” When you want to talk about risk, I’m here.

Originally posted on Your Survival Guy.