The New York Fed announced yesterday that household debt levels have fallen to $11.23 trillion, down from a peak of $12.68 trillion in the third quarter of 2008. That’s good news for Americans’ personal balance sheets, but paying off debt isn’t enough to get one through his golden years. Are you saving enough for retirement?

[expand title=”Click here to read more.”]

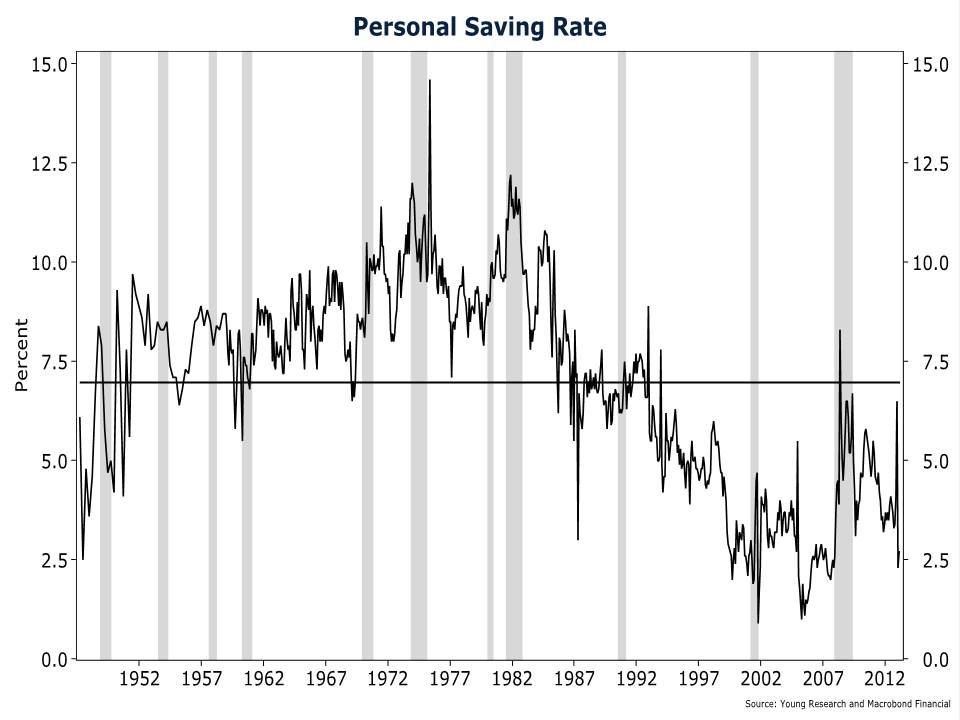

As you can see on the chart below. Savings rates have been very low for a long time. Since 2000, the average monthly savings rate has been 3.5%. For the last two months the rate has been below 2.8%. But the historical average since 1947 is closer to 7%, double the average of the last decade.

Americans know they aren’t saving enough. In March the Wall Street Journal reported “Fifty-seven percent of U.S. workers surveyed reported less than $25,000 in total household savings and investments excluding their homes[…] Only 49% reported having so little money saved in 2008. The survey also found that 28% of Americans have no confidence they will have enough money to retire comfortably—the highest level in the study’s 23-year history.”

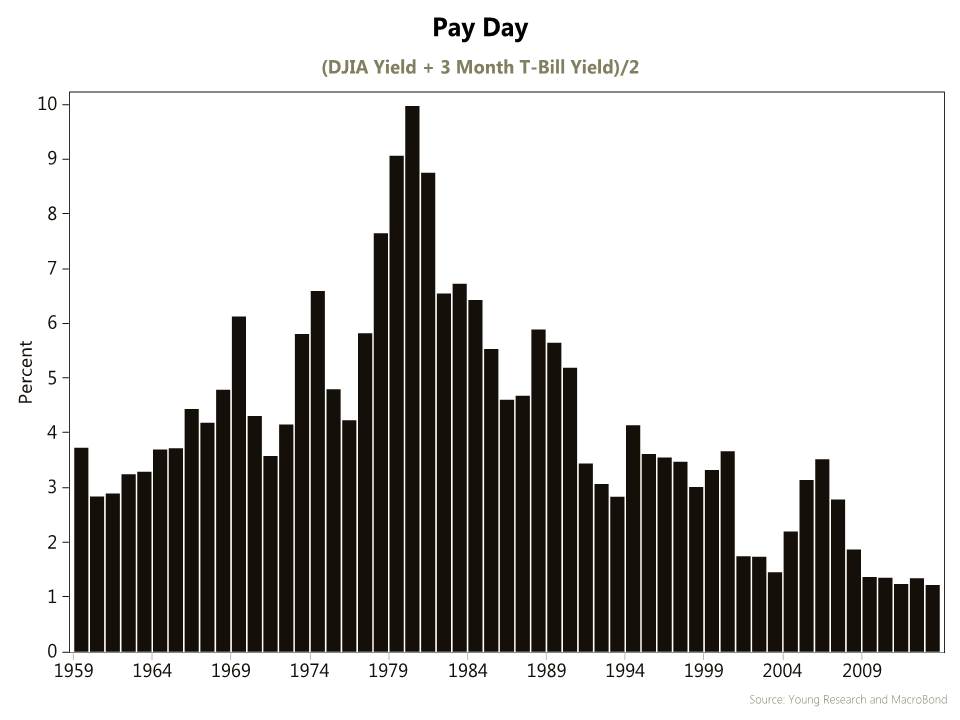

Those are shocking statistics. As indicated by our Pay Day chart, interest rates and yields are at some of their lowest levels ever. That makes saving extra even more important, as the return on your investments could be limited by such low rates and yields.

To determine if you’re saving enough, ask yourself this question. Are you saving until it hurts? If not, you need to save more. To prevent yourself from outliving your money in retirement, you only want to withdraw 4% of your initial portfolio value each year. So do an estimate of what kind of money you’re going to need each year to live the life you want in retirement. Then estimate how much you’ll have saved by retirement given your current savings rate. Will 4% of your projected savings be enough to fund what you want to spend in retirement? If not, you need to save more now.

[/expand]