As U.S stock prices continue their liquidity-fueled ascent, the rationalizations for remaining bullish on the U.S. stock market become more perverse by the day. Barron’s is calling this the TINA market, as in There Is No Alternative to U.S. stocks. [expand title=”Click here to read more.”] How comforting. The best justification for putting your life savings into the stock market is, “Might as well, ain’t nothing better.” The peddlers pushing product for Wall Street’s biggest banks are using a similar line of reasoning, telling their clients to load up on U.S. stocks because the American economy is the best house in a bad neighborhood. That in itself is reason for caution. Maybe buying the best house in a bad neighborhood is sound advice in Manhattan, but not in the rest of America. As every successful real estate investor will tell you, buying the best house in a bad neighborhood is the last thing you want to do.

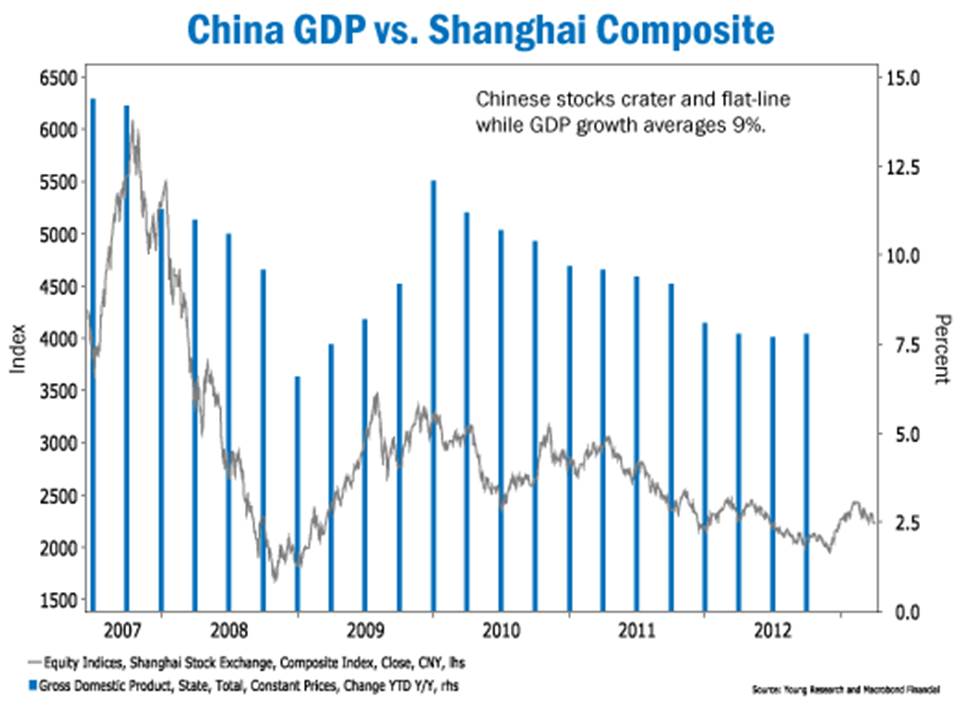

The U.S. economy may be the best looking house in bad neighborhood, but successful investing is about more than buying stocks in the best or fastest growing economies. Anyone who has owned Chinese shares over the last six years has the battle scars to prove that strong economic growth is not a guarantee of future investment success. Our chart on Chinese GDP vs. the Shanghai Composite drives home the point. What you see is a stock market that has cratered from its 2007 high and, for all practical purposes, flat-lined since.

U.S. economic data has had a better tone to start the year, but we have seen this movie before. Since the recovery began, we’ve seen a tendency for U.S. economic growth to accelerate at the start of the year, only to fizzle out as we move into the summer. Some economists point the finger at seasonal adjustment factors that were thrown off kilter as a result of the unusually deep recession in 2008–2009. Others chalk up the seasonal slowdown to coincidence. In 2011 and 2012 the spring slowdown in economic growth coincided with flare-ups in the euro-area debt crisis.

Irrespective of what caused past summer swoons, investors should stay alert for a repeat in 2013. Not because of seasonal factors or another flare-up in the euro-area, though we wouldn’t rule either out, but because the economy is still digesting over $264 billion in tax hikes and $85 billion in spending cuts. There seems to be an assumption among the media and some market participants that because the tax hikes didn’t have an immediate impact on growth, there isn’t going to be an impact. It is, of course, possible that this time is different, but like monetary policy, fiscal policy works with long and variable lags. And based on the historical record, the drag on growth from tax hikes won’t reach its high point until the second half of 2013. The bottom line here is that the jury is still out on the fiscal drag.

As summer approaches with stocks soaring to new all-time highs, invest with caution.

[/expand]