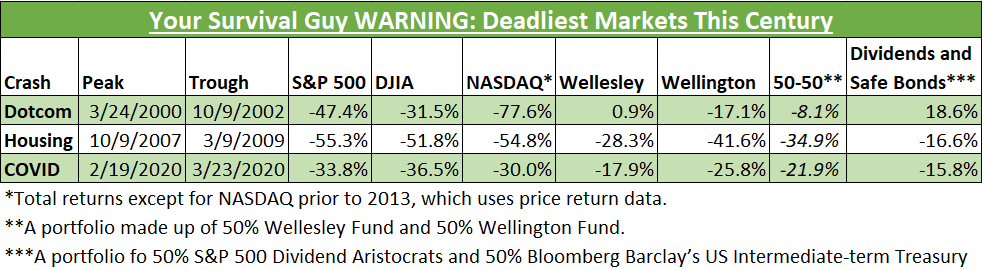

When it comes to your money, I want you to be a survivor. As you can see in my table, stocks have declined by over 30% three times already in this young century, and I’m talking about blue-chip stocks in the Dow Jones Industrial Average. When we look at the tech-laden NASDAQ and the S&P 500, declines have been far more precipitous—declines as high as 68% and 55% respectively. Moving forward, your job will be to survive the wreckage. I’m here to help.

In my table below, you’ll see the performance of the Vanguard Wellesley and Wellington funds during these tumultuous periods in history. The allocation of the former is roughly 60/40 bonds/stocks, while the latter is 40/60—an equal combination of the two is about 50/50 bonds stocks. (Note: I prefer buying individual stocks and bonds today to control dividend yields and maturity dates.)

Turning to Chapter 8, p. 94 of the fourth revised edition of The Intelligent Investor by Benjamin Graham copyright ©1973.

We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds. There is an implication here that the standard division should be an equal one, or 50-50, between the two major investment mediums. According to tradition the sound reason for increasing the percentage in common stocks would be the appearance of the “bargain price” levels created in a protracted bear market. Conversely, sound procedure would call for reducing the common-stock component below 50% when in the judgment of the investor the market level has become dangerously high.

These copybook maxims have always been easy to enunciate and always difficult to follow—because they go against that very human nature which produces that excesses of bull and bear markets. It is almost a contradiction in terms to suggest as a feasible policy for the average stockowner that he lighten his holdings when the market advances beyond a certain point and add to them after a corresponding decline. It is because the average man operates, and apparently must operate, in opposite fashion that we have had the great advances and collapses of the past; and —this writer believes—we are likely to have them in the future.

Action Line: You NEVER want to be in the interest rate prediction business. Follow the guidelines illustrated above and chances are you’ll Survive & Thrive.

Originally posted on Your Survival Guy.