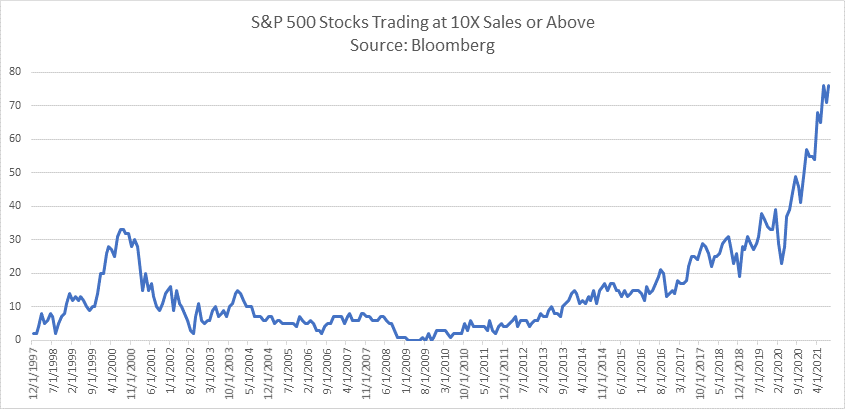

You know it’s no fun getting homework, especially on a Friday. But this is too important to let the weekend go by without thinking about what I’m about to write. Because every now and then, there’s a piece of research or an article that’s a game-changer, like this chart below, showing you the madness in the stock market and probably in your mutual funds and ETFs.

But that’s not my focus today because this week, I read one of the most important articles I’ve ever read on annuities and life insurance, two areas Your Survival Guy eschews and treats like rat food, that the article deftly illustrates and has been one of my biggest concerns. But before we get into that, let me tell you, I have no problem with the brokers who sell insurance.

Why? Because you’re usually introduced to an annuity or life insurance product simply living in your hometown by a broker you’ve known for a long time. You see him at events. You like him. You trust him, and you like doing business with him, plus his office is close by, making it easy for you to stop in if you need to. This personal relationship is what I love about the insurance business.

But (you knew that was coming) problems arise when the insurance company he works for sells your annuity or life insurance to another company that’s, let’s say, a not-so blue-chip operator. Insurance companies do this all the time and, especially now, are dropping parts of their business (you?) faster than Biden’s approval ratings. Why?

Look, it’s no fault of your own to be lured into buying a product that guarantees positive returns with no losses like an indexed annuity. But think about that for a second. Do you really think insurers are in the game so you invest and they lose? Please, of course NOT. Look at what’s going on with the ESG racket and you quickly realize, “I get it, it’s you invest, they win.” Ahhhhh, silly me.

Right now, insurers are selling their overpromised book of annuities and life insurance businesses. They’re selling them to hedge funds, smaller companies, and or the private equity guys. Is that a problem?

Well, imagine when you first bought your house and a mortgage. You write a check to the same bank for months or years, and then one day, a letter arrives in the mail letting you know your mortgage has been sold to XYZ Bank, and to send the checks to them, thank you very little. No big deal because you have your house. But when your annuity or life insurance is sold to a lesser provider, how do you know they’ll be able to make good on the promises you initially signed up for?

You don’t. And now you’re months or years older where if you want to get your money back, you might be faced with egregious surrender fees. Or worse yet, your health ain’t what it used to be, so you’re never getting a new life insurance policy. So you’re stuck, and you just hope and pray it all works out. As my father-in-law, Dick Young, reminds us, “HOPE IS NOT A STRATEGY.”

Action Line: You know what? We’re lucky to have Leslie Scism at The Wall Street Journal, who wrote “Who Owns Your Life Insurance Policy? It Might Be a Private-Equity Firm” sticking her neck out to bring this intelligence to us. Believe me, there’re some big-time fights going on behind closed doors. Just read the article to see why. It’s breathtaking how a nice relationship and agreement you had with your trusted local insurance agent can turn into you being stuck with an owner you never thought you’d do business with. Now what?

Scism writes:

Americans own more than 160 million individual life insurance and annuity policies. A big, unexpected change is ahead for many of them.

Traditional life insurers are leaving the business in droves. The responsibility for death benefits, which might be a half-century away, or for annuity income streams that run over decades, is increasingly in the hands of a new breed of insurance-company owner.

The growing wave of deal activity is unsettling to some policyholders who had chosen well-established and often strategically conservative companies in the 262-year old U.S. life-insurance industry. In some cases, a key component of families’ financial planning suddenly is in the hands of newcomers, some known for investing in distressed companies and unusual securities. Moving to a new carrier isn’t always simple or affordable depending on their age or declining health.

The newcomers, which include private-equity, asset-management and other investment firms, often believe they are scooping up insurers on the cheap, or are attracted to the premiums paid by policyholders that they will be able to invest for fees. Some are acquiring entire insurance companies, and others are buying stakes in them. Policyholders who bought life insurance from Allstate Corp. unit Allstate Life Insurance Co. ALL 0.35% , for instance, soon will rely on entities managed by Blackstone Group Inc. BX 1.01% to pay their beneficiaries after they die.

The steep drop in interest rates since 2008 is a driving force behind the deal frenzy. It has led traditional insurers, which invest policyholders’ premiums and the capital backing up their obligations primarily in plain-vanilla bonds, to retreat from products most hurt by low rates. Many are unloading blocks of old policies and annuities. More deals are expected, as shareholders pressure publicly traded insurers to ditch businesses that drag down returns.

Many new owners think their expertise with less-common investments, such as privately placed corporate debt and asset-backed securities, will give them an edge over more cautious insurers. The new guard sometimes invests in unusual things—like the Los Angeles Dodgers baseball team. But their investments generally are only modestly riskier than traditional insurers’, and they on average hold more cash and have larger capital cushions as an offset, according to an analysis by ratings firm A.M. Best.

So far, more than two dozen investment firms own or control 50 U.S. life-insurance companies out of just over 400, according to Best’s data. The new owners’ insurers total more than $600 billion of assets, according to Best.

Principal Financial Group Inc., which has been in the life-insurance business for 142 years, is in the process of discontinuing sales of individual life products and certain types of annuities to U.S. consumers, and is looking for ways to potentially divest old blocks of business. Hartford Financial Services Group Inc. and Voya Financial Inc. have exited entirely insurance and annuity sales to individuals, including through divestitures.

MetLife Inc. spun off the bulk of its U.S. retail operations, and American International Group Inc. has a public offering of its life-insurance and retirement-services unit planned. AIG is selling a 9.9% stake in the unit to Blackstone, which will manage a portion of the assets. Last week, Prudential Financial Inc. said it reached a $1.5 billion pact to sell an annuities unit to Bermuda-based Fortitude Re, which is backed by investors including Carlyle Group.

The new guard includes affiliates of Apollo Global Management Inc. and KKR & Co. Ranks also include smaller firms that most ordinary Americans wouldn’t know.

“The restructuring in the insurance industry isn’t showing any sign of slowing down,” said James Belardi, chairman and chief executive of Athene Holding Ltd. , an insurer that Apollo helped launch in 2009.

Smaller investment firms with limited resources are increasingly seeking to do deals, say industry bankers, lawyers and consultants. Consumers may face more risk if these buyers replace financially strong parents, particularly if they aim to invest aggressively.

A lot is riding on state insurance departments. They must approve all deals to weed out inexperienced buyers who wouldn’t be able to weather tough times. They also have ordered extra consumer protections to approve transactions such as requiring the buyers to hold higher levels of capital than customary.

Some policyholders and annuity owners are alarmed when a company has handed off their business. Some hear about deals from headlines, and some from agents. Others find out when the new owner sends a letter announcing a name change.

Note from Your Survival Guy: Read this last paragraph again.

Originally posted on Your Survival Guy.