As pensions loaded up on real estate as a “sure thing, can’t miss” investment, office buildings are drowning from a wave of sublease space. Konrad Putzier reports on the glut of office space in The Wall Street Journal, writing:

The amount of space listed for sublease surged in the first year of the pandemic to the highest level in decades in some cities. But it fell in the second half of 2021 as offices leased up and some companies took listings off the market.

Now it is rising again. Sublease availability across the U.S. increased 3.6% in the first quarter to 159 million square feet, according to CBRE Group Inc. That is still below last year’s peak of 162 million square feet, but well above prepandemic levels.

All that space is hitting the market at a time when landlords are already grappling with low demand and a record amount of lease expirations, pushing rents down and vacancies up.

“There are not enough tenants who will absorb these spaces,” said Jim Wenk, vice chairman at real-estate brokerage Savills.

The recent uptick in companies putting their space on the market is a delayed response to the Omicron outbreak of late 2021, which led more companies to settle on hybrid work and cut space, said Julie Whelan, global head of occupier research at CBRE. It also reflects uncertainty over the economy amid inflation and rising interest rates, she added.

Now, thanks to these and other bad investments, pensions are dropping and participants have every right to be scared. Heather Gillers reports separately in the WSJ:

State and local government retirement funds started the year with their worst quarterly returns since the beginning of the pandemic. Things have only gone downhill since.

Losses across both stock and bond markets delivered a double blow to the funds that manage more than $4.5 trillion in retirement savings for America’s teachers, firefighters and other public workers. These retirement plans returned a median minus 4.01% in the first quarter, according to data from the Wilshire Trust Universe Comparison Service expected to be released Tuesday. Recent losses have further eroded their holdings.

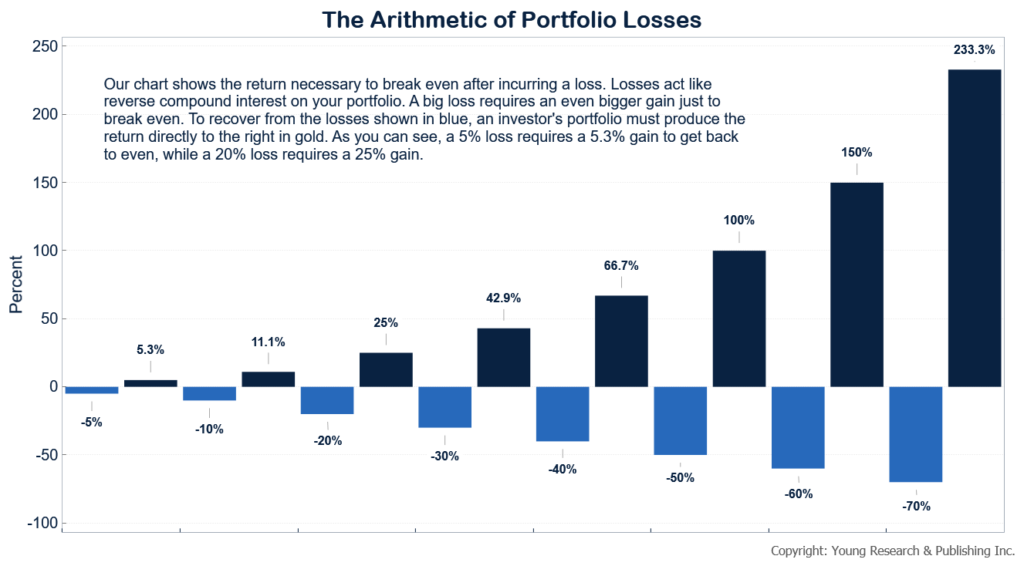

Too many pension funds have been trying to make up for lost time by taking on greater and greater risks. Now they’ll only lose even more ground they’ll have to try to make up. Take a look at my Arithmetic of Portfolio Losses chart. You’ll see just how difficult it can be to make back what you’ve lost. That’s why I want you to focus on return of capital, not return on capital.

Action Line: Pensions are busy trying to make up for lost time, but you can put time on your side by harnessing the power of compound interest. If you need help building an investment plan focused on the power of compounding your wealth in times like these, I would love to talk with you.

Originally posted on Your Survival Guy.