By marcogarrincha @ Shutterstock.com

With securities markets in a heightened state of volatility, it’s a great time to ask yourself how exposed your portfolio is to risk. Most investors, if asked, would be able to provide little detail about the risks to their portfolio. If you find yourself unable to answer, that’s ok.

It’s Not Too Late, Yet

Now is the time to begin assessing the risk in your investment portfolio. If your holdings are not balanced to help you achieve your goals, you should begin shifting them as soon as possible, because, as I wrote in April 2017, retirees cannot afford a walloping.

Retirees Cannot Afford a Walloping

Back in 1989, I said, “let capital appreciation come as it will.” Unlike dividends, capital gains don’t show up every year. Since 1960, the S&P 500 has recorded 17 down years, with one of those down years coming in at a stomach-churning 38%, two in the 20%–30% loss range, and seven additional years that recorded double-digit losses. Retired or soon-to-be-retired investors simply cannot afford to get walloped with double-digit losses without a steady stream of dividend income to soften the blow. The last thing you want in a bear market is to be forced into selling shares at the bottom to fund living expenses. Steady, increasing dividends provide the cash flow and comfort necessary to ride out down markets. Investors who bail at the bottom decimate their portfolios and are forced into playing a game of “catch up” to get back to even.

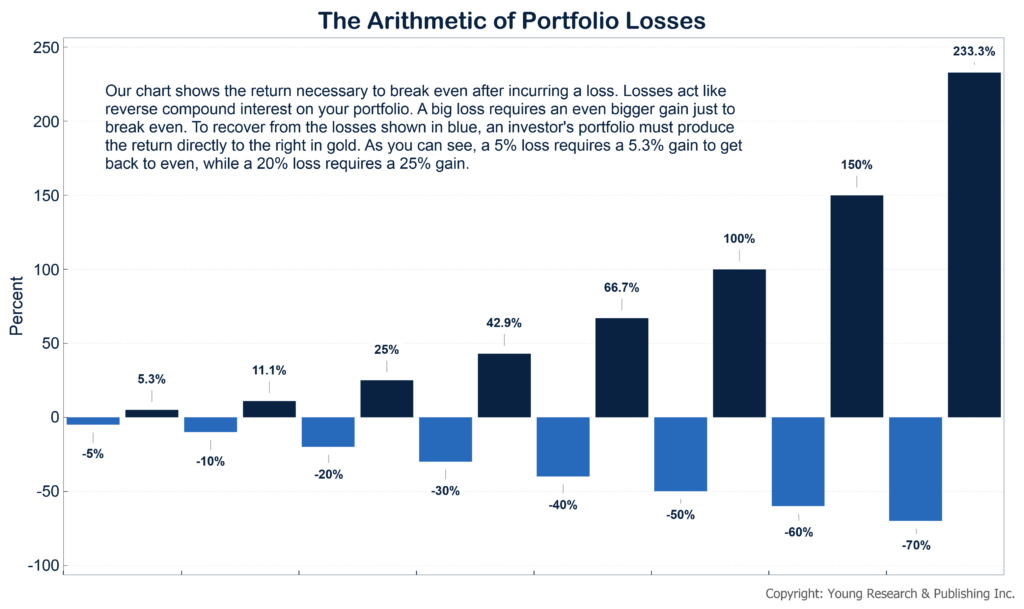

You can see on my chart the return necessary to break even after incurring a loss. Losses act like reverse compound interest on your portfolio. A big loss requires an even bigger gain just to break even. To recover from the losses shown in black, an investor’s portfolio must produce the return directly to the right in blue. As you can see, a 5% loss requires a 5.3% gain to get back to even, while a 50% loss requires a 100% gain.

If you need assistance in rebalancing your portfolio, fill out the form below. You will be contacted by a seasoned professional from my family run investment counsel firm, Richard C. Young & Co., Ltd. who will perform a free, no-obligation review of your current portfolio.

Originally posted on Young’s World Money Forecast.