Your November Rage Gauge™ is in, and it’s at a record high, but you don’t need me to tell you that—just look around you. This week you learned Social Security’s cost of living adjustment will average about twenty bucks a month next year. You remember a time when a crisp twenty-dollar bill meant something to you.

It meant I had to cut my neighbor’s lawn twice or scoop ice cream for five hours. Today you’re looked at as old-fashioned when presenting one for payment—as if cash is an inconvenience. “Just Venmo me.” What could possibly go wrong with the digitalization of the dollar?

What could go wrong when the Fed destroys your dollars with a few keystrokes while you’re sleeping? Where’s the accountability? If we can’t end the Fed, then how can this possibly end well?

It’s in times like these you need to make sure you protect what you’ve made. Separating you from your money is so much easier when you don’t even know they’re doing it. So what are you to do? What is your action plan?

First and foremost, consider working longer and if you’re retired, consider downsizing and cashing in on your home (don’t worry, the kids will visit). Understand your money is your “Revolutionary army,” holding the line against a tyrannical government that doesn’t realize the harm it’s doing (or does it?).

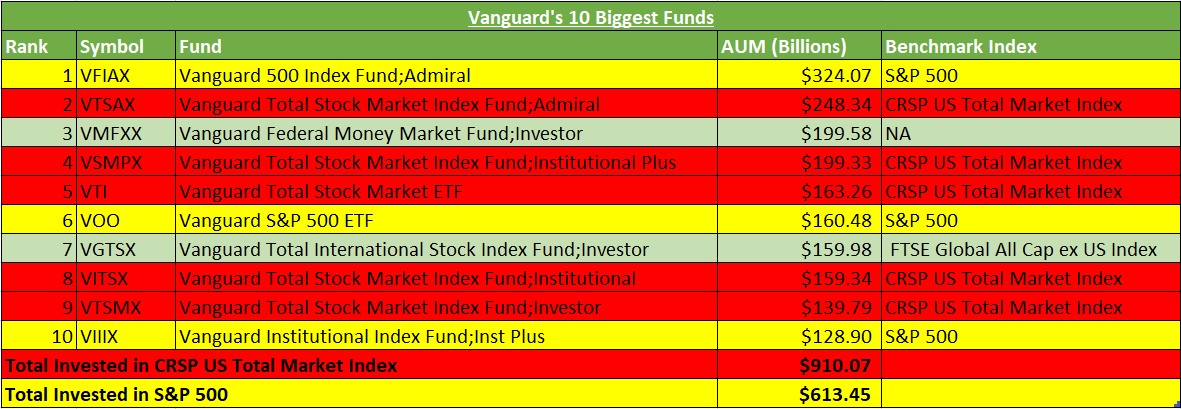

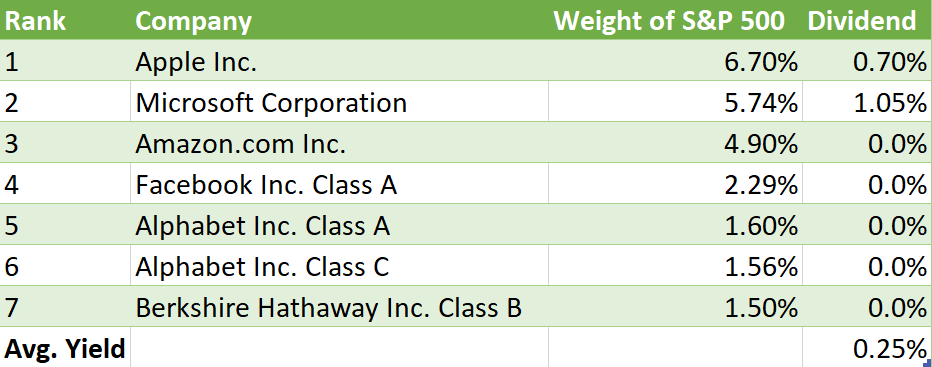

Consolidate your assets at Fidelity and understand what you own if you’re at Vanguard. By no means do I want you in the Jabba the Hut of funds as I’m growing more uneasy even about a list of others you know as household names.

There was a time when you’d talk to your broker on a rotary phone. Commissions were high. But today, you can do it online for free to have a little fun. Buying stocks should not be fun. It’s monotonous, borderline b-o-r-i-n-g work. But when it begins to compound, then yes, it becomes F-U-N.

Action Line: The next three weeks will impact the next few years like no other. Take a few minutes to understand what you own and to consider if it belongs in your portfolio. Do one thing to beat inertia and put yourself on the path of action. Make sure your money is working for you and not just singing the song.

Originally posted on Your Survival Guy.