With stocks down more than 33% three times now this century, it’s clear that investors have a short-term memory problem—forgetting how bad they felt in March 2001/2008/2020—which is why my RAGE Gauge continues to signal my highest risk level.

With stocks down more than 33% three times now this century, it’s clear that investors have a short-term memory problem—forgetting how bad they felt in March 2001/2008/2020—which is why my RAGE Gauge continues to signal my highest risk level.

The new normal we’re living with is a manmade China virus and manmade chaos created by blue state government. Schools are a mess as lawyers lick their chops, ready to pounce with class-action suits, and parents seethe because they want their kids in the classroom where they belong. Anecdotally, at my son’s school, a positive test (kid feels fine) means you’re sent home, and those in close contact must quarantine for 14-days (in a dorm room).

In America, assets are booming, especially your home (if you’re not in a city that is) and your portfolio. Speculation is rampant in the second and third home spec markets, and Robinhoods are day trading their lives away. Around town and on Main Street, businesses tell me it’s a struggle at best.

The Fed is going wild, pushing on a string, while guys like Mark Cuban say everyone should get a thousand bucks cash every two weeks while his struggling NBA product continues to be unwatchable. I guess it’s all funny money when it comes so easily. No inflation? How about putting food on your table and going (I never will) to a game. Have you ever felt more disconnected from the Fed and professional sports?

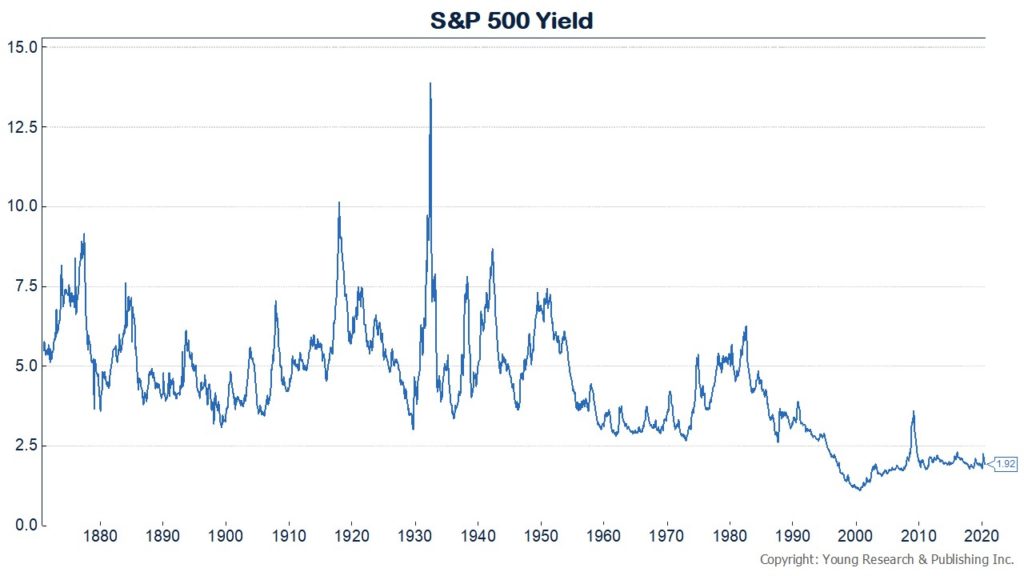

Think about how much money you have saved in your lifetime and what you’d have to do in today’s environment to match it. While you’re rubbing your eyes thinking about that depressing scenario, let’s not forget that the foolish indexes like the S&P 500 aren’t paying squat, with yields rounding out at some of the lowest ever. Remember, a higher than average dividend (what we favor) is the definition of value investing.

| Rank | Company | Symbol | Weight in Index | Yield |

| 1 | Apple Inc. | AAPL | 6.5% | 0.8% |

| 2 | Microsoft Corporation | MSFT | 5.7% | 1.1% |

| 3 | Amazon.com Inc. | AMZN | 4.8% | 0.0% |

| 4 | Facebook Inc. Class A | FB | 2.2% | 0.0% |

| 5 | Alphabet Inc. Class A | GOOGL | 1.6% | 0.0% |

| Total | 20.8% | |||

| Average | 0.4% |

Pay attention to what I’m saying. When one’s risk tolerance is discovered after the crash, you quickly realize that a low return on assets still means a return of said assets. Keep what you make, downsize your living, and understand that half the people out there simply see the world entirely different than you do. Prepare your family now, because when you’re gone, who’s going to look out for them? Mark Cuban? The Fed? Your governor? Your mayor? Don’t count on them. You are your best salvation. You are the light your family needs in times like these.

Action Line: If your family is going to rely on you, you need intelligence. Click here to sign up for my monthly RAGE Gauge alert. I’ll keep you on the pulse so you won’t miss the boat.

P.S. This morning, my father-in-law, Dick Young, gave his readers insight into stock market investing for a secure retirement. He writes:

Here’s why I don’t follow the meaningless price or market capitalization stock market averages, especially the likes of the Dow and S&P 500.

- The S&P 500 Index: only 50 of the biggest cap names account for more than 50% of the total S&P500 Index.

- The Dow 30: only 10 of the highest priced stocks account for more than 50% of the total Dow Jones Industrial Average.

No thanks to index investing in either the Dow or the S&P.

Dick Young’s Investment Rules

Why savvy investors saving for a long and comfortable retirement should always follow RCY’s guide in crafting balanced portfolios:

- RCY: I rarely invest in stocks that (1) pay no dividend or (2) have not increased shareholder payout for years.

- RCY: I don’t like companies with high P/E ratios. In fact, stocks with single-digit P/Es are most appealing.

- RCY: Consumer expenditures account for $7 out of every $10 of real GDP, so I use Vanguard’s broad Consumer Staples ETF portfolio as a handy shopping list for many of my individual stock purchases. This allows me to craft portfolios with an average yield of about nearly 3%

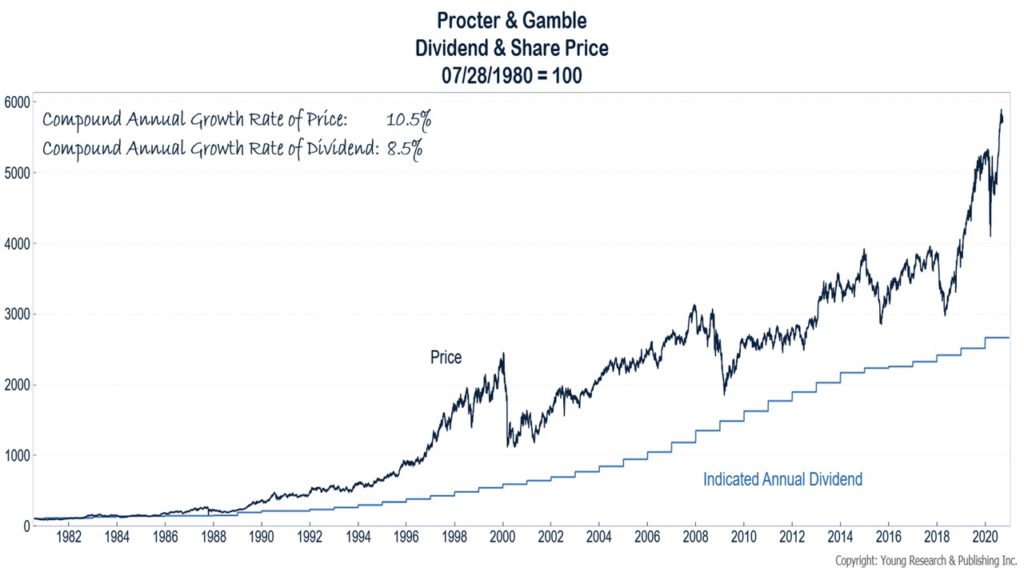

- RCY: I also insist on long-term annual dividend growth.

Over the long term, stock prices most often follow dividend increases upward.

Once you construct a conservative portfolio in a low interest rate environment like the one we face today, cash flow can be readily enhanced with a modest, replaceable draw from principal. By example, a client wanting a 4% annual portfolio draw can withdraw temporarily an additional 1% from principal annually.

Don’t forget, each year your portfolio receives more cash from increasing dividends, your yield on initial investment goes up. Talk about a winning hand.

Originally posted on Your Survival Guy.