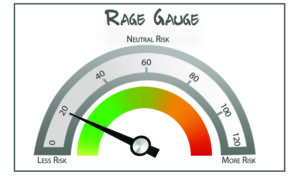

Investors are in what Bloomberg writer Adam Haigh calls a euphoria today. According to my RAGE Gauge, Americans are still not factoring in much, if any, risk. While the economy is strong and the stock market is up, it’s always a good idea to be wary when others are not. When you hear words like euphoria being used to describe investor mentality, it pays to be skeptical. Haigh writes:

Euphoria on Wall Street that stocks can just keep on building on record highs is getting so stratospheric that it’s reaching levels that previously signaled a slump.

Analysts are ratcheting up their forecasts for U.S. corporate profits at the fastest pace in more than 10 years, according to the research firm Bespoke Investment Group. And that’s happening, unusually, right in the run-up to an earnings-season kick-off. While the upgrades could be taken as a positive reflection on the economy’s outlook, in the past such bullish analyst sentiment has served as a precursor to a market decline.

The last time the gap between analysts lifting forecasts and those lowering estimates was this wide was in May 2010. The divergence at the time widened after the U.S. S&P 500 Index had climbed more than 10 percent over the previous three months. Just before analyst sentiment peaked, stock prices also topped out, and the index slid more than 15 percent.

Read more here.

Originally posted on Yoursurvivalguy.com.