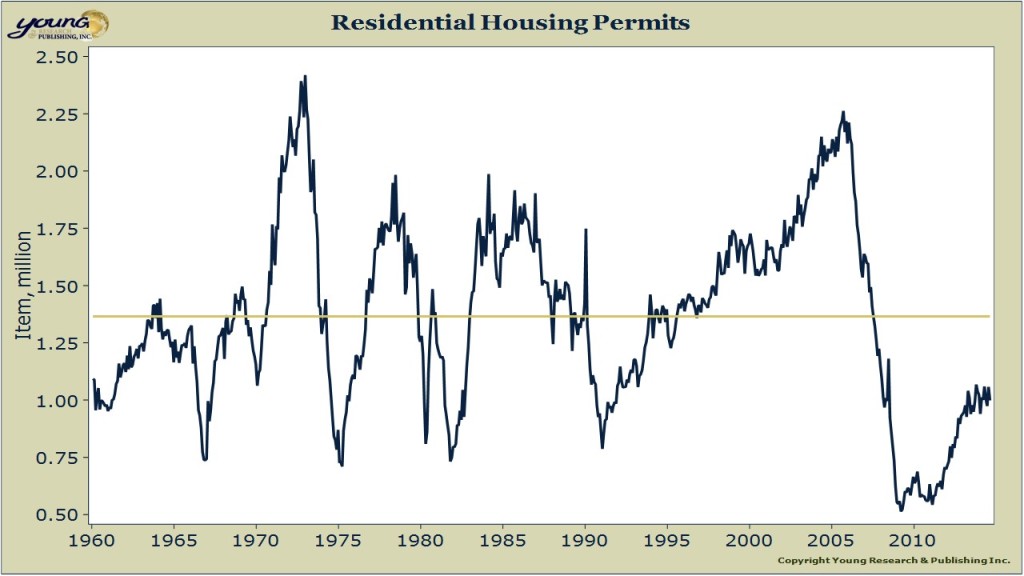

A disturbing look is appearing on the long-term chart of residential housing permits granted in the United States. The monthly measure has stabilized near 1 million. That’s about twice as many as the depths of the housing crisis, but not even close to its long term average of 1.4 million permits per month. Worse yet, you can see from the chart that it’s rare for a stabilization like this to have an upward exit. Most stabilizations signal an end of the cycle. In this case it would be the end of a housing cycle that hadn’t even really begun.

Could the trouble be in restrictive government policies as JP Morgan’s Chief Global Strategist David Kelly recently said? CNBC writes:

“The reason housing is still weak in the United States is because of the combined efforts of the federal government and Federal Reserve to help,” Kelly said at the Morningstar ETF Conference in Chicago. “The federal government … is on a witch hunt after the large banks because they decided to assign to the large banks all the blame for what happened in 2008.”

“You really don’t want to write a bad mortgage today,” Kelly said of what he called the “war on risk” by the government. “Banks really don’t want to do this because if they do the right thing, there’s a chance they’re going to get beaten up horribly, multiple-fold, a few years from now.”