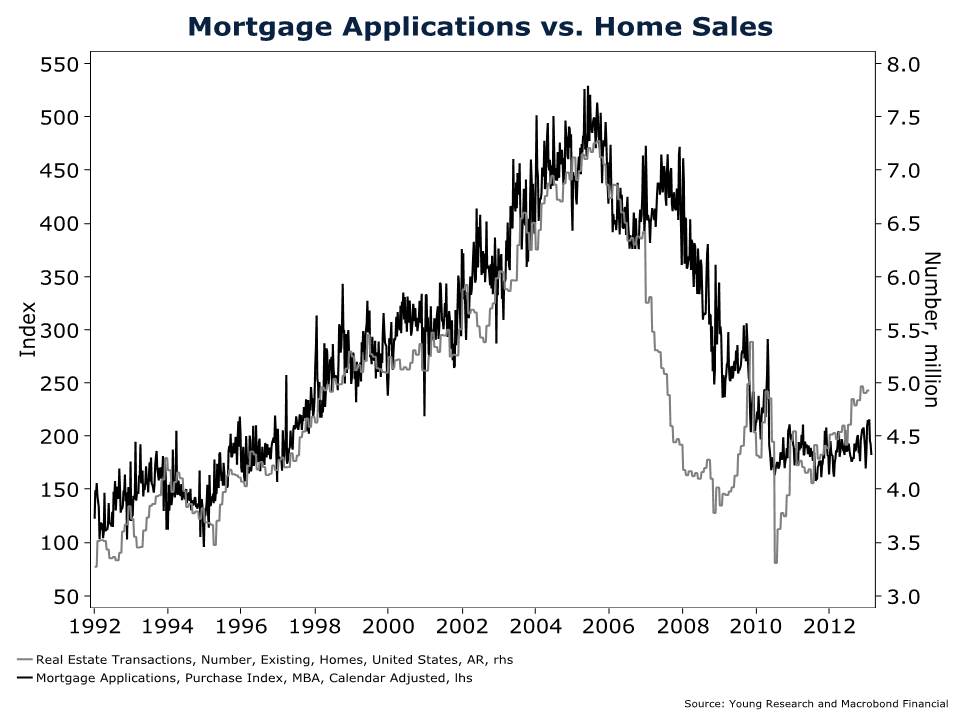

You can see on the chart below that over time, sales of homes and the number of mortgage applications have tracked each other pretty close. Those fundamentals seem to have broken down at the end of 2006 when the number of mortgage applications was still rising but the number of homes actually being sold was plummeting. Throughout the recent crisis the relationship failed to repair itself.

But something interesting is happening now. While the number of mortgage applications has been slowly rising from the middle of 2010, since the middle of 2011 home sales have been surging upward. That’s a sign that many buyers are using cash to purchase new and existing homes. Most Americans don’t have the kind of money lying around to purchase a home without a mortgage, so the buyers are probably investors and hedge funds looking for a good deal.

CBS MoneyWatch reports that absentee buying is up over its ten year average in 28 metropolitan areas around the country. Absentee buying is another good indicator of investor demand. This is their explanation of the results.

Even at the peak of the bubble in 2005, only 11.5 percent of homes in Los Angeles were purchased by absentee buyers — now 25 percent are. Over the past decade in Miami, only 33 percent of homes were purchased by absentee buyers, while in 2012 42 percent were absentee. In Las Vegas, a whopping 51 percent of purchases consisted of absentee transactions; while this is more typical in a vacation destination like Las Vegas, that total is still a full 10 percentage point higher than average.

Even in areas where you would ordinarily see almost no second-home purchasers, like Cincinnati, there’s a significant increase in absentee buyers. The average number of absentee buyers in that Ohio market over the past 10 years accounted for 22 percent of all home purchases. In 2012, by contrast, 35 percent of all homes purchased were by an absentee buyer, likely investors looking to pick up a cheap piece of property. That’s a huge jump.

Cautious optimism should be the mindset of anyone considering the real estate market for investment. While the market is certainly picking up, a reliance on investor buying could indicate that the fundamental demand necessary to develop a long-term bull market may not yet exist.