“A stock-market selloff intensified Wednesday, wiping out hundreds of billions of dollars in value from the Magnificent Seven group of tech giants and pushing the Nasdaq Composite to its first decline of 3% or more in 400 trading days,” reads the WSJ.

Are we having fun yet?

Your Survival Guy’s not tooting his own horn (maybe a little), but yesterday’s selloff illustrates the counterbalancing and shock absorption properties of a well-balanced portfolio—the importance being not necessarily what you invest in, but how you invest. Because when you have a counterbalance of bonds anywhere from 30-70 percent, you don’t have all your retirement eggs in one basket.

With interest rates at generational highs, it’s time you considered bonds, don’t you think? When a dollar isn’t worth a dime, you realize you don’t like how it feels to lose money in both stocks and the checkout line. But “stocks always go up over the long-term,” you think. I hate to be the bearer of bad news, but if you’re in retirement or it’s right around the corner, you can’t wait for the “long term.”

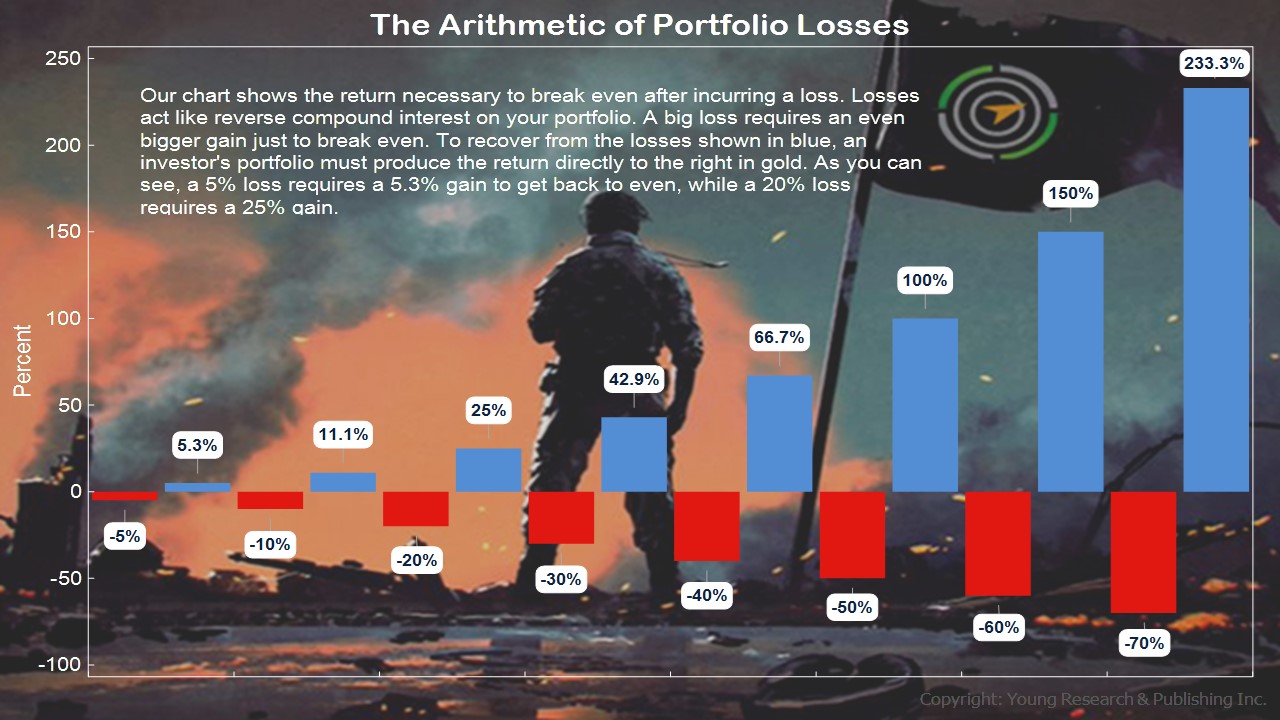

This mini jilt in stocks is nothing. But it is eye-opening, isn’t it? It’s easy for investors to ignore their portfolio until it starts to go down. Then, it becomes serious. That’s the hard arithmetic of portfolio losses. They’re hard to make up. “I seriously can’t afford to lose money,” you think. Here’s the rub. You don’t want to miss the boat on the upside. You want to have as much money as possible for when you need to spend it. I hear you.

But spending, like saving, is a learned habit. It’s not easy to do correctly. It’s scary. And that’s why investors prefer not to pay attention. Yes, “don’t just do something, stand there” are words to live by, with a caveat: Only if how you’re invested is right for your age.

Action Line: Inertia is a terrible foe. If you’re beginning to feel uneasy about your portfolio, now may be the time to act. When you’re ready to talk, let’s talk. But only when you’re ready to be serious about your retirement life.

Originally posted on Your Survival Guy.