Originally posted September 15, 2022.

Your Survival Guy’s four ways to your wealth are:

- Let your money hibernate

- Work for as long as you can

- You are most valuable

- Get your lazy cash off the couch

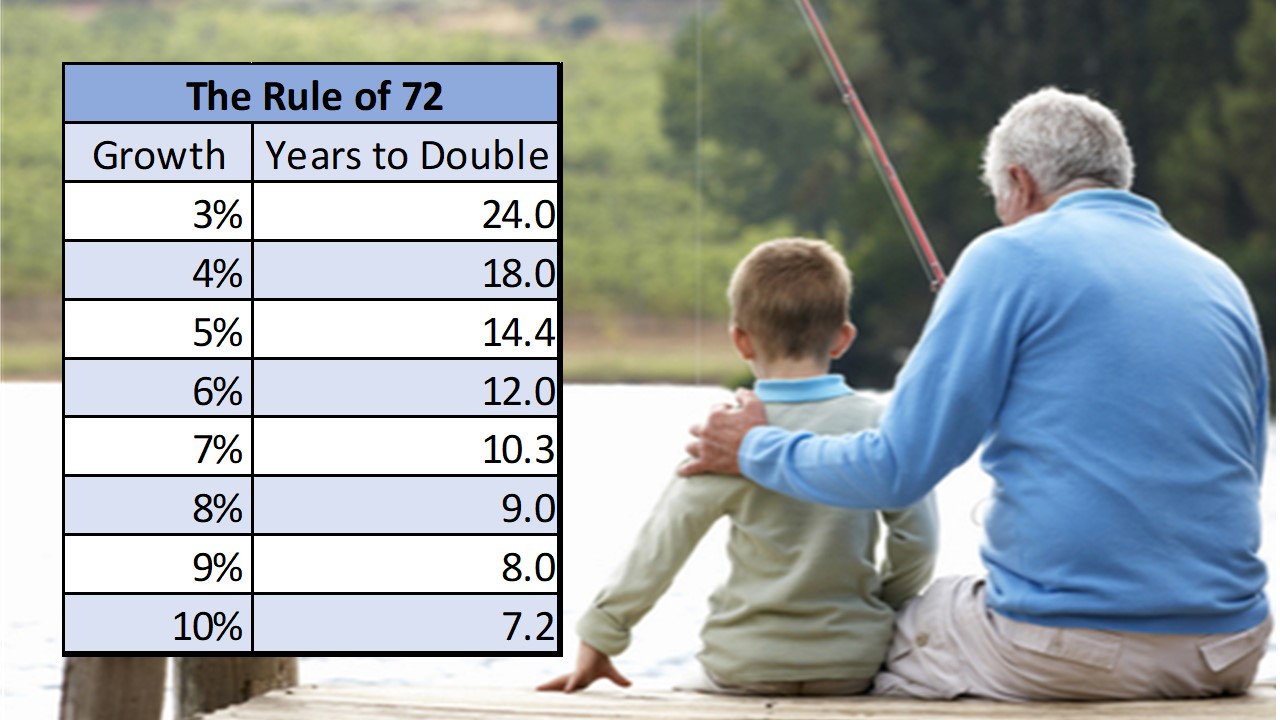

Look, I want you to be a compounding machine. I’ve spent most of my life compounding money beginning with a passport savings account my dad helped my sister, and I set up at the local bank when we were kids. Back then, interest rates were something you could sink your teeth into, and if you kept the money invested long enough, you saw interest on interest work its magic.

I didn’t worry about inflation. That’s the beauty of saving money. It hibernates. It wakes up in the spring (or years later), having missed a cold, dark winter. “What’s everyone so upset about?” you wonder.

Save ‘til it hurts is what I want you to do. And it’s not that painful. Most of the time. My son still reminds me I put all his summer savings into an “stupid” IRA (I guess they exist), and he has no money for pizza. “It’s not good for you anyway,” I joke. Note to self to review savings plan next year. Save ‘til it hurts, and let that money hibernate and grow.

OK, how about work? Work for as long as you can. That’s number two. Sorry for the drudgery. Yep, you want to work for as long as you can. In times like these, with inflation eating away at your dollars that aren’t worth a dime, you gotta keep working.

Now I don’t like the idea of working to a certain “number” that you feel you “need” (a terrible word when associated with most things money; “Dad, I need the new iPhone,” for example). I want you to work for as long as you can because when you bring in cold hard cash, you allow your savings to breathe. Let them relax, and to be added to. That’s a good thing.

Number three is don’t lose money. I want you to invest to keep what you make. YOU are your most valuable investment. What you do with your JOB every day, getting to work, is a linear event. It turns into geometric growth as your experience compounds over your career. Imagine starting out all over again. That would be rough. Imagine losing your experience. Losing money is losing a piece of your soul. That’s tragic. It really is.

Finally, beat inertia. We all deal with it. We all have it. It’s part of life. It never goes away. What are you going to do with it? You got to get your lazy cash off the couch. Commit to a life of putting your earnings to work because it’s too expensive not to.

Action Line: Slow and steady wins the race. I’m living proof of that. Easy to write. Harder to do. Stick with me. You got this.

Originally posted on Your Survival Guy.