How should you invest in gold? We explain how to invest in gold in seven different ways. We explain how to invest in gold coins or bars. How to invest in gold exchange traded funds (ETFs). How to invest in gold mining stocks and gold royalty stocks, and how to invest in gold futures.

At Young Research, we have followed the gold market for over four decades. Young Research’s founder and Chairman, Richard C. Young even owned a small private gold company that specialized in Gold Pandas.

To invest in gold back then, it was either gold mining stocks or gold coins for most.

Today, investors have many options for gold investment.

What Is The Best Way for You to Invest in Gold?

The most important part of that question is the “you.” The best way for you to invest in gold may be different than the best way for somebody else to invest in gold.

You can prevent a costly mistake by planning your gold investment. Deciding what your goals, motivations, and objectives are with a gold investment should be priority number one.

For example, are you buying gold to diversify your retirement portfolio? Do you have a large or modest amount of money to invest in gold? Have you thought about where you would store gold if you decide to take possession of it? Have you compared the tax implications or the various forms of gold investment? Are you making a long-term investment, or are you more interested in trading gold?

Seven Different Ways to Invest in Gold

Below we cover 7 of the most popular ways to invest in gold. Click the links in the table of contents below to skip to a section.

- Gold Exchange Traded Funds (ETFs)

- Gold Bullion Coins and Bars

- Collectible Gold Coins (Numismatics)

- Gold Mining Stocks

- Gold Mining Mutual Funds & ETFs

- Gold Royalty Stocks

- Gold Futures

- Summary of How to Invest in Gold

How to Invest in Gold Exchange Traded Funds (ETFs)

Until the first physical gold-backed ETF, the StreetTRACKS Goldshares ETF (GLD) (later renamed SPDR Gold Shares) came to market in 2004, investing in physical gold was more onerous. Investors usually had to take delivery of gold and find a place to store it securely.

There was an exchange traded vehicle that allowed physical investment in gold, but it was in the form of a closed-end fund. That fund, now called the Sprott Physical Gold and Silver Fund (CEF) is still around. It is modest in size, owns both silver and gold, and there are closed-end fund premiums and discounts investors must worry about, but it is an exchange traded option.

Gold-Backed ETFs

The listing of the SPDR Gold Shares ETF (GLD) made investment in physical gold much cheaper, more convenient, and more liquid. Today there are 7 physical gold-backed ETFs which can be purchased on U.S. exchanges.

Structure of Gold ETFs

Most physical gold backed ETFs are structured as trusts. Each trust has a sponsor, an administrator, and a custodian. The sponsor is the firm that establishes the trust and oversees its other service providers. The sponsor of the SPDR Gold Shares ETF (GLD) is the World Gold Council. The administrator is the firm that performs and supervises the performance of services necessary for the operation and administration of the trust. The Bank of New York Mellon is the administrator for GLD. The custodian is charged with safekeeping the gold. The Custodian for the SPDR Gold Shares ETF is HSBC Bank plc.

The Gold in physical gold backed ETFs is stored in bank vaults on an allocated basis. The SPDR Gold Shares ETF’s gold is held in London vaults. A list of gold bars is updated and made available on the SPDR Gold Shares ETF website along with the most recent inspection certificates. The gold can be audited twice per year by the trustee, and the trust’s independent auditors may audit the gold as part of their financial statement audit.

List of Gold-backed ETFs in the United States

The table below includes the name of each Gold-backed ETF along with the expense ratio, average bid-ask spread, and the assets in each fund.

| Name | Fund Assets (millions) | Expense Ratio | Avg. Bid-Ask Spread |

| SPDR Gold Shares Trust (GLD) | 44,120 | .40% | .01% |

| iShares Gold Trust (IAU) | 17,070 | .25% | .07% |

| Aberdeen Standard Physical Gold (SGOL) | 1,173 | .17% | .07% |

| SPDR Gold MiniShares Trust (GLDM) | 1,099 | .18% | .07% |

| Graniteshares Gold Trust (BAR) | 589 | .17% | .12% |

| VanEck Merk Gold Shares (OUNZ) | 173 | .40% | .08% |

| Perth Mint Physical Gold ETF (AAAU) | 166 | .18% | .07% |

Tax Implications of Gold ETFs

Gold ETFs can be held in taxable accounts as well as IRAs and other tax-deferred and tax-exempt accounts. Profits on gold ETFs are taxed as collectibles at a maximum tax rate of 28%. Depending on your tax situation, it might make sense to hold gold ETFs in your tax-deferred accounts.

Gold-backed ETFs are a convenient and cost-effective way to invest in gold. For investors purchasing gold to diversify a portfolio, or to actively trade gold (not a strategy we advise), gold ETFs are hard to beat.

How to Invest in Gold Bullion Coins & Bars

Bullion is the term given to gold coins and bars minted primarily for the value of their gold, not for their value as a collectible. Collectible coins are often referred to as numismatics.

Until 1974, it was illegal to own much gold in bullion form as a private citizen. In 1973, Jim Blanchard, a pro-gold legalization activist, arranged for a plane pulling a banner that read “Legalize Gold” to fly over the second inauguration of President Richard Nixon.

Shortly after Gerald Ford legalized personal ownership of gold in 1974, Blanchard opened Blanchard and Company in New Orleans.

Today, Blanchard is the largest and one of the oldest and most respected gold dealers in the United States.

At blanchardgold.com, you can buy gold bullion, numismatic coins, and other precious metals. You can purchase fractional coins, bars, certified coins, and investment-grade coins.

If you want to take physical possession of gold, purchasing gold bullion coins or bars is likely your best option.

You Will Pay a Premium Above Spot to Buy Gold Coins

Buying physical gold coins or bars comes with a cost, though. The dealers selling gold bullion must make a profit. As a result, you will pay a premium to spot to purchase gold bullion, and you will receive a discount to spot if you plan to sell your gold bullion. At blanchardgold.com, the quoted price of American Eagles or American Buffalo one-ounce gold bullion coins is about 4% higher than the spot price. If you instead opt for a 10 ounce Credit Suisse gold bar, you will pay a premium of about 2%.

Insuring Gold During Shipping

If you are purchasing a large quantity of gold for shipment, you may be worried about insurance. Many gold dealers will insure your gold during shipping until you accept the delivery, or until delivery confirmation has been received.

How to Insure Gold at Home

If you buy a large quantity of gold and store it at home, you might want to protect yourself from the dangers of theft with the purchase of insurance.

Your homeowner’s insurance policy may cover a small part of your gold investment, but you should be aware that many cap coverage at pretty small amounts.

Instead, you may want to get a collectibles insurance policy. People use such policies to cover everything from fine wine and sports cars to baseball cards and of course, gold.

Collectibles insurance can cover everything from theft to fires, natural disasters, and more. Current online quotes price gold collectibles insurance around 0.60%-0.70% of your collection’s value.

Can I Buy Gold from my Stock Broker?

If you want the ability to take physical possession of your gold, but don’t want to have to worry about where to store it, buying gold through a brokerage may be right for you. Some brokerage firms offer clients the ability to buy gold bullion bars and coins.

You Can Buy Gold at Fidelity

Fidelity, for instance, will allow account holders to purchase gold at a minimum investment of $2,500. Subsequent investments in gold can be made at a $1,000 minimum.

In an IRA, you can buy gold at a smaller initial investment of $1,000. There are some restrictions on the type of gold you can buy in your IRA. The only gold coins that can be purchased in a Fidelity IRA are Gold American Eagles (1 oz, 1/2 oz, 1/4 oz, and 1/10 oz), and Gold American Buffalos (1 oz). Fidelity doesn’t hold gold in other types of retirement accounts.

Fidelity uses FideliTrade and ScotiaMocatta (a subsidiary of Scotiabank) to trade and store gold for clients. The trading is done only in whole ounces, or whole numbers of coins.

Trading fees at Fidelity are a percentage of the transaction amount and range from 1%-3%. Storage costs for gold are 0.125% per quarter or 0.50% annually.

You can also take delivery of the gold you purchased through Fidelity. There are charges applied for delivery, and you may have to pay taxes on your purchase.

How to Invest in Gold Collectibles (Numismatics)

Buying collectibles (numismatics) and rare gold coins is a form of gold investing, but there are many more factors to consider when buying numismatics. Numismatics are purchased for their rarity as opposed to the value of the gold in each coin.

If you are investing in physical gold you can store at home as an inflation hedge or as a safeguard against economic or political turmoil, bullion coins and bars are your best bet. Numismatics’ value could potentially drop to the melt value (value of gold only) during such times.

For instance, today, on blanchardgold.com, you can buy a Spanish gold coin from the late 1400s to the early 1500s weighing less than a quarter of an ounce for $4,799. Surely the rarity of this coin has value to many collectors, but in tough times, what might that gold be worth? Quarter-ounce bullion Gold Eagles cost $430.12 today. Selling your Spanish collectible at its melt value would lead to a loss of over 90%. Not exactly what you signed up for when investing in the “safety” of gold.

Unless you are buying rare gold coins as a hobby or have superior knowledge in numismatics, collectibles should be eschewed. The premiums paid on buys and the discounts taken on sales can be stiff. And if you are hoping your numismatics are guaranteed to soar in price when gold prices rise, don’t count on it. Like any collectible, the price of rare gold coins is subject to the whims and sentiments of buyers. If confidence plummets during a recession, collectors may lower the price they are willing to pay.

How to Invest in Gold Mining Stocks

Gold Mining companies acquire, explore, develop, and produce gold.

Senior Gold Miners vs. Junior Gold Miners

Investors divide gold miners into two segments—senior gold miners and junior gold miners. Senior gold miners are larger, more established businesses that tend to have more gold reserves and more producing mines. Newmont Mining (NEM) and Barrick Gold (GOLD) are considered senior miners.

Junior miners are smaller, more speculative companies. They tend to be younger firms focused on exploration. Junior miners have smaller market values and are often less liquid than senior miners. Novagold (NG) and Eldorado Gold (EGO) are considered junior miners.

Gold Mining Stocks are Leveraged to the Price of Gold

Investing in gold mining companies brings with it many additional risks. For starters, gold miners are more volatile than the price of gold. Gold miners that do not hedge are effectively a leveraged investment in gold.

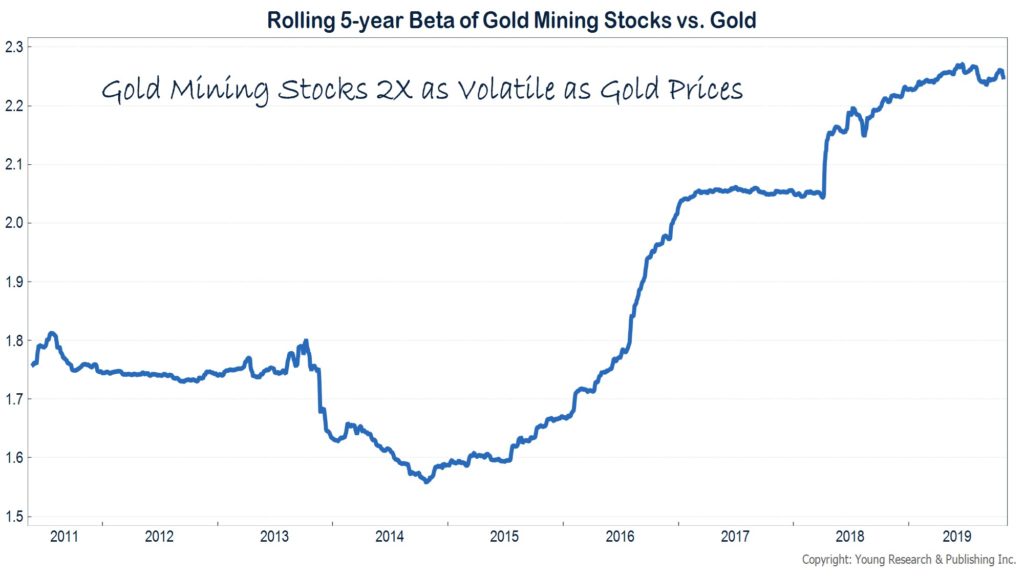

Beta of Gold Miners

The beta of gold miners relative to gold is useful summary measure of the leverage in gold mining stocks. Over the last five years, the beta of gold mining stocks vs. gold is 2.24. A beta of 2.24 means that for every 1% move in the price of gold, the price of gold mining stocks would be expected to move by 2.24%.

Gold Miners’ Operating Leverage

The reason gold stocks move more than the price of gold is because the cost of gold production is independent of the price of gold. As a simple example, if it costs Newmont Mining $800 to produce an ounce of gold, at a gold price of $1,000 per ounce, Newmont will earn a profit of $200. If the price of gold rises by 20% to $1,200 an ounce, Newmont’s costs are still $800, so the profit will now double to $400. A 20% increase in the price of gold resulted in a 100% increase in profit at Newmont.

When gold prices are rising, gold miners are likely to outperform gold, but the knife cuts both ways. When prices fall, gold mining stocks take it in the neck.

Hedging Risk in Gold Mining Stocks

The additional volatility assumes the gold mining stocks in question haven’t hedged their output. Gold hedging by gold mining firms became popular in the mid-to-late 1990s as gold prices trended lower and ultimately bottomed near $250 per ounce. When prices subsequently rose to $1,000 per ounce over the next eight years, gold miners that hedged had to unwind costly hedges or accept the lower profits resulting from hedges put in place years earlier.

Business, Operating, and Country Risk of Gold Mining Stocks

There is also business, operating, and country risks to worry about when investing in gold miners. When you buy a gold miner, you are investing in a company. Fraud at the company level, problems with mines, or foreign governments changing the rules, royalties, or taxes of gold miners are all risks to consider.

In our view, gold mining stocks have too many risks and are not reliable enough a proxy for the price of gold to make them a strategic holding in a well-diversified portfolio. That doesn’t mean you should never invest in gold miners, but they should be evaluated just as you would evaluate any other mining stock.

Tax Benefit of Investing in Gold Mining Stocks

The one advantage gold miners do have over physical gold is that capital gains are not subject to the collectibles tax.

How to Invest in Gold Mining Mutual Funds & ETFs

Gold mining mutual funds and ETFs such as the Fidelity Select Gold Fund (FSAGX), the VanEck Vectors Gold Miners Index (GDX), and VanEck Vectors Junior Gold Miners ETF (GDXJ) are another way to invest in gold miners. For individual investors, a gold mutual fund or ETF can add diversification and reduce individual company risk, but beyond purchasing a gold mining fund or ETF as a trade, we don’t see much benefit. The gold mining industry in aggregate has not created value for shareholders.

From year-end 1989, when the price of gold was $401/oz, until September of 2019 when the price of gold was $1,472/oz, the Philadelphia Gold & Silver Index (gold and silver mining index) gained 0.06% on a compound annual basis.

As a strategic long-term holding, gold mining index ETFs should be avoided. You can probably put actively managed gold mining funds in that camp as well, but we would point out that from year-end 1989 through September of 2019, the Fidelity Select Gold Fund (FSAGX) compounded investors’ money at 3.4% compared to the .06% for the Philadelphia Gold & Silver Index.

How to Invest in Gold Royalty Stocks

Gold royalty companies are a different animal than gold miners. Gold royalty companies don’t have the same operational risk or leverage to the price of gold as gold mining companies.

Gold royalty companies essentially provide capital to gold miners to help finance the build-out of mines or to free up funds for gold miners to invest in other projects. There are many different structures that gold royalty firms enter into with gold miners. You can read an explanation of the various structures used here.

The more conservative nature of gold royalty firms results in more consistent cash flows, providing the foundation for gold royalty stocks to pay more reliable dividends to shareholders.

Top Gold Royalty Stocks

The table below lists the top gold royalty firms traded in the U.S. along with the current dividend yield.

| Name | Symbol | Market Cap. (mil $) | Dividend Yield |

| Franco-Nevada | FNV | 18,001 | 1.04% |

| Wheaton Precious Metals | WPM | 12,782 | 1.29% |

| Royal Gold | RGLD | 8,087 | .86% |

| Osisko Gold Royalties | OR | 1,408 | 1.54% |

| Sandstorm Gold | SAND | 1,103 |

Gold royalty firms strike a nice balance on the risk-scale between an investment in physical gold and an investment in gold miners. Royalty firms tend to move up and down in price more than the price of gold, but less than gold mining companies.

Taxes on Gold Royalty Stocks

Like Gold Mining Companies, the gold royalty companies receive favorable dividend and capital gains tax rates.

How to Invest in Gold Futures

Gold futures are exchange-traded contracts to buy or sell a set quantity and quality of gold at a predetermined price for delivery at a future date. The contract specifications for the most active gold futures in the U.S. are for 100 troy ounces of gold with 995 fineness (99.5% gold). At current prices, the value of one gold futures contract is about $150,000.

Gold Futures Offer Leverage

Gold futures are the best way to take a leveraged position in gold. The initial margin or amount of collateral an investor must deposit in his futures account to purchase a single gold futures contract is $4,950. Putting up the minimum margin would result in a gold position that is leveraged more than 30X. A modest 3% increase in the price of gold would almost double an investor’s money, but a 3% drop in the price of gold would wipe him out.

Gold Futures Not Good for Long-term Investment

For sophisticated traders and speculators looking for leverage, gold futures should be a consideration. For long-term investors interested in taking a strategic position in gold, gold futures are low on the list.

Gold Futures can be a Hassle

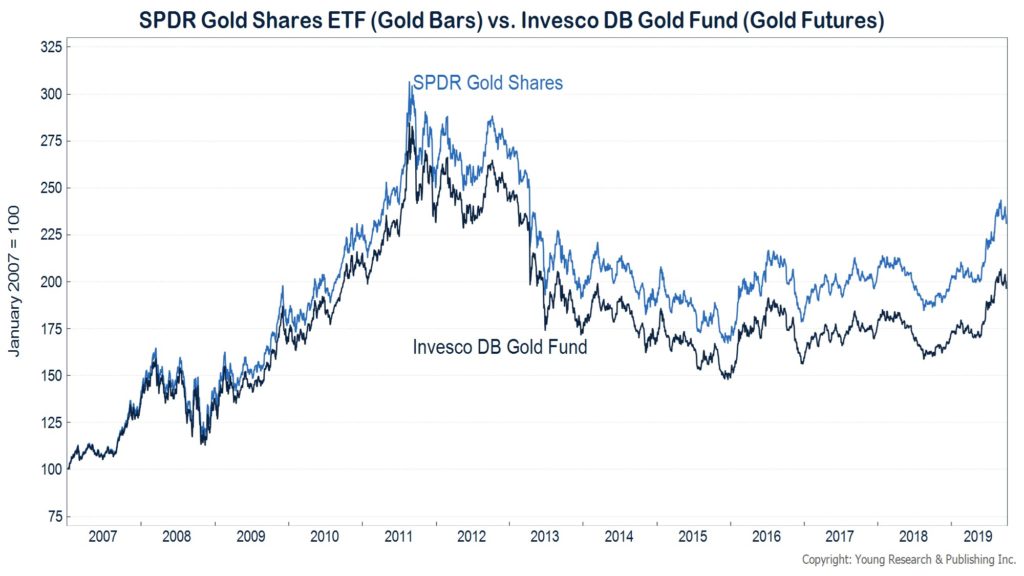

Futures can be complicated. There are margin requirements to worry about and contact expiration can be a hassle. Gold futures also trade in contango, which is a situation where gold contracts for future delivery trade at a premium to spot prices. The problem with contango is that assuming no change in the spot price of gold, as a futures contract reaches expiration, its price will fall. Over the long-term, this has resulted in gold futures underperforming spot gold prices.

Cost of Carry and Roll in Gold Futures is a Headwind

The chart below compares the performance of the SPDR Gold ETF, which owns physical gold and the Invesco DB Gold ETF which invests in gold futures. The futures-based ETF has underperformed the physical gold ETF by a compounded 1.35% (about 30% of this is a result of a higher expense ratio on the Invesco ETF).

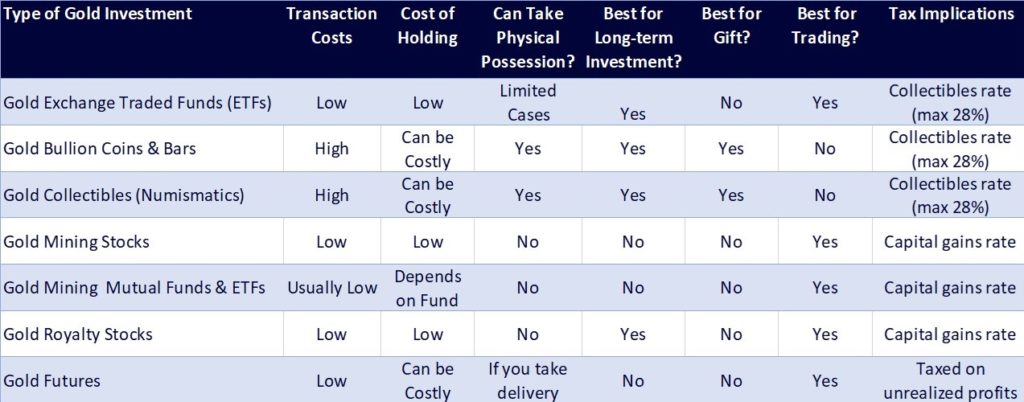

Summary Table of How to Invest in Gold

As you contemplate the best way to invest in gold to achieve your goals and objectives, the table below provides a summary of key considerations for the 7 ways to buy gold outlined in this post. For many investors and especially for investors who are looking to include gold in a well-diversified portfolio of stocks and bonds, gold ETFs are going to be the best choice.

Originally posted October 29, 2019.