Netflix reported second quarter results earlier this week that “blew away” expectations according to many financial news outlets. It wasn’t a beat on earnings, which actually missed expectations, or a beat on revenue which was inline with expectations. Subscriptions are the metric Netflix investors care most about. Netflix’s beat on subscriptions pushed the shares up almost 14% for an increase in market value of about $10 billion.

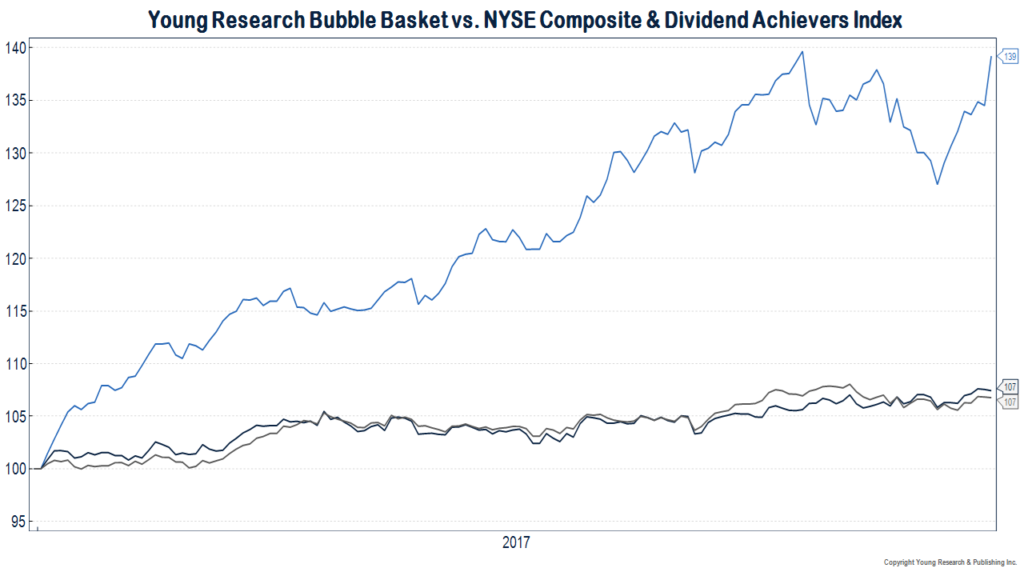

The jump in Netflix shares yesterday pulled the shares of the rest of the FANG group higher with it. Young Research’s Bubble Basket is now back near its high for the year—up almost 40%.

The optimism and sentiment toward the stocks that compose Young Research’s Bubble Basket has a dotcom-era feel. The bulls are convinced each of these businesses is a near monopoly in its space and that growth is likely to continue unabated for decades.

Robust growth is one possible outcome for the FANG stocks, but another is that competition finally starts to emerge. You are already seeing hints of it in certain areas where the FANGs operate. Brick and mortar retailers who have been decimated by Amazon finally look like they are getting serious about online. Chinese phone companies are selling smart phones that are competitive with the iPhone, but at a fraction of the price. The cable and content companies that have stupidly fed content to Netflix for years and created a formidable competitor in original programming, now finally seem to be improving their user interfaces.

The chart below shows the ratio of Netflix’s enterprise value to the number of Netflix streaming subscribers. Investors used to pay about $100 for each subscriber, but as of last night they are now paying almost $800 per subscriber. And this chart actually understates the magnitude of the increase as Netflix DVD by mail business was much bigger as a share of total company value in 2011 and 2012 than it is today.

The higher and higher price that Netflix investors are paying for each subscriber shows the optimism that is being baked into the stock. Should the company run into trouble, or should the competition that is finally starting to emerge take market share, Netflix’s stock could take a serious blow to the gut. Serious as in a 50%-60% haircut.