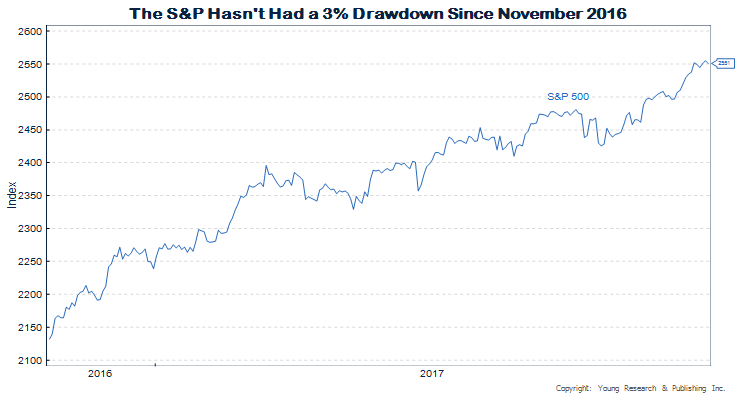

MarketWatch reports here that the S&P 500 is on the verge of its longest streak of going without even a 3% correction. Why are markets so quiet? An excess of global liquidity in the face of an improving global economy is probably the primary cause, but business sentiment and investor sentiment have also clearly gotten a boost from a more business friendly administration. Enjoy the quiet while it lasts. Stability has a tendency of breeding instability in financial markets.

Mark Decambre reports:

Just eight more trading sessions sans a 3% daily drop—a fairly normal occurrence even in a bull market—and the S&P 500 SPX, +0.17% will mark history.

An unnatural stretch of placid markets comes as the S&P 500, the Dow Jones Industrial DJIA, +0.09% and the Nasdaq Composite Index COMP, +0.27% have embarked upon one of the most resilient climbs to all-time highs. Neither a parade of hurricanes, earthquakes in Mexico, the threat of nuclear war in the Korean Peninsula, equity valuations seen as too rich, nor anxieties about the White House have disrupted this bull market rally that has entered its ninth year.

On Wednesday, all three main benchmarks finished at records. Thursday, however, features a bit of a pullback though equity benchmarks remain well within striking distance of ringing up more history.

Read more here.