Investors pay a lot of money to sound good at cocktail parties. Owning growth companies, often found in the NASDAQ Index, sounds exciting, cutting edge, and like a can’t miss investment. But good ideas often make for terrible investments, whereas good “values” make for great ones. That’s why you should always consider the value you’re getting for any stock you purchase.

An easy way to do that is to evaluate a stock’s dividend and dividend increases over an extended amount of time. A simple comparison of how this dividend-centric approach has worked over the last 17 1/2 years is to compare the boring Dow to the high-flying NASDAQ.

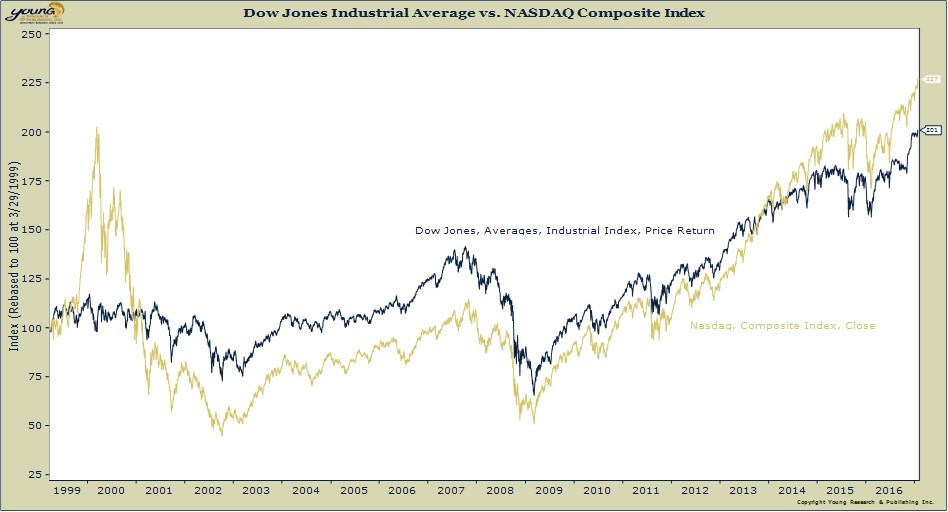

In the first chart below, you can see that without dividends included, from the time the Dow hit 10,000 in 1999, to today, the NASDAQ has beaten the Blue Chips index by about 26%.

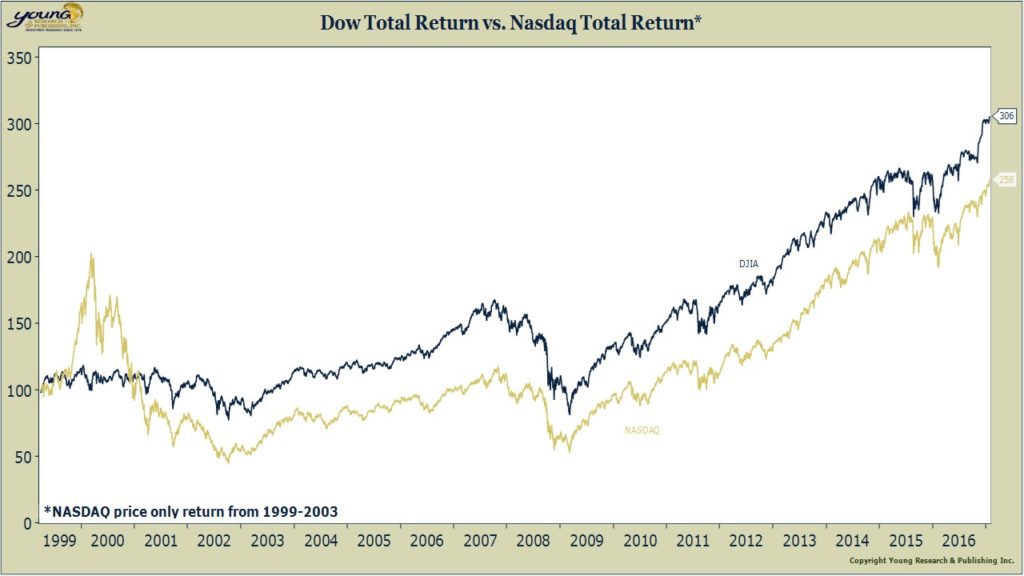

But in the second chart, you see the total returns of each index from March 1999, and they paint a different picture. When dividends are included, the Dow beat the NASDAQ by 48%. (both charts are rebased to 100 at 3/29/1999).

As you can see it’s usually the slow and steady investments that win the race.