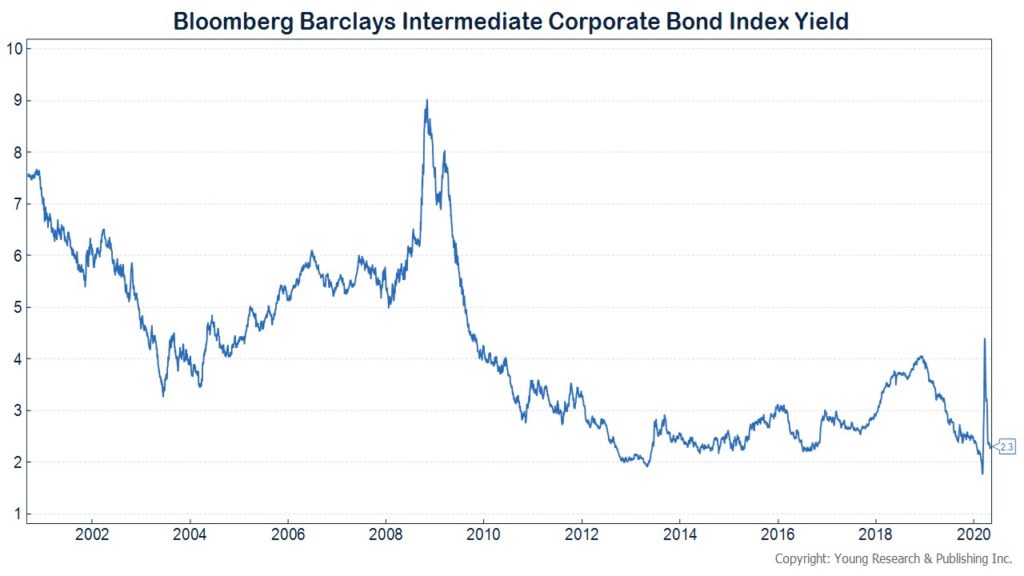

The Fed has gotten praise from both sides of the aisle for acting quickly and boldly in recent weeks. Who doesn’t like a bailout when it stops their portfolio value from cascading? Well…cascading if you consider a rise in investment-grade corporate bond yields from 2% to 4.5% during what is likely the greatest and most abrupt halting of economic activity in modern history.

For some perspective, we’ve included the chart on the Bloomberg Barclay’s Investment Grade Corporate bond index below. During the pandemic, yields rose a little higher than their year-end 2018 level and they were half of the level reached during the Financial Crisis. The Fed didn’t bail out the corporate bond market on either of those occasions. Why now?

There will be long-lasting implications of the Fed’s corporate bond bailout and almost all of them are negative for the ongoing health of the U.S. economy. For starters, as is outlined below, now that the Fed has bailed out asset prices once again under the guise that free markets need the government to find a bottom in asset prices, investors may be on the hook for new taxes.

Hooray for bailouts!

Bloomberg reports:

The “investor class” will have to pay for the ballooning debt stemming from the Covid-19 crisis, according to Jim Millstein, the co-chairman of Guggenheim Securities who led restructuring efforts at the U.S. Treasury Department after the financial crisis.

“There is one clear implication: The era of tax cuts is over,” Millstein said Monday in a Bloomberg Television interview. It’s “inevitable” that the wealthy will face greater taxes, he said. “People who have been fortunate enough to be able to make significant incomes are going to have to make a greater contribution.”

The restructuring banker, whose firm is working with companies in the travel industry burned by the pandemic, said he’s concerned about businesses taking on more debt while still unable to generate revenue during the economic lockdown.

He said unprecedented support by the U.S. Federal Reserve to backstop credit markets has benefited investors in a way they’ll eventually have to pay back.

“That kind of support for the investor class is ultimately something the investor class is ultimately going to have to pay for,” Millstein said. “If we’re really creating a backstop against credit losses then, you know, eventually, if this government is doing that much for that class, then that class is going to have to start paying for it.”