States are supposed to be the laboratories of democracy, but the “scientists” running the labs in places like New York, New Jersey, Illinois, and California have been failing for years. One reason for that is their tax policies don’t consider the long-term competitiveness of their states, and instead focus on raising money to pay for politicians’ dream projects. The Wall Street Journal’s Editorial Board explains that “the real economic benefits come from making a state more competitive for the long haul.”

They rank the 10 best states for tax climate in 2023:

- Wyoming

- South Dakota

- Alaska

- Florida

- Montana

- New Hampshire

- Nevada

- Utah

- Indiana

- North Carolina

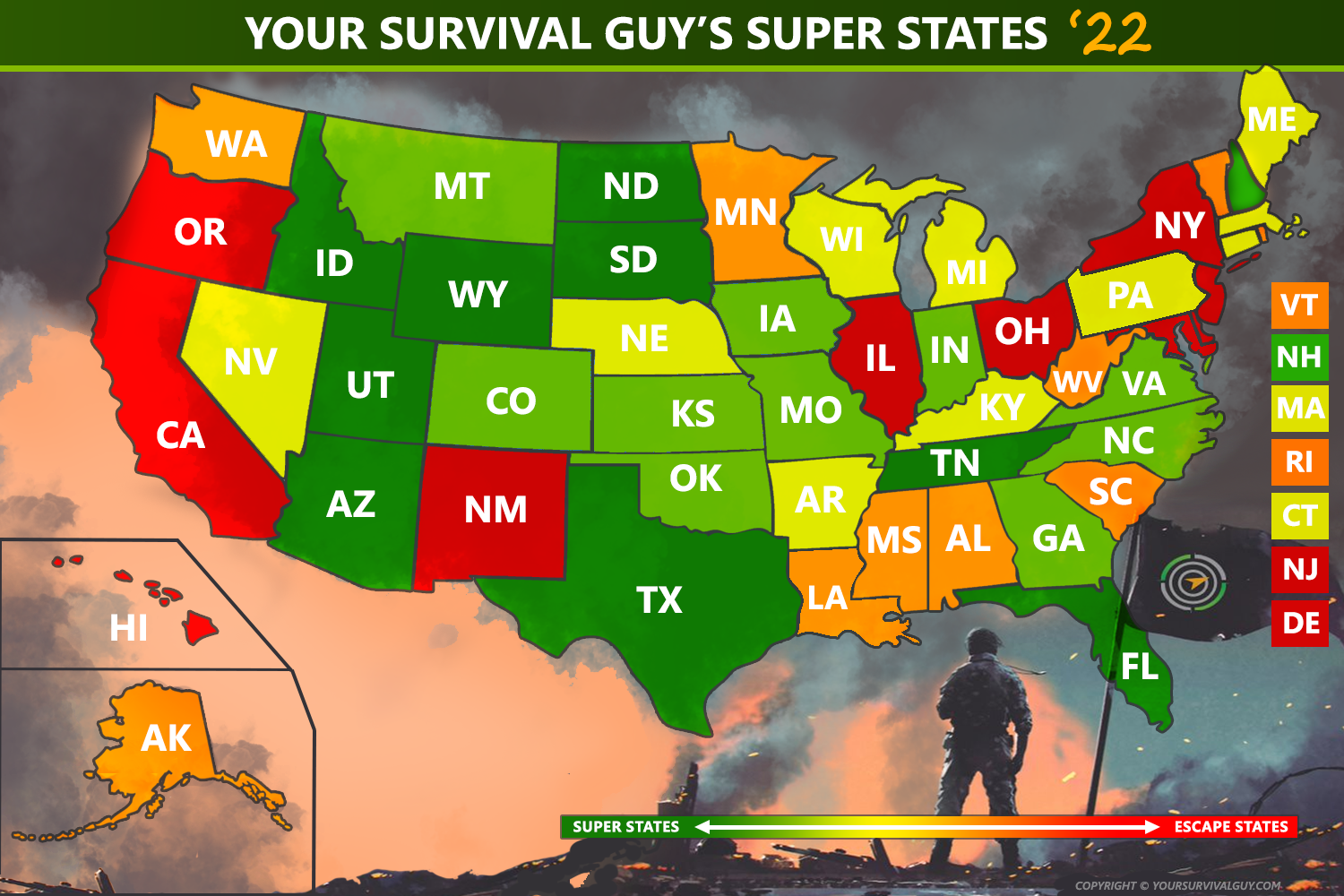

Many of these are among the best on my map of 2022 Super States.

The 10 worst states for tax climate in 2023 are:

- Alabama

- Rhode Island

- Hawaii

- Vermont

- Minnesota

- Maryland

- Connecticut

- California

- New York

- New Jersey

No surprise to see a number of my Escape States on this latter list. The economic potential being stunted in these states is depressing. Voters need to elect governors and legislatures here that will make these states competitive again.

The Editors conclude:

None of the best four tax states levy a personal state income tax: Wyoming, South Dakota, Alaska and Florida. Foregoing an income levy is a hedge against the upward tax-rate rachet that typically happens. Montana manages to get along with no sales tax. Wyoming and South Dakota have neither a corporate nor an individual income tax. North Carolina, in 10th, levies a 2.5% tax on corporations, the lowest rate nationally, as the report notes.

Plenty of states have room for improvement. Texas (13th overall) doesn’t have an individual income tax, but property taxes are high and the average burden for state and local sales tax is 8.2%. Arkansas deserves credit for reducing its top individual rate to 4.9% from 5.9%, plus a corporate cut to 5.9% from 6.2%, but the state still clocks in at 40th owing in part to a byzantine structure.

Another GOP-run state that could do much better is Ohio, ranked 37th. Its business tax is a mess that doesn’t account properly for expenses. The Buckeye State’s top individual rate is only 3.99%, but the brackets aren’t properly adjusted for married filers, known as a “marriage penalty,” and local entities pile on their own income taxes. Ohio Gov. Mike DeWine and the state Legislature ought to use their likely majorities next year to do more than spin their spending wheels. They might consult neighboring Indiana, which ranks ninth.

The state that improved the most is Arizona, which moved up to 19th this year from 24th, thanks to Republican Gov. Doug Ducey’s tax reform. Arizona consolidated four income-tax brackets into two and lowered the top rate to 2.98% now, from 4.5%. In 2023 a flat 2.5% rate will kick in, a year ahead of schedule thanks to a boom in revenues, and the Tax Foundation says this means Arizona will climb higher in the ranking next year.

The bad example is Washington state, which fell to 28th from 15th. The state’s new 7% levy on some capital gains isn’t adjusted for inflation, which means the bite will increase over time. The report notes that Washington’s “aggressive gross receipts tax and high-rate sales tax, has always been” offset in the ranking by its lack of an individual income tax. The capital gains tax is being challenged in court for violating the state constitution.

Too many Governors in both parties like to cut taxes only as temporary rebates or other sops in election years, but the real economic benefits come from making a state more competitive for the long haul. Americans and their money have never been more mobile, and Florida and other low-tax states will continue to reap the benefits of good policy.

And, if past is prologue, New York and New Jersey will continue to shed taxpayers.

Action Line: If you live in one of the worst states, you may want to look for a better America. Start with my Super States. Then click here to subscribe for my free monthly Survive & Thrive letter, and I’ll push you to make the move that protects your family’s personal and financial security.

Originally posted on Your Survival Guy.