One of the big disappointments (among many) in the GOP tax-reform is that there was no reduction in dividend and capital gains tax rates. With the Obamacare investment tax add-on, the maximum dividend and capital gains rates are almost 25% today. That’s up from 15% during the Bush and early Obama years.

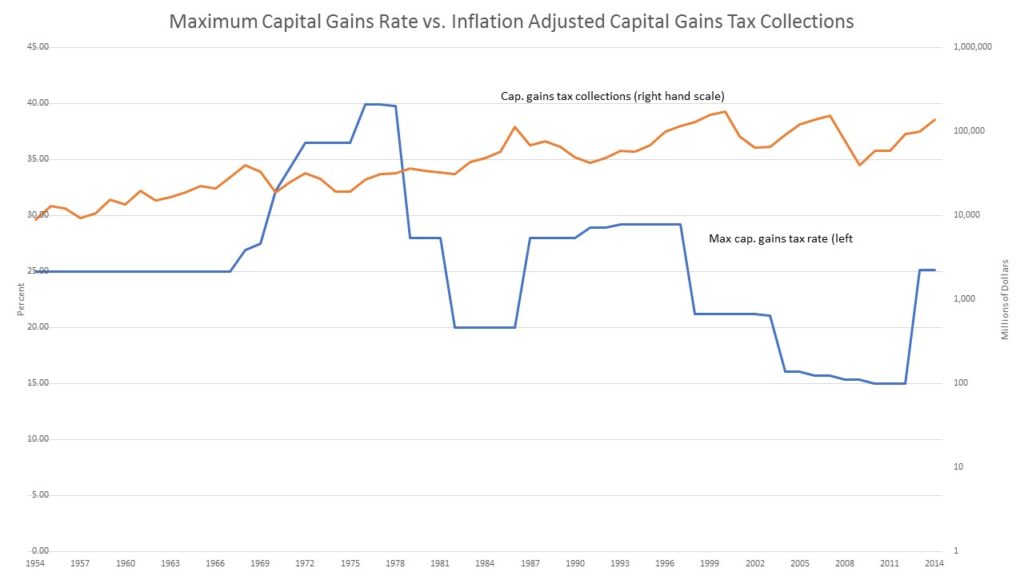

Capital gains taxes are one of the easiest taxes to dodge. Investors simply hold their investment positions instead of selling them and paying taxes on the gain. The simplicity with which capital gains taxes can be avoided means there is almost no correlation between the maximum capital gains tax rate and the amount of capital gains taxes the government collects.

The chart below shows the historical record. Looking at the data, one could even make the case that a lower capital gains tax rate results in more tax revenue, not less.

But not only didn’t Congress lower dividend and capital gains tax rates, but the Senate added a provision into their version of the bill that further gums up the allocation of capital.

Today, when you sell a portion of an investment, you have the option of selling the lots with the highest cost basis. The higher the cost basis the lower your capital gains. The Senate tax bill would require investors to use a first in first out (FIFO) method which would raise an investor’s tax liability in most cases.

An example may help illustrate. Let’s say you bought 500 shares of Procter and Gamble in March of 2000 at $28 per share. Now assume that in December of 2007 you came into some money and decided to add another 500 shares to your P&G position at $70 per share. Your total investment in the stock would be $49,000.

Fast forward to today, your P&G position is worth $91,500 and you decide you want to cash in half of it to buy a new car.

Under current tax law, if you sell 500 shares of P&G, you can choose to sell the shares you bought in December of 2007 for $70. Selling those shares would result in $10,750 in capital gains and a tax liability of about $2,870 assuming the maximum capital gains tax rate.

Under the Senate’s proposal, you wouldn’t have the choice of which shares to sell. If you sold 500 shares of P&G, the IRS would automatically assume you sold the shares you bought in March of 2000 at $28. Instead of recognizing a gain of $10,750 you would recognize a gain of $31,750 and owe tax of about $7,940.

Sounds like a terrible idea, does it not?

More maddening than the provision itself is the fact that it only applies to mom and pop investors. Holdings within hedge funds, mutual funds and ETFs are exempt, but your positions in those funds are not.

The Senate likely added the provisions to pay for other cuts, but it is unlikely to generate the revenue assumed. Investors will find ways around the rule. Some are already considering splitting high cost and low-cost shares between brokerage firms or account registrations to dodge the FIFO rule.

Talk about an administrative nightmare if this thing goes into effect.

The House-Senate conference should kill this provision before the bill is signed into law.