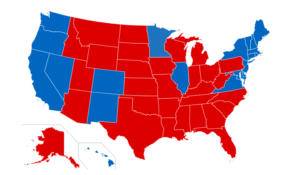

Click here to visit Richardcyoung.com’s Liberty & Freedom map. There you can see how your state’s tax picture compares to all the others’.

It is important to analyze your political situation. Is your state taxing you unfairly? Is there an alternative? I wrote this piece on October 8, 2018 to encourage Americans to think about what happens when wealthy taxpayers flee punitive taxation. Who will pay for a state’s government when there’s no one left with any money?

My friend Chris Edwards, director of tax policy studies at Cato and editor of www.DownsizingGovernment.org, outlines the hypocrisy in the way states run their tax schemes. He points out that states’ biggest tax payers are sensitive to the top marginal rates, and when they leave, they take large portions of the state’s budget with them. Edwards writes:

With Democrats, the problem is incoherence. They claim that the 2017 act was a giveaway to the rich, even though it made the tax code more progressive. And they claim that the rich don’t pay their fair share, even though the top 10 percent pay 71 percent of all federal income taxes.

Democrats complain that the rich are rampant tax avoiders. But then they push to raise tax rates on the rich, which will just prompt more of the avoidance they dislike. You can see this at the state level with the ongoing exodus of high earners from high-tax states such as California, Connecticut, New Jersey and New York to low-tax states such as Florida.

New Jersey’s richest person, David Tepper, moved with his hedge fund business to Florida in 2016. That single move cost the state of New Jersey up to $100 million a year in lost income taxes. Yet, this year, New Jersey’s Democratic governor Phil Murphy hiked the top income tax rate from 8.97 to 10.75 percent. Murphy wanted to raise revenue, but the hike won’t do that if it prompts more of the rich to leave. The top 1 percent in New Jersey pay 37 percent of the state’s income taxes.

Connecticut is also losing its wealthiest residents after tax hikes by Democratic governor Dan Malloy. In recent years, the state has lost stock trading entrepreneur Thomas Peterffy (worth $20 billion), executive C. Dean Metropoulos ($2 billion), and hedge fund managers Paul Tudor Jones ($4 billion) and Edward Lampert ($3 billion).

Those folks all fled to Florida, which has no income tax or estate tax. Barry Sternlicht, who runs Starwood Capital Group, said that he was also part of the “massive exodus” from Connecticut to Florida to save on taxes.

The question is, what will happen to the high tax states of the Northeast and West Coast when all the high income earners have left? Read more here.

Originally posted on Yoursurvivalguy.com.