Barbara Kollmeyer, reporting at MarketWatch, rounds up a host of negative views on the future of the FAANGS. She writes:

Hide behind defensives? That doesn’t seem like such a crazy strategy lately as investors wait to see if worries about the U.S. economy turn into real problems in the coming year.

Tuesday’s session offered the most recent evidence of that as health care, consumer staples and utilities drove the gains for the S&P 500. Compare these numbers—the Utilities Select Sector SPDR XLU, -0.30% is up 4% for the quarter, while the Technology Select Sector SPDR XLK, +0.84% has slumped over 12%.

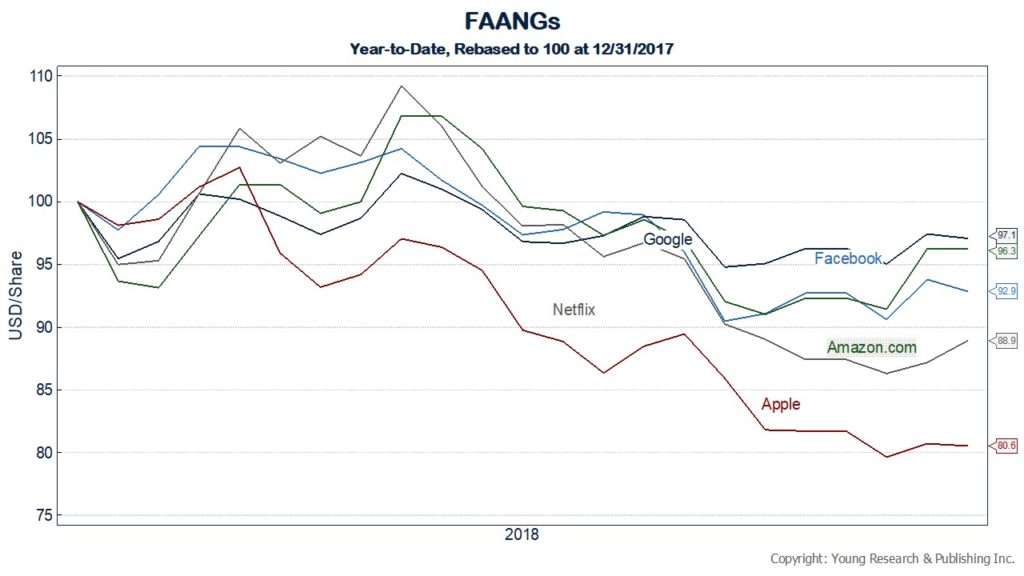

Another burning question for investors is whether the bloodletting has stopped for shooting-star growth names—Facebook FB, -1.07% , AAPL, +0.66% AmazonAMZN, +2.12% Netflix NFLX, +0.63% and Google-parent AlphabetGOOGL, +0.10% —which have been shoved into bear territory after helping to drive a nearly decadelong bull market.

Our call of the day from analysts at Canaccord says stay hunkered down. They see the outperformance for defensives as just getting started, because FAANG underperformance is also in its early innings.

Defense stocks were supposed to be the story for 2019 but have stepped up to the plate early because big value sectors—financials and energy—didn’t, say Canaccord’s Martin Roberge and Guillaume Arseneau.

Portfolio managers haven’t seen any big hurt when it comes to that group of growthy stocks because year-to-date, some of those tech-focused names are still outperforming the market, they note. Beaten-down Apple is still up nearly 3% year-to-date, against a 0.3% rise for the S&P.

Read more here.