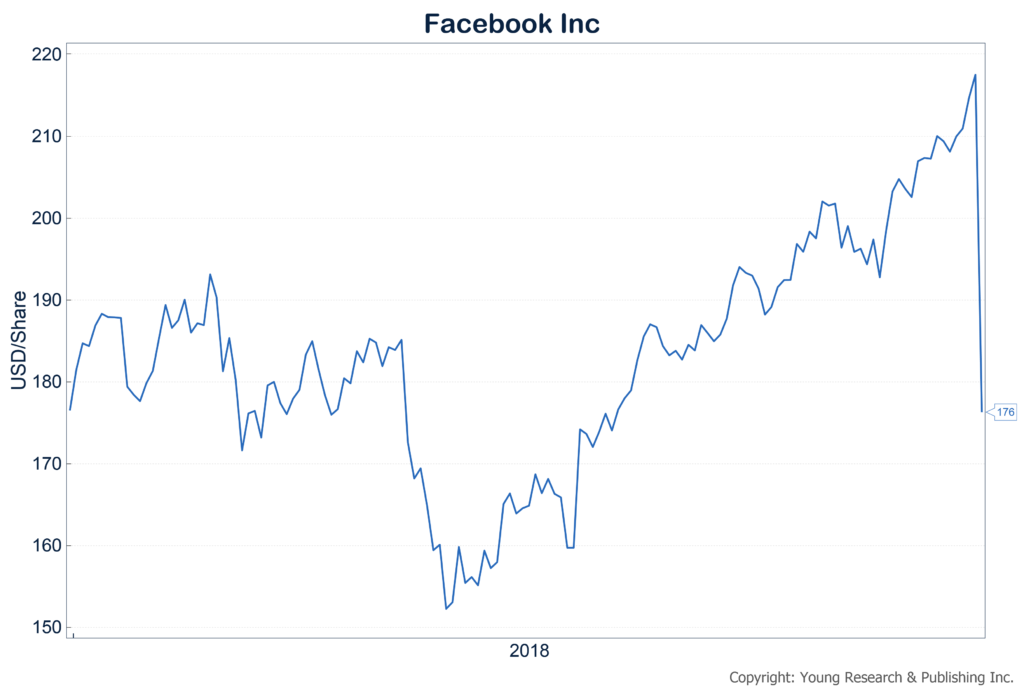

Yesterday, investors in Facebook stock had the entirety of this year’s gains wiped out in a flash. The quarterly earnings crowd on Wall Street pulled the chair out from under Facebook after receiving bad news on the company’s growth.

It’s that sort of volatility that conservative, retired or soon to be retired investors should attempt to avoid. Getting hit with a 19% loss in one day is hard to stomach when you have no new income coming in, and don’t have time to recoup those losses.

There’s a Better Way to Invest than in Volatile Tech Stocks

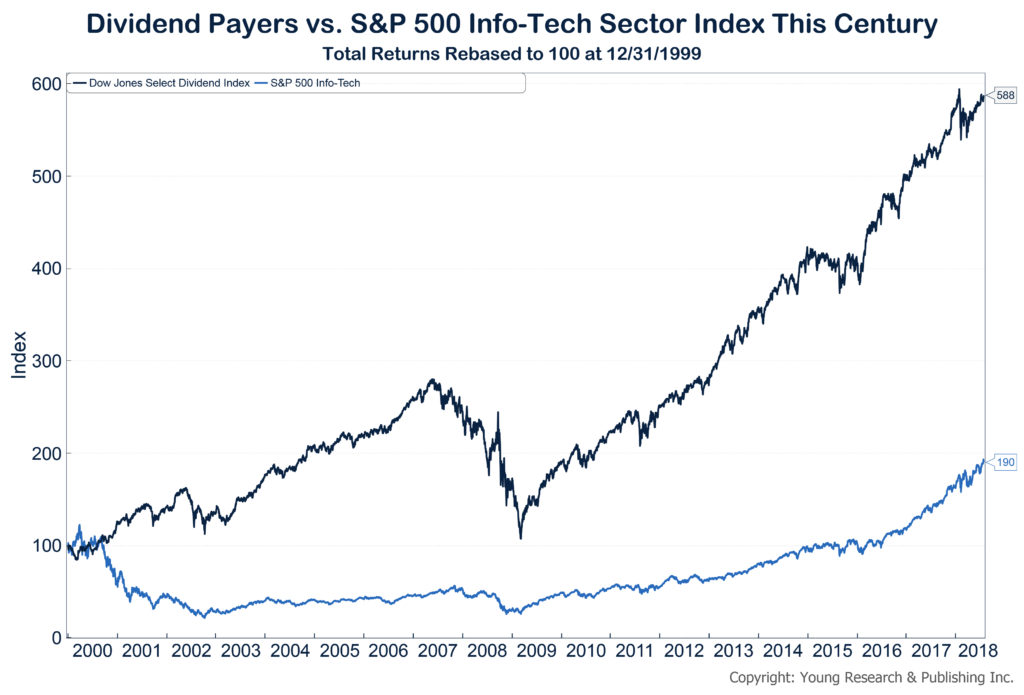

A better way to build a portfolio you can be comfortable with through good times and bad is by focusing on companies that pay you dividends every quarter, and increase those dividends each year. Take a look at my chart below of performance of the Dow Jones Select Dividend Index vs. S&P 500 Info-Tech Index. You can see that this century, an investment in solid dividend paying stocks rather than tech stocks, has been the right call for investors.

At The Wall Street Journal, Dan Gallagher reports on the collapse of Facebook shares, and what happened when the company lowered its outlook for growth.

A disastrous second-quarter report and accompanying outlook cut nearly $120 billion off the social network’s market value Thursday. That put the shares down 19% at $176.26 by the closing bell—wiping out the stock’s strong gains for the year. That officially makes Facebook one of the worst-performing of the mega-cap tech stocks this year, second only to IBM . Facebook’s valuation fell to 23 times forward earnings, which is close to its lowest multiple on record and down 23% from just a year ago, thanks to the company’s sharply growing bottom line. Facebook’s multiple drops to 21 times excluding net cash, which puts it at a 16% discount to Google-parent Alphabet Inc. on the same measure.

Read more here.

Originally posted on Yoursurvivalguy.com.