I often write about diversification and the benefits diversification offers to investors. Diversification is said to be the only free lunch in investing. It allows you to lower risk, without sacrificing meaningful return. The basic concept of diversification is of course intuitive. Don’t put all your eggs in one basket. And don’t invest your entire portfolio in one security—that would be too risky. You want to spread your assets among many different securities. If one goes bust you only lose a little bit instead of everything.

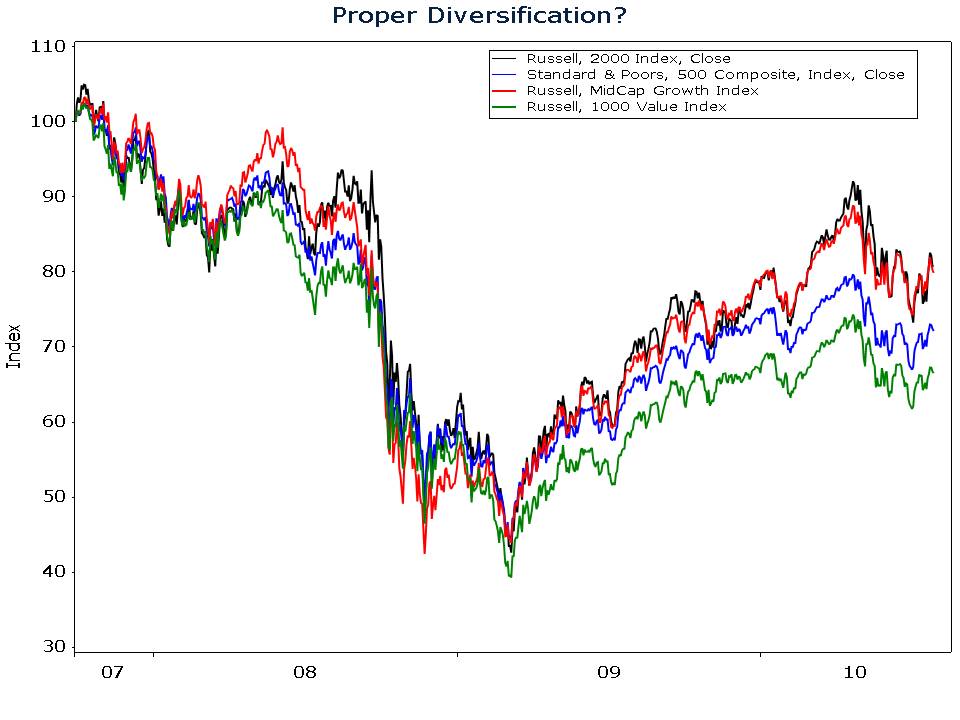

But there is more to diversification than spreading your assets among different securities. When I write about diversification I am careful to distinguish between proper diversification and simple diversification. Too often investors and their advisors assume a portfolio that spans the style box passes for proper diversification. It doesn’t. If you owned a large-cap value fund, a mid-cap growth fund, and a small-cap fund, during the recent bear market your portfolio fell just as much as the S&P 500.

To properly diversify a portfolio and avoid debilitating bear market losses, you want counterbalancers in your portfolio. When stocks are diving, you want something in your portfolio that will be rising or at least maintaining its value. As my chart above makes painfully clear, different varieties of stock funds don’t qualify. In my over four decades in the investment business, bonds have been the most reliable counterbalancer to stocks. Equity bear markets are often accompanied by rising bond prices. In 13 of the 14 years that the S&P 500 has been down since 1950, intermediate-term government bonds advanced. That’s a .929 batting average. And in the only exception year, intermediate-term government bonds were down a scant 0.74%. If you want to craft a properly diversified portfolio, I suggest you start with some bonds.