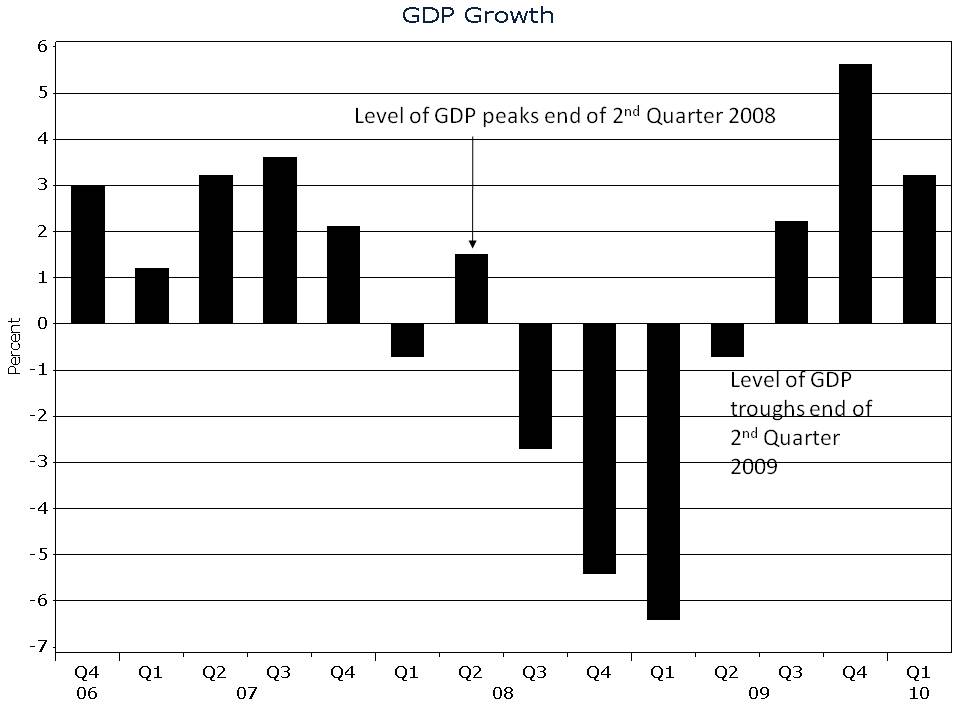

My favorite leading indicator is Young Research’s Moving the Goods Index. Moving the Goods is a market-capitalization-weighted index of non-airline transportation companies. Transportation companies are some of the first businesses to realize a change in economic activity. You have to move the goods before you produce or sell the goods. Young Research’s index is a real-time leading indicator of economic activity. GDP data show the economic downturn started in the third quarter of 2008. I recognize that the National Bureau of Economic Research, the official arbiter of U.S. recessions, dates the start of the recession to the end of 2007, but the GDP data didn’t peak until June of 2008. The NBER has it wrong. Moving the Goods peaked in early June of 2008, ahead of the peak in GDP, and then bottomed in early March of 2009, ahead of the June trough in GDP.

My Moving the Goods chart shows that the index was again forecasting economic growth for the first quarter of 2010, and GDP data released today confirm that the economy grew at a 3.2% rate in the first quarter. For the current quarter, Moving the Goods is off to a strong start, indicating that the economy is still growing. I remain skeptical of the sustainability of the economic recovery. I monitor Moving the Goods daily for early warning signs of a slowing economy.

If I could only use one economic indicator to help guide my investment strategy, Young Research’s Moving the Goods Index would be it.