Chances are you’re not saving enough. To find out for sure, do this simple exercise. Calculate how much you expect to save by the time you retire. Then calculate what percentage of your savings you’ll need to spend each year to sustain your standard of living (while factoring in investment returns of course). If you answered more than 4%, you aren’t saving enough.

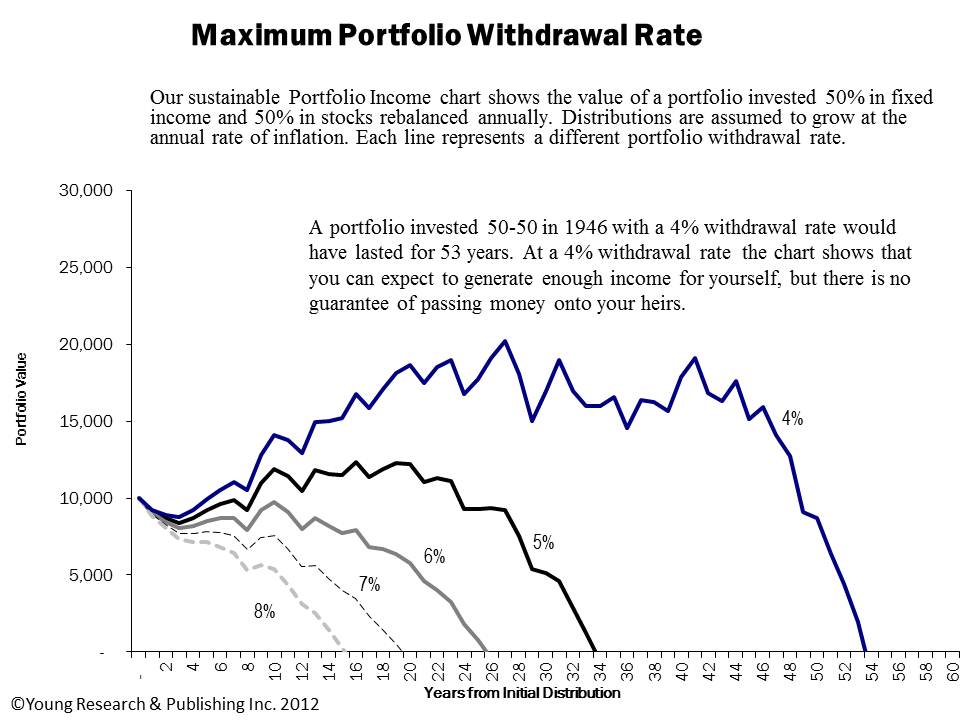

Take a look at the chart below. An investor retiring in 1946, who put her money in a balanced portfolio of stocks and bonds, would have exhausted her nest egg only 33 years later if she was taking 5% a year from her portfolio. The numbers are uglier for 6%, 7%, and 8%. Withdrawing at those rates would have emptied the portfolio in 25, 19, and 15 years respectively.

A 4% draw would have given the retiree enough spending power to avoid the threat of living on Ramen noodles through her golden years. Don’t save yourself short, make sure you are adding plenty of future purchasing power to your portfolio every year.