When you hear the names Fannie Mae and Freddie Mac or the term mortgage-backed securities, you don’t get a warm and fuzzy feeling, do you? Peace of mind and comfort don’t roll off of the tongue either. But some mortgage-backed securities do make sense. So what separates fish from fowl? Four letters: GNMA.

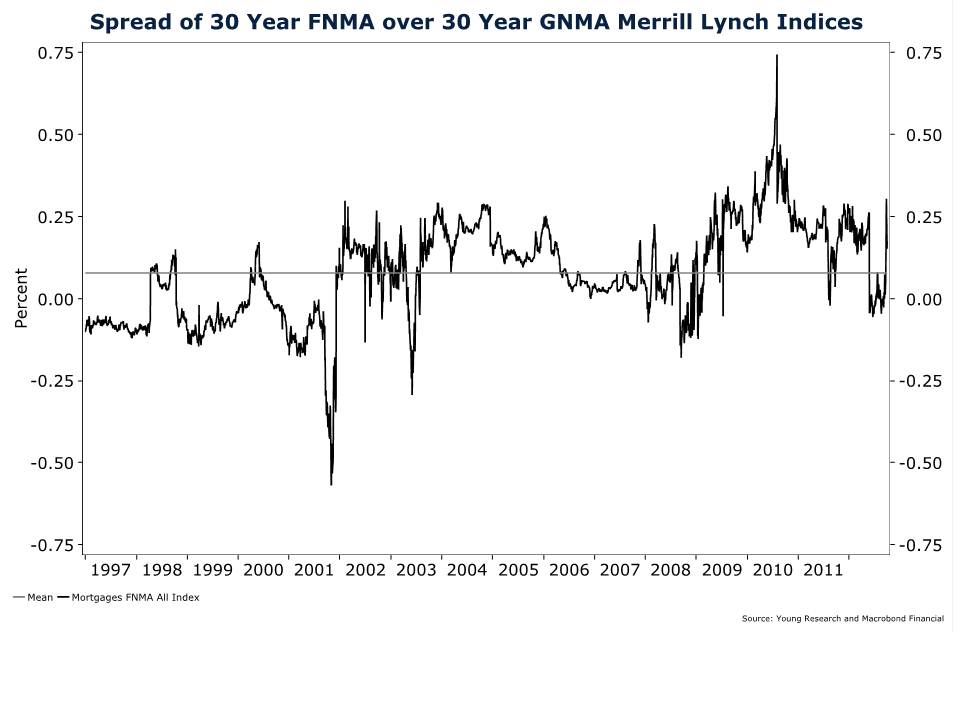

“GNMA is the only mortgage-backed security that enjoys the full faith and credit of the United States Government,” reads the website. As you can see on the chart below, the spread between yields on 30-year GNMA mortgages and 30-year Fannie Mae mortgages averages about 8 basis points, or 0.08%. But the GNMA mortgages are explicitly backed by the full faith and credit of the U.S. government. You should check out the website to learn more, but I’ll leave you with this little tidbit: “Ginnie Mae does not buy or sell loans or issue mortgage-backed securities (MBS). Therefore, Ginnie Mae’s balance sheet doesn’t use derivatives to hedge or carry long term debt.”