Putnam Investments’ full-page colored advertisement in this week’s WSJ was hard to miss—the Putnam marketing team made sure of that. In the ad, they tout their suite of Absolute Return Funds, which seek to do well in any type of market environment, up or down. As is often the case, and certainly is here, if it sounds too good to be true, it is. The funds have outperformed their laughable benchmarks, but have failed every one of mine. It used to be a well-known fact at Proctor & Gamble that the smart people worked in engineering and the really smart ones worked in marketing.

I’ve been paying close attention to these funds since they were introduced just over a year ago, and I’m not impressed. Unfortunately, the marketing blitz has helped the funds gather over $1 billion in assets. Imagine what investors have paid in fees. Read on, and I’ll give you the details of what the small print really means.

First off, the prospectus shows that the Putnam Absolute Return Funds are basically diversified portfolios and not much more. Their marketing material leads investors to believe that by owning the funds they will receive a specific rate of return over T-bills annually over a three-year period. This is not guaranteed.

In fact, each of the four funds has a goal, again not a guarantee, of beating T-bills by a certain percentage or number of basis points. One percentage point equals 100 basis points. Therefore, the targets above T-bills are in the names of the funds: Absolute Return 100 Fund (target is T-bill plus 1%), Absolute Return 300 Fund, Absolute Return 500 Fund, and Absolute Return 700 Fund.

The ad reads: “Putnam Absolute Return Funds strive to keep you ahead of inflation, so your income doesn’t fall behind.” I wouldn’t count on this strategy for steady income. The funds’ respective annual income yields are only 0.32%, 0.96%, 1.05%, and 1.33%. Not anything I’d be interested in, but then again, I would never buy these funds.

The ad shows that the Absolute Return 100 Fund’s “A” shares were up 4.04% last year. The prospectus suggests it’s a good replacement for short-term securities. But as of December, it invested in a group that doesn’t quite engender the comfort I’d like in a short-term security, with 70% of the fund in cash and the remaining 30% in a combination of agency CMOs, commercial MBSs, emerging-market bonds, high-yield corporate bonds, investment-grade corporate bonds, non-agency RMBSs, sovereign debt, and U.S. government bonds.

Don’t forget the small print. The public offering price (POP) factors in returns received by the public after it pays the front-end load for a mutual fund. The one-year POP for the Absolute Return 100 Fund, we learn, is only 0.62%, as compared to the 4.04% noted in the colored bar chart. Not quite the POP investors are looking for, I’m sure. The front-end load is in small print, again, not bright orange like the returns they want you to see in the ad. They know most readers don’t know what POP means and that they’re not likely to look it up.

Now to be fair, Putnam is saying the target returns are for a three-year period. So, the 3.25% front-end load can be spread out over that time. However, there’s still an annual expense ratio of 1.66%, which is a sinful amount for a bond fund. Here again, the ad is misleading. To the right of the expense ratio is a “what you pay” column. In this column, we learn that Putnam was kind enough to reduce the fee to 1.25%. But, as the small print points out, that’s only until October.

So the investor feels like he’s getting a deal with the “what you pay” column being lower than the expense ratio column. It’s a technique used to take attention away from the dismal POP and the criminal 3.25% or 5.75% front-end loads.

The rest of the Absolute Return funds track a similar pattern. The 500 and 700 funds, as the small print points out, have a 5.75% front-end load. The four funds, 100, 300, 500, and 700, had the following POP performance in 2009, respectively: 0.62%, 4.68%, 3.60%, and 7.84%. The POP returns that class “A” share investors would receive are dreadful, as is the amount that, in reality, they end up paying.

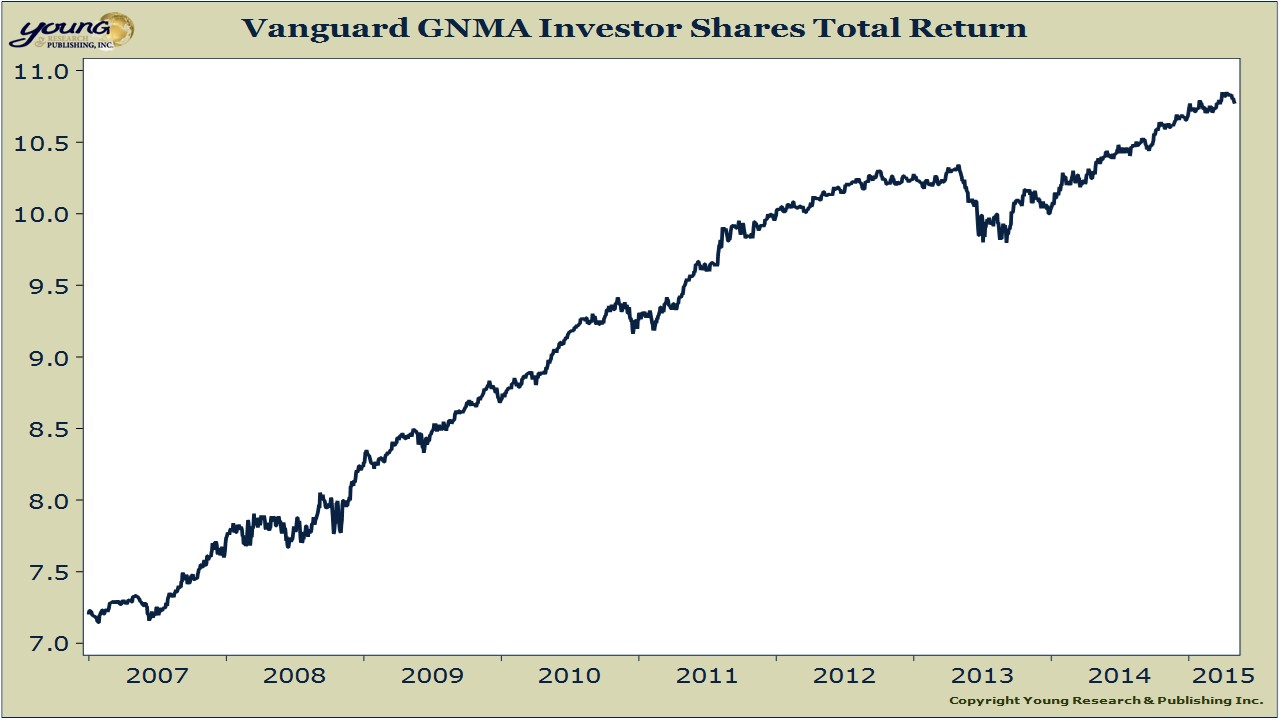

As the prospectus suggests, the funds are replacements for typical mutual funds: the 100 for short-term securities, the 300 for a typical bond fund, the 500 for a balanced fund, and the 700 for a stock fund. Compare, if you will, to my benchmarks’ respective performances for 2009: Vanguard’s Short-Term Investment-Grade Bond Fund, 14%; Vanguard GNMA, 5.3%; Vanguard Wellington, 22.2%; and Young Research’s Retirement Compounders, a dividend-paying common stock program, 30%.

An absolute return fund is today’s latest marketing gimmick from the mutual fund industry. So make sure you read the small print. As it turns out, selling mutual funds isn’t that much different from selling toothpaste.