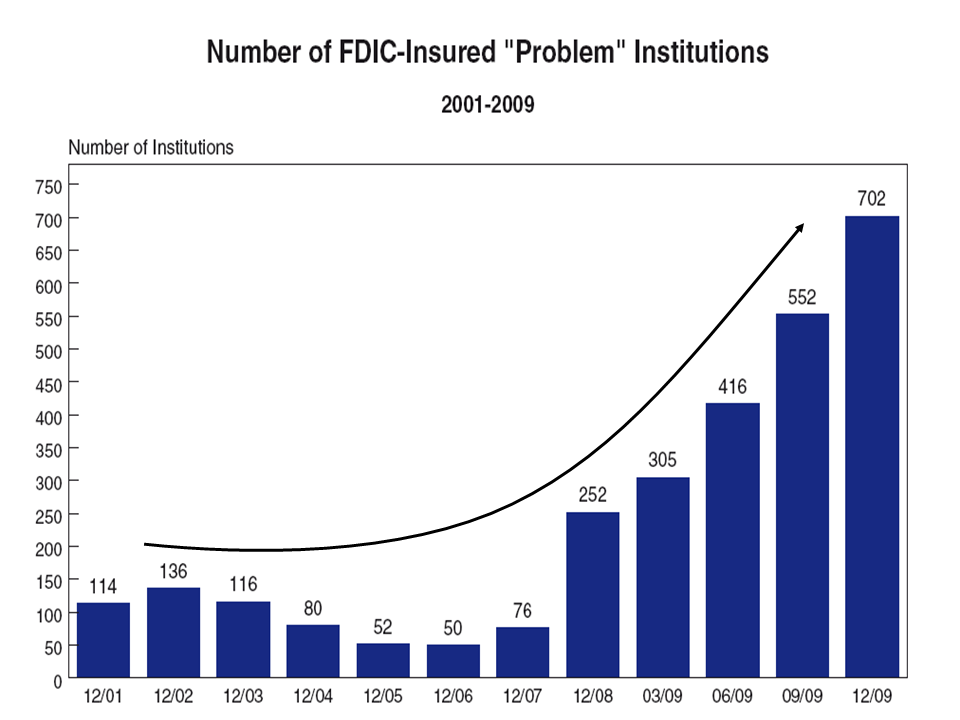

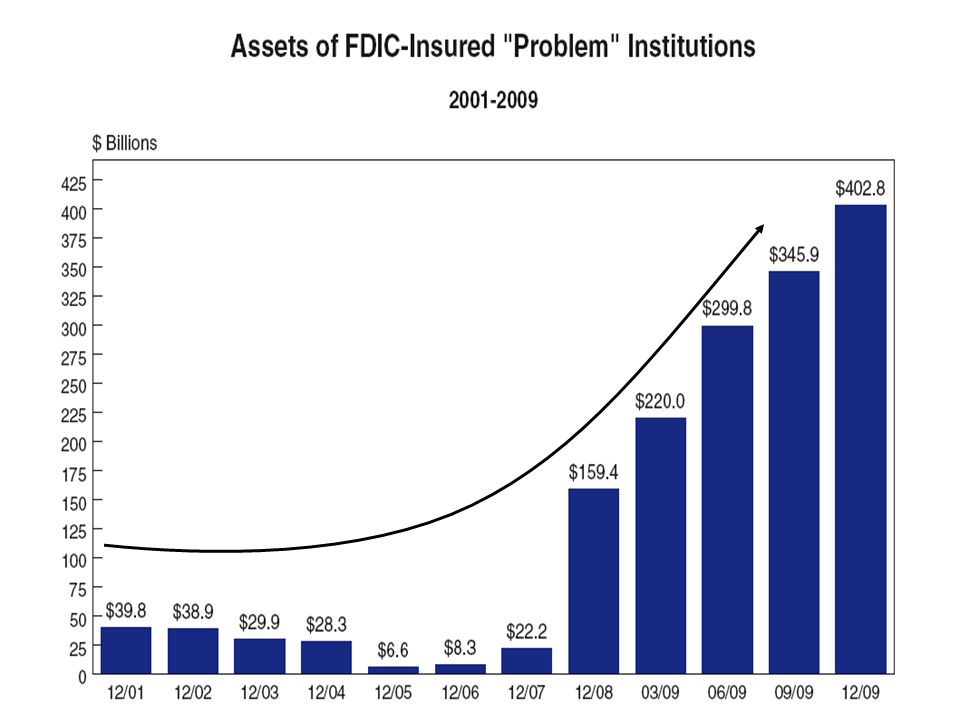

In 2009, the number of problem banks increased nearly 200%. Problem banks now hold $400 billion in bank assets. Most of these problem institutions are regional and community lenders. The same banks that dominate in small business and commercial real estate lending. A continued rise in problem banks is likely to hinder a recovery in these sectors of the economy.

Jeremy Jones, CFA, CFP® is the Director of Research at Young Research & Publishing Inc., and the Chief Investment Officer at Richard C. Young & Co., Ltd. CNBC has ranked Richard C. Young & Co., Ltd. as one of the Top 100 Financial Advisors in the nation (2019-2022) Disclosure. Jeremy is also a contributing editor of youngresearch.com.

Latest posts by Jeremy Jones, CFA (see all)

- Money Market Assets Hit Record High: $5.4 Trillion - May 26, 2023

- The Mania in AI Stocks Has Arrived - May 25, 2023

- The Wisdom of Sam Zell - May 24, 2023