We have warned readers on this website and in our premium strategy reports, Richard C. Young’s Intelligence Report and Young Research’s Global Investment Strategy to avoid Facebook shares. After the company’s first earnings report was released yesterday, those warning were proved prescient. A Reuters report on the release by Alexei Oreskovic and Gerry Shih illustrates the drastic overvaluation that the IPO market attached to Facebook shares.

Facebook Inc reported a drastic slowdown in revenue growth and failed to offer financial forecasts to quell fears about its ability to boost advertising growth, sending its shares plummeting to a record low.

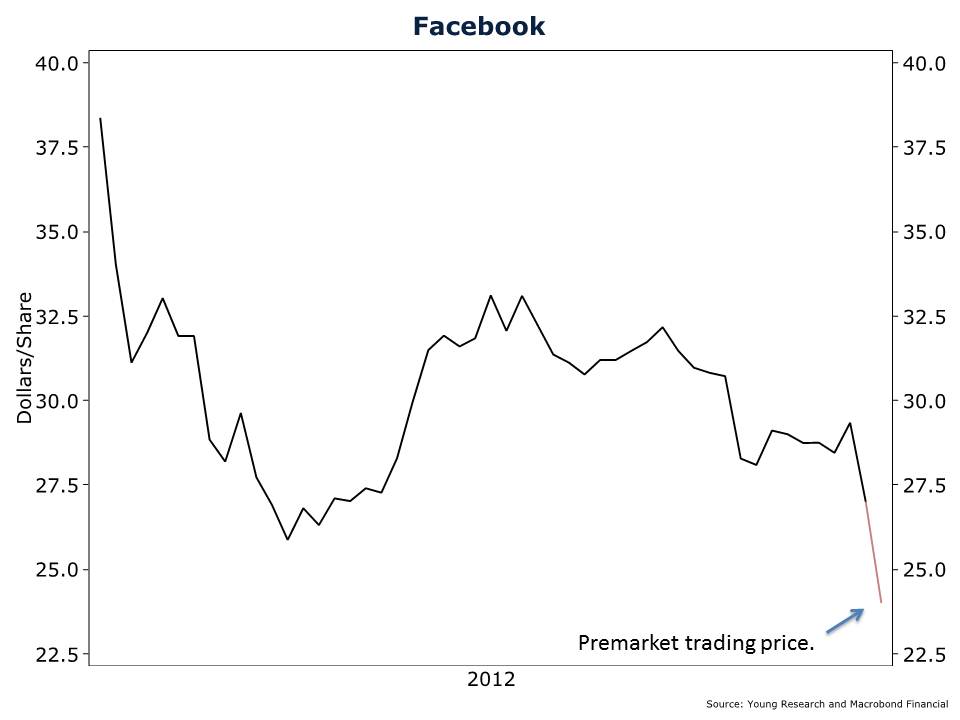

Shares of Facebook, which has shed a third of its value since its haphazard May debut at $38, hit below $24 in frenzied after-hours trading.

Facebook is bleeding cash to improve its business, but is not confident enough in the future to even offer guidance on the next quarter, quashing investor confidence in the company.

The company said that its capital expenditures more than tripled to $413 million in the second quarter…But it offered no outlook for the current period as some investors had hoped.

Even Facebook’s gaming cash cow, Zynga is proving to be a fad as its earnings tumble.

On Wednesday, social games leader Zynga – which accounts for over a 10th of Facebook’s revenue and faces the same challenge of earning off mobile users – stunned investors after slashing its 2012 earnings forecasts.

That helped wipe 9 percent off Facebook’s value during regular trading on Thursday.

Put plainly, buying companies with easily imitated business models is pure speculation. Savvy investors favor companies with high barriers to entry and other durable competitive advantages. Facebook has almost no barriers to entry. As we have written in the past, the social network is only one college dropout away from becoming an also-ran.