In a Wall Street Journal front page report, Starbucks CEO Howard Schultz hit the nail on the head regarding corporate profits.

Coffee chain Starbucks last week warned that customer traffic in U.S. cafes began slowing in June. The softness continued in July, so the company cut its earnings guidance for the third quarter.

“This is not a Starbucks issue,” said Howard Schultz, chief executive. “This is a macro problem of weak consumer confidence.”

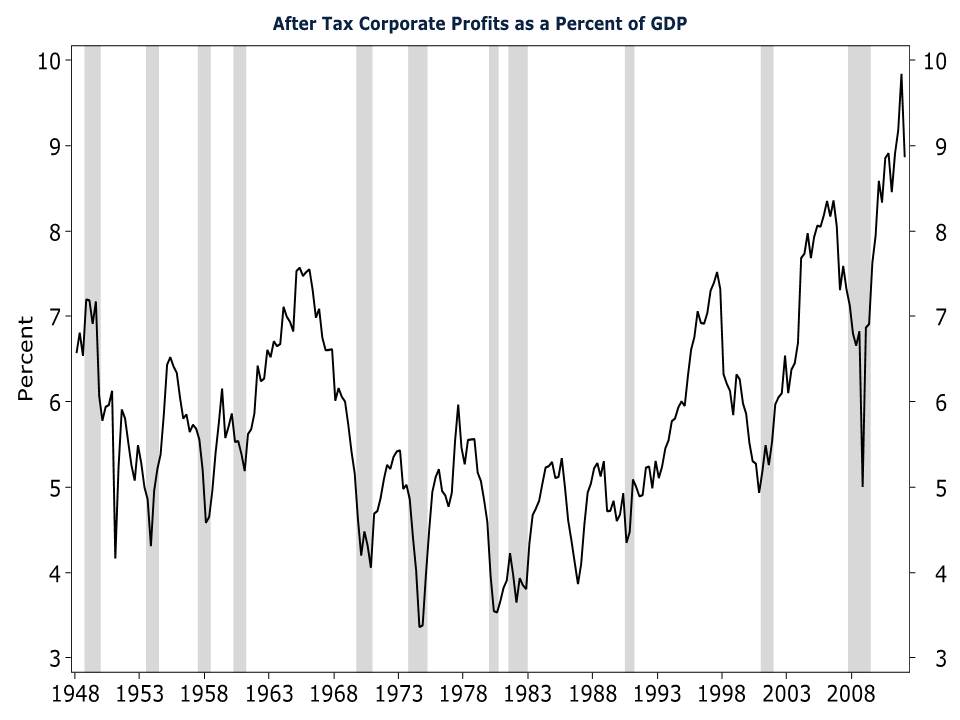

Corporate profits as a percent of GDP have been at unsustainable levels. You can see on my chart below that profits peaked out in the fourth quarter of 2011 at 9.8% of GDP, and are now headed back toward trend. That number has dipped to 8.9% of GDP, even while GDP growth has dropped to 1.5% in the most recent report.

There are few places left for already lean corporations to cut costs. Any increase in profits from here on out will have to come as a result of increasing sales, something that looks increasingly less likely given the turmoil in Europe, slowing Asian demand and the lackluster consumer confidence mentioned by Schultz.