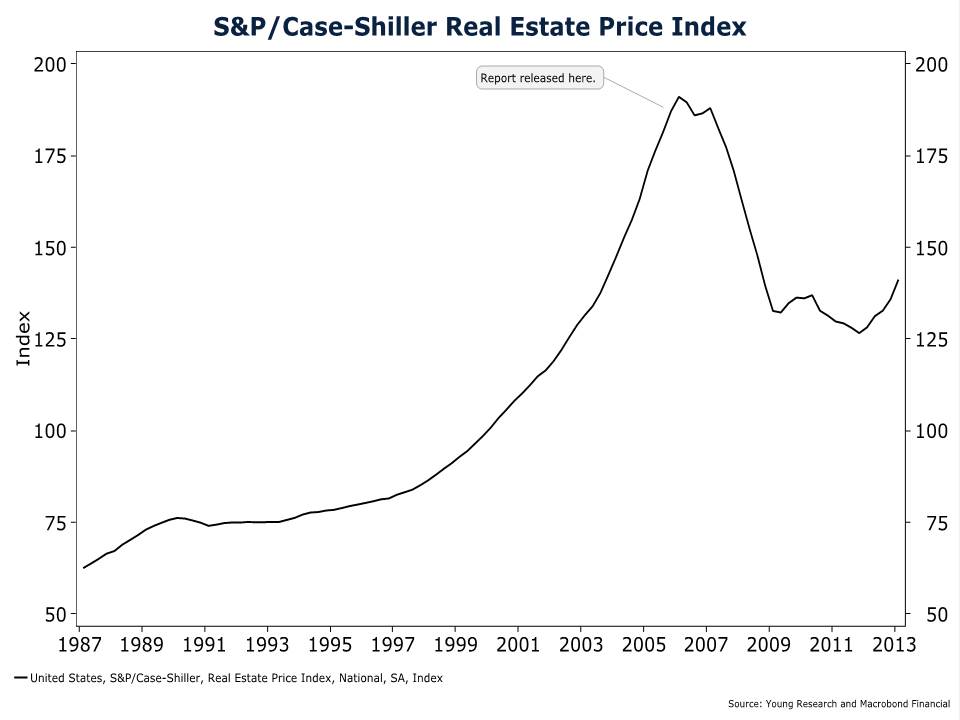

Here is a blast from the past. I came across this little nugget while doing some work on real estate. The title of the piece is Bubbling (or Just Frothy) House Prices? It was written by a couple of researchers at the Federal Reserve Bank of St. Louis in November of 2005. For context, I’ve included a chart of the Case-Shiller Home Price index with an arrow pointing to when the report was released. From the report (emphasis is ours):

Yet, do the P/I [Price-to-Income] ratios observed on the two coasts constitute a bubble? Note that when real estate is evaluated as a potential investment, housing prices should be determined by discounting the expected flow of income (rents) and other services using an appropriate risk-adjusted capitalization rate. Considering the difference between capitalization rates implied by house price indices and long-term government bond yields, we find indications against the presence of a bubble. House price data imply that the spread between capitalization rates and long-term bond yields has increased from an average level of 0.7 percent for the period 1975-99 to an average level of 2.3 percent for the period since 2000. These positive spreads imply that house prices have in fact remained consistent with risk-adjusted discounting of future rents.

In conclusion, the evidence in favor of a recent housing bubble is controversial at best. Ongoing research is struggling to isolate real house price increases justified by underlying fundamentals from irrational, possibly harmful, excesses.

I am not posting this to Monday morning quarter back the Fed. Hindsight is always 20/20, but when it has become so very obvious that the model being used was critically flawed wouldn’t you expect the Fed to take a different approach to evaluating asset prices in the future? Well, they haven’t. Bernanke & Co., continue to evaluate asset prices using the same flawed model as the researchers in 2005 did. So when you hear Dr. B. and his allies say “I don’t see much evidence of an equity bubble” because relative to record low and manipulated interest rates stocks look cheap, you can now confidently disregard their views. The Fed’s model of asset prices is so critically flawed that they couldn’t spot a bubble if it smacked them in the face.