Since 2005, investment in commodities futures funds has increased over 200% to an estimated $250 billion. Some of the biggest inflows to commodities futures funds have been from institutional investors—pensions, endowments, and foundations. Not by mistake, the institutional crowd moved into commodities futures just as a powerful bull market was getting under way. Institutional investors are just as susceptible to performance chasing as the average investor, but they would never admit it.

The institutional crowd will instead tell you that they are investing in commodities futures funds for the diversification benefits. Their conclusion is supported by reams of historical data and lengthy academic research papers. They used the same justification to load up on commercial real estate in the early part of this decade. Needless to say, that hasn’t worked out well.

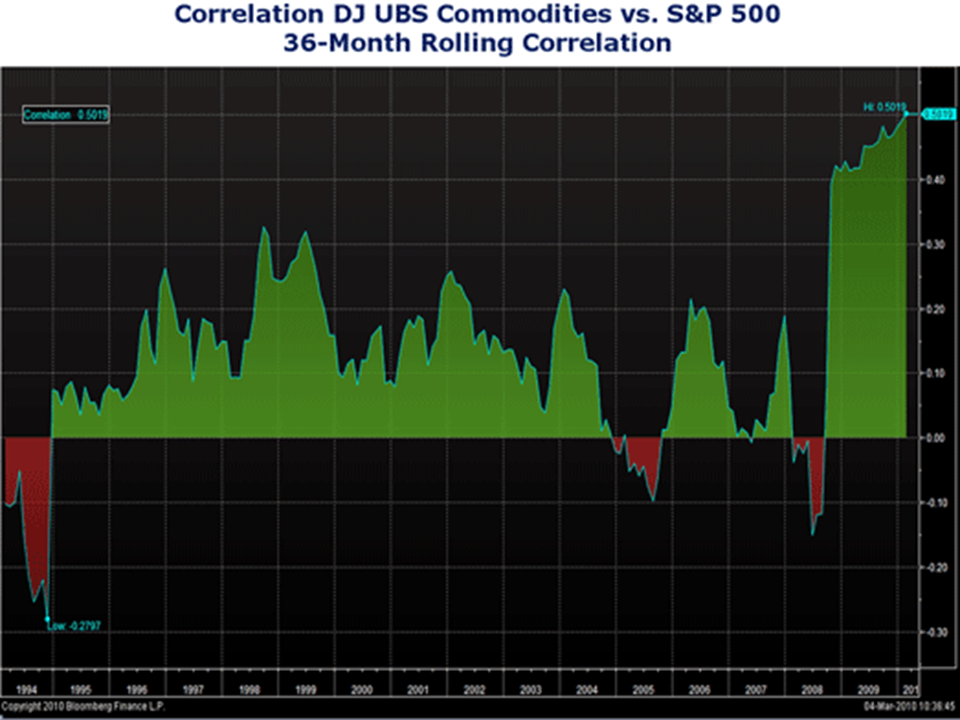

The problem with relying on historical correlations, the building blocks of diversification, is that they are not stable through time. Commodities futures index returns are especially unreliable because they are derived from periods when there was little investment from institutional and individual investors. As more investment money pours into an asset class, its correlation with the stock market rises.

My chart shows the 36-month rolling correlation of the Dow Jones-UBS Commodity Index and the S&P 500. As more assets have moved into commodities futures index funds, their correlations with the stock market have risen. If you’ve been sold a commodities futures index fund solely on the basis of diversification, it’s time to reevaluate your position.