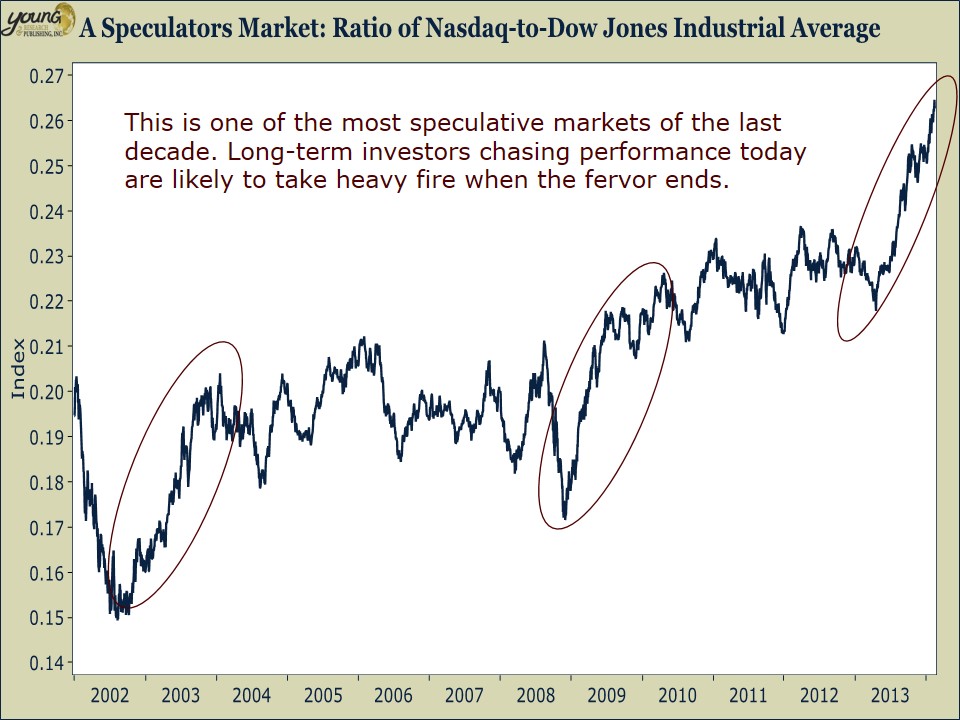

After a mini-correction to begin the year, the stock market has staged an impressive rally. The Dow has risen 5.6% in only two weeks and it is now within a couple of percentage points of moving into the green for the year. The much more speculative NASDAQ index has already achieved that feat. The NASDAQ index is up 1.6% so far in 2014 after rising 38% last year. Compare that to the 26% gain in the blue-chip Dow for 2013. The NASDAQ outperformed in 2013 and it is doings so again YTD.

What does the continued outperformance of the NASDAQ say about the stock market? This is a speculators market. Long-term investing is not being rewarded. Unless you are taking a reckless amount of risk, chances are the hot money crowd is leaving you in the dust. That’s perfectly fine. You don’t want to chase performance in a speculative-driven market. Enduring periodic bouts of discomfort (read lagging performance) is what enables savvy investors to generate the returns that trump those of the average trader and speculator. Stay the course and focus on the long-run.