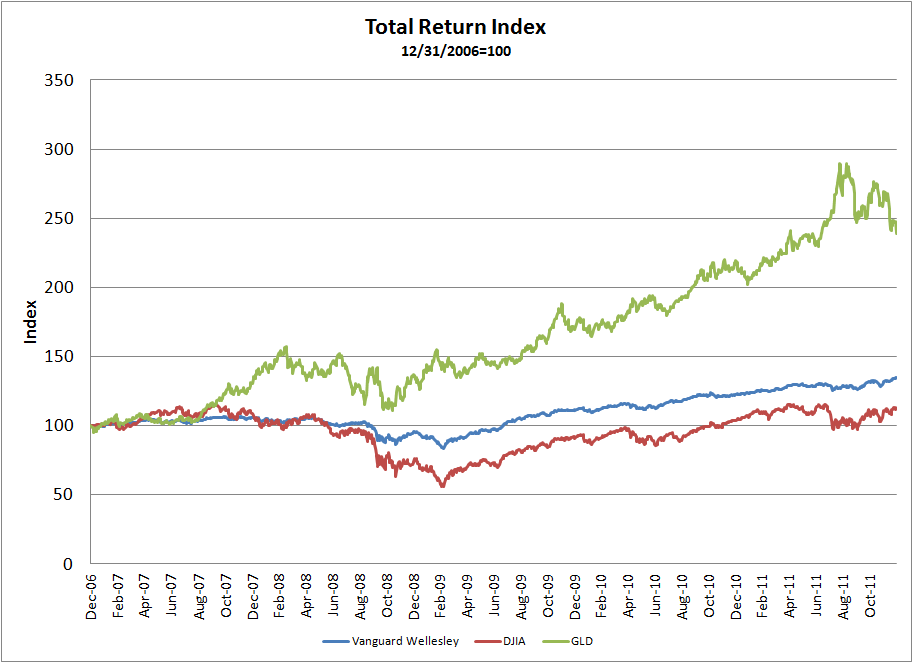

In its quarterly funds report printed on January 9, The Wall Street Journal lists the 45 largest stock and balanced funds by assets. The best performers of this group for 2011 were a gold ETF, SPDR Gold (GLD), up 11.2%, and a balanced fund, the Vanguard Wellesley Admiral shares (VWIAX), up 9.7%. The worst performers of the group of 45 were both emerging market funds, each down about 19%. On average, U.S. stock funds were down 2.9% and U.S. taxable-bond funds were up 4.6% last year.

The two best five-year average returns on the list were, once again, SPDR Gold and Vanguard Wellesley Admiral shares, up an average of 19.4% and 6.1% per year, respectively. The average five-year return for U.S. stock funds was a loss of 0.4% per year, and the average taxable-bond fund recorded a gain of 4.9% per year.

The proof is in the pudding. A counterbalancing strategy helps keep you in the game. And as a bonus, it’s fun reading performance figures when you own the winners.