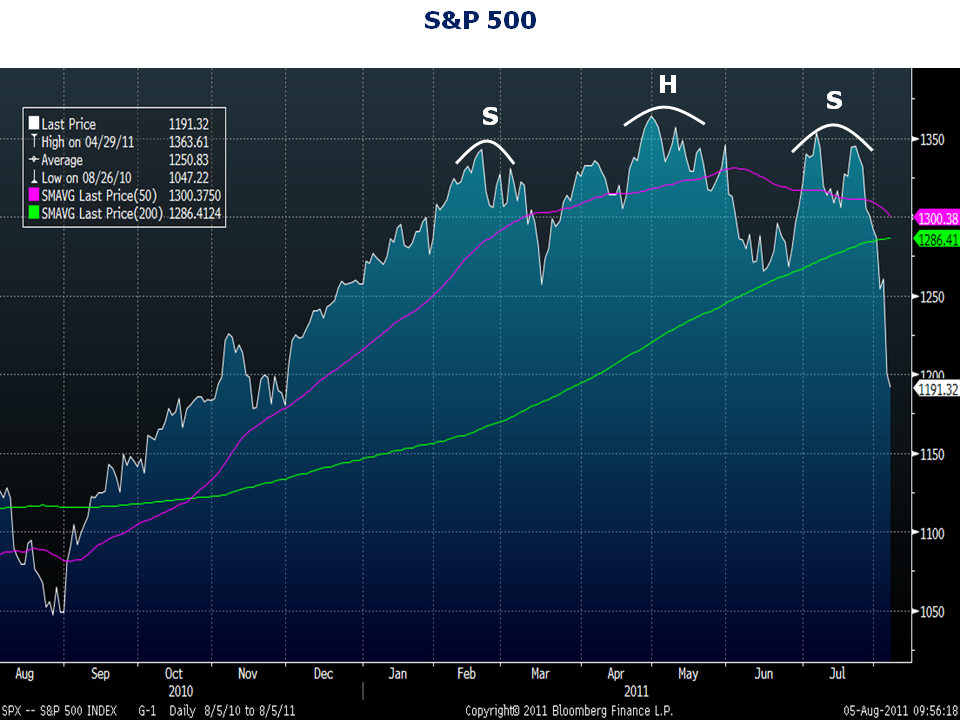

The S&P 500 has now clearly carved out the head-and-shoulders top formation I wrote about in Young Research’s last two technical analysis updates. The price action in the market has a real weak look. Stocks blew threw their widely followed 200-day moving average and headed straight to their next support level near 1,200. The S&P 500 is down almost 8% in August alone. If the market can’t hold the 1,200-ish level, the index is likely headed to the 1,100 – 1,150 level where there is significant support.

Latest posts by Young Research (see all)

- Tesla’s Charging Station Adaptation - March 6, 2024

- Can $7 Trillion End AI Chip Scarcity? - March 1, 2024

- Apple Ends Its EV Effort - February 28, 2024